EURCAD Price Analysis – February 3

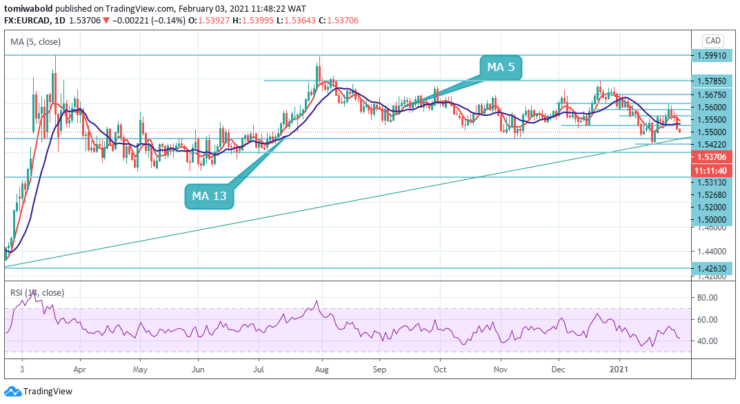

The EURCAD’s lower break of 1.5422 level by sellers now confirms the resumption of the whole decline from 1.5979 towards the mid 1.5300 level. The EURCAD pair had slipped underneath the 1.5400 early during the European session as Loonie stays firm on the oil price surge. However, the primary upward driver of the loonie is the BOC’s upgrade of its growth forecasts.

Key Levels

Resistance Levels: 1.5600, 1.5500, 1.5422

Support Levels: 1.5313, 1.5268, 1.5200

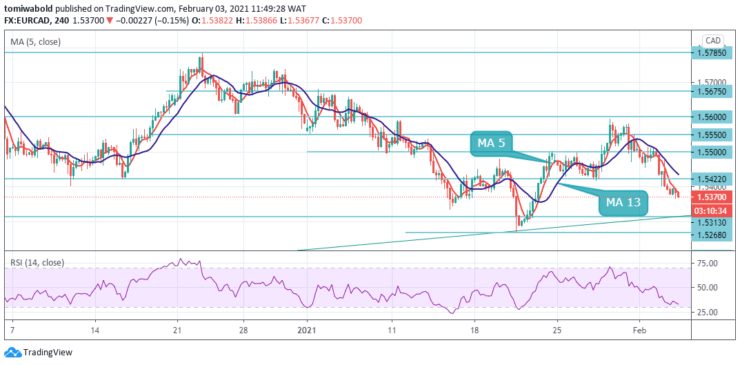

The currency pair has plunged beneath the 1.5400 marks down to the lower boundary of the descending pattern at the 1.5364 level during European trading sessions. The technical indicators are endorsing the negative bias with the RSI holding below its midlines. If the prices decline further support could be found around the 1.5313 horizontal support zone.

In the long term, only a pullback below the ascending trendline support could switch the outlook into a negative one like under the support region. To the upside, if the pair manages to rebound and overcome the 1.5422 resistance level, the next level to be watched will be the 1.5500 level and also 1.5593 swings high level of Jan 28.

In the short-term, the outlook remains negative since prices hold below the 1.5400 marks and the moving average 5. However, bearish traders could target the support cluster at the 1.5313 level. Also, the currency exchange rate might make a brief rebound towards the round figure pivot at the 1.5400 level in the shorter term.

If the ascending trendline pattern holds, bullish traders are likely to continue to pressure the price higher during the following trading sessions. Against this, the loss of support at the 1.5313 lows could pave the way for a deeper retracement to the 1.5268 neighborhood.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.