EURCAD Price Analysis – January 27

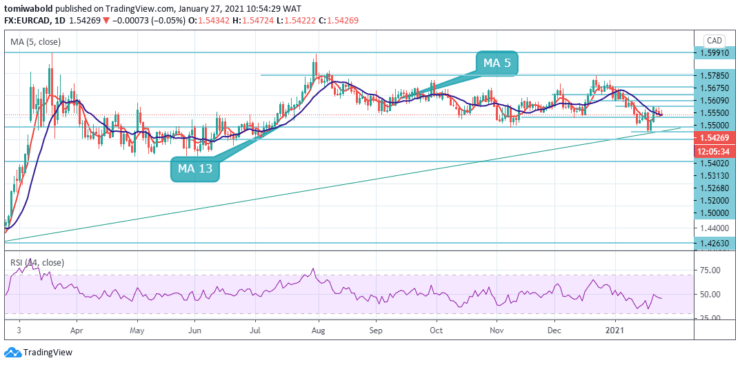

The single European currency has edged lower by 0.05% against the Canadian Dollar since the beginning of the Wednesday session. The currency pair stays lower from the intraday’s price of 1.5472 with the upside run staying constrained beneath 1.5500. Given the exchange rate’s recent rebound from lows, the pair retains its optimistic outlook.

Key Levels

Resistance Levels: 1.5785, 1.5675, 1.5550

Support levels: 1.5402, 1.5313, 1.5268

As seen on the daily chart in a negative scenario, immediate support could hold at the horizontal level at 1.5402 beneath the alignment of the moving average 5 and 13 at 1.5420 marks. Slipping under this important 1.5402 base, further supporting foundations stays at the ascending trendline and recent lows at 1.5268 level could challenge the dive.

A push higher could re-test the 1.5550 level and spike through for a move upwards to challenge yearly highs at the 1.5680 troughs. In summary, the levels near the boundaries would also need to be broken to accelerate the price in the relative direction.

Intraday bias in EURCAD remains weak to the downside and consolidation under the 1.5500 level could extend further. On the upside, a sustained break of the 1.5550 resistance level will suggest that it’s at least in correction to the fall from 1.5785 Dec .22, 2020 high level.

The further rise should then be seen to the retracement of 1.5785 to 1.5550 at 1.5970 levels. However, rejection by 1.5785 level will maintain near term bearishness for another fall through 1.5550 level later in subsequent sessions to come soon.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.