The currency pair could see more downward forces.

The bears may take the leading.

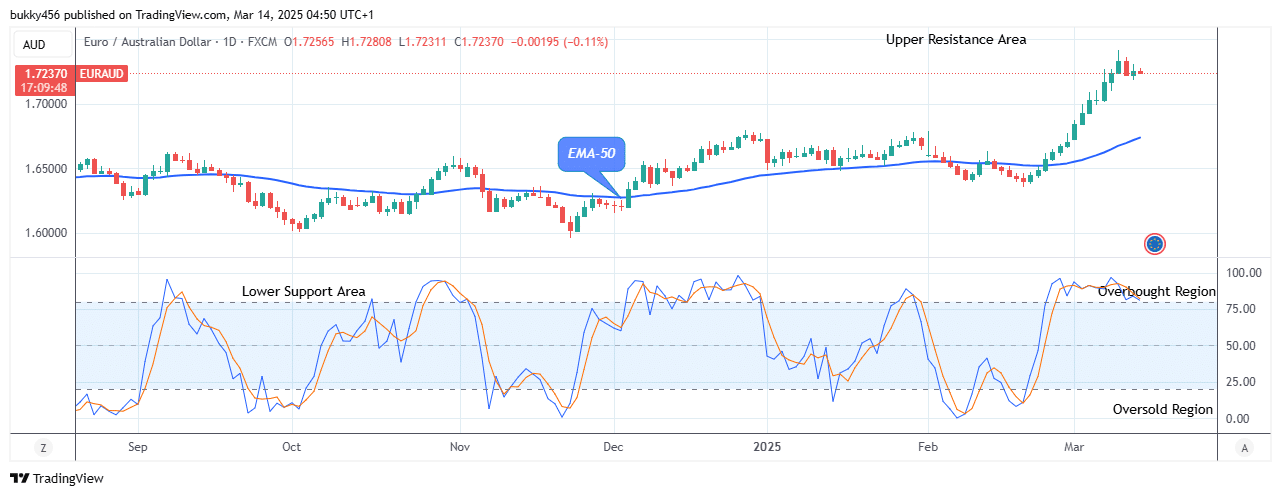

EURAUD Weekly Price Analysis – March 16

The EURAUD pair could see more downward forces as the bullish pressure has ended. The pair may continue with the dumps if the sell traders renew their selling strength and drive the Yen price to the $1.59 prior support level. The pair may drop further even reaching the $1.58 lower support mark, leading to a potential sell signal for interested traders.

EURAUD Market

Key Levels:

Resistance levels: $1.72, $1.73, $1.74

Support levels: $1.59, $1.58, $1.57

EURAUD Long-term Trend: Bullish (Daily Chart)

Despite the moves from the bears, the EURAUD market remains bullish. However, the pair could see more downward forces as buying pressure is unlikely.

momentum.

The sustained bullish pressure to the $1.73 high level in the previous action has enabled the Yen price to stay in an uptrend in its recent low. Hence, the currency pair is overbought and is on the verge of more downward forces.

The EURAUD price dropped even further today, reaching a low of $1.72 above the supply levels as the daily chart opens today, suggesting an uptrend.

However, if a renewed surge in sellers’ interest occurs, the Yen price could drop further to retest the prior low of $1.59 level, providing sellers with huge selling potential.

Additionally, the EURAUD pair may see more downward force as the market faces down at the overbought region of the daily signal, implying that the selling pressure might continue.

As a result, the bearish pattern might reach the $1.58 lower support level in the days ahead in its long-term perspective.

EURAUD Medium-term Trend: Bullish (4H Chart)

EURAUD is bullish on the medium-term outlook but could see more downward forces as the bears return briefly to resume the bearish pressure. The Yen price is above the moving average, confirming its bullishness.

.

The market price of EURAUD could see more downward forces as it drops to a $1.72 low mark above the moving averages as the 4-hourly session opens today, initiating another downward correction due to low bullish momentum.

A strong push by the short traders below the $1.63 previous support point with a 4-hour candle closing could signify a shift in the market dynamics.

Such a breakdown would enable sellers to regain control and potentially drive the Yen price towards the $1.63 low mark.

In addition, the price of the EURAUD pair is pointing down on the daily stochastic, indicating that more downward forces are coming.

In light of this, the Yen price may slide to reach the $1.58 lower support level in the days ahead in its medium-term forecast.

Note: Learn2.Trade is not a financial advisor Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.