EURCAD Price Analysis – December 2

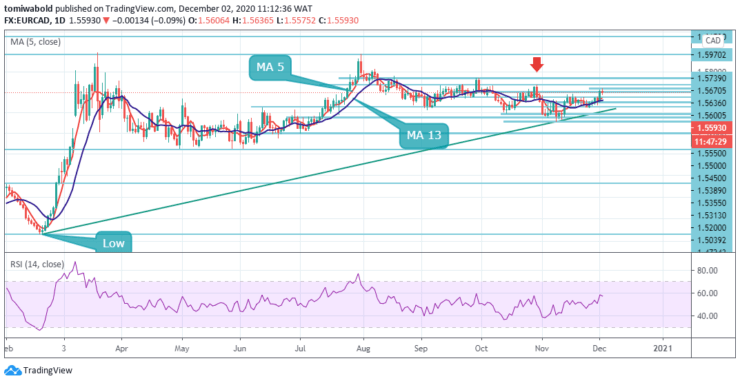

After the upside breach in EURCAD to 1.5636 early Wednesday’s European session, the price put in an impulsive move lower due to a corrective pullback. Sellers’ activity pushed the EURCAD beneath the 1.5600 level which may be followed by more impulsive buying. The Canadian Dollar was recently boosted by positive Canada’s GDP.

Key Levels

Resistance Levels: 1.5970, 1.5739, 1.5636

Support Levels: 1.5550, 1.5450, 1.5313

The EURCAD has dropped back under 1.5600 level pulling lower from today’s rebound high at 1.5636 level. The oil market will remain the dominant driver of EURCAD. However, the bulls are holding the major control with momentum indicators such as RSI above its midline.

In the long term, only a pullback below 1.5550-1.5500 levels could switch the outlook into a negative one like this a key Support region. To the upside, if the pair manages to overcome the key 1.5670 resistance level, the next resistance level to be watched will be the 1.5739 level and also 1.5970 swings high level on July 31.

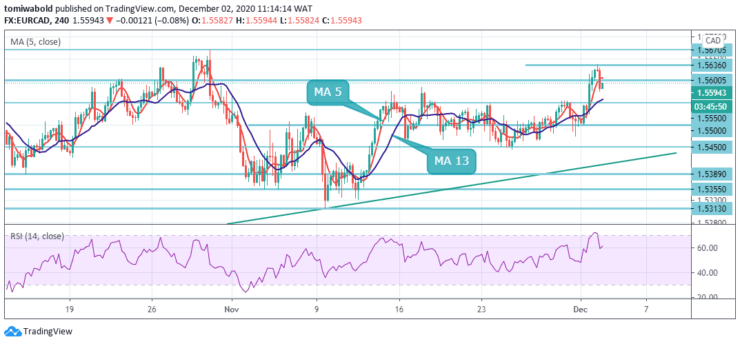

On the 4-hour time frame, the next level of interest is the 1.5550 level which acted as a resistance level that coincides with late November highs. This level now acts as a take-off point and support zone for the pair with MA 13 reinforcing the uptrend.

Its short-term bias is bullish and weak pullbacks into support can offer potential buying opportunities to traders who are not long the pair yet. Nevertheless, a strong breach and exit back beneath the 1.5450 level would put the 1.5400 marks back into focus.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.