EURCAD Price Analysis – December 30

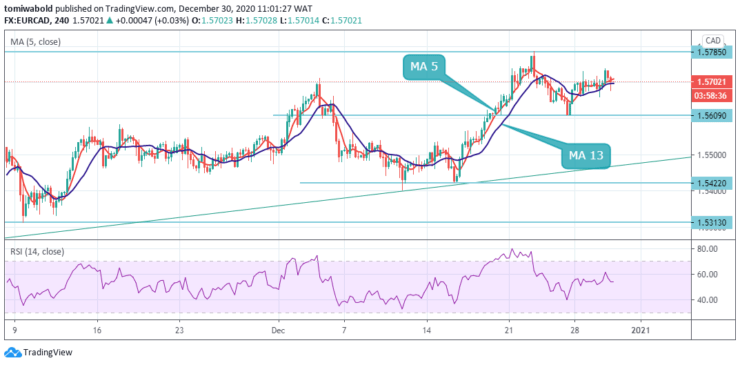

EURCAD probes intraday high around 1.5737 level and retreats to 1.5677 level as buyers continue to hold price ahead of 1.5600 level for the 4th day in a row on Wednesday. A modest uptick in oil prices supported the Canadian dollar and added to the selling bias. Meanwhile, a broader risk bias might influence the EUR’s price and produce some upside opportunities.

Key Levels

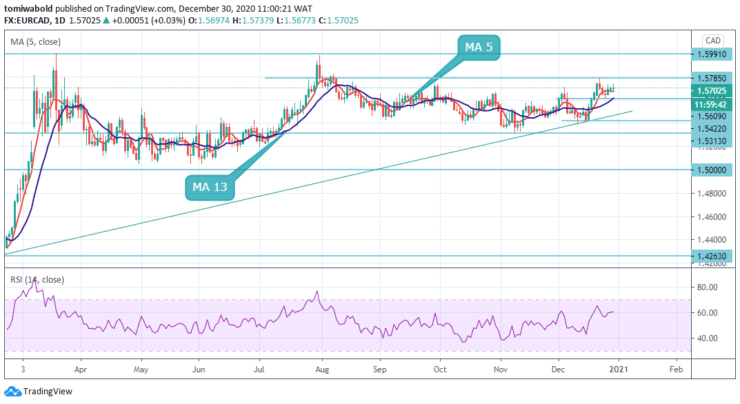

Resistance Levels: 1.6200, 1.5991, 1.5785

Support Levels: 1.5609, 1.5422, 1.5313

As seen on the daily, the technical indicators are holding in the bullish territory and still far from being in the overbought territory, a move beyond the 1.5700 marks, en-route the 1.5785 resistance zone, remains a distinct possibility.

Any meaningful pullback below the moving average 5 support breakpoint might continue to attract some dip-buying near the 1.5600 marks. The corrective pullback is now being followed by more impulsive buying, further confirming that bulls are in control in the medium to long term.

Short-term bias is mixed and weak pullbacks into support can offer potential buying opportunities to traders who are not long the pair yet. A strong break and close back below mid 1.5600 would put 1.5600 back into focus.

The EURCAD pair is now set to range some more and reach recent highs around 1.5785 level. On the other hand considering down looking RSI conditions, as well as price trading above moving average 5 and 13 respectively around 1.5710 and 1.5690, EURCAD bulls are set to challenge the monthly peak surrounding the 1.5785 zones.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.