EUR/USD was impacted by the European Central Bank’s (ECB) decision to raise interest rates by 50 basis points on Thursday. This move was in line with market expectations, and the ECB confirmed that it plans to raise rates further to bring inflation back to its 2% medium-term target.

The central bank has been hawkish in its approach to monetary policy, with ECB policymakers signaling their intent to raise rates by another 50 basis points at the next monetary policy meeting in March.

In addition to the interest rate hike, the ECB also confirmed the decline of its APP portfolio. The Eurosystem will not reinvest all of the principal payments from maturing securities, leading to a measured and predictable decline of €15 billion per month on average until June 2023. The subsequent pace of the decline will be determined over time.

As the ECB moves forward with its monetary policy, inflation and core inflation data will play a significant role in shaping future decisions. ECB policymakers have been focused on bringing inflation back to target, and they appear to be prepared to continue taking action to achieve this goal.

EUR/USD Trading Down By 0.6% on Thursday

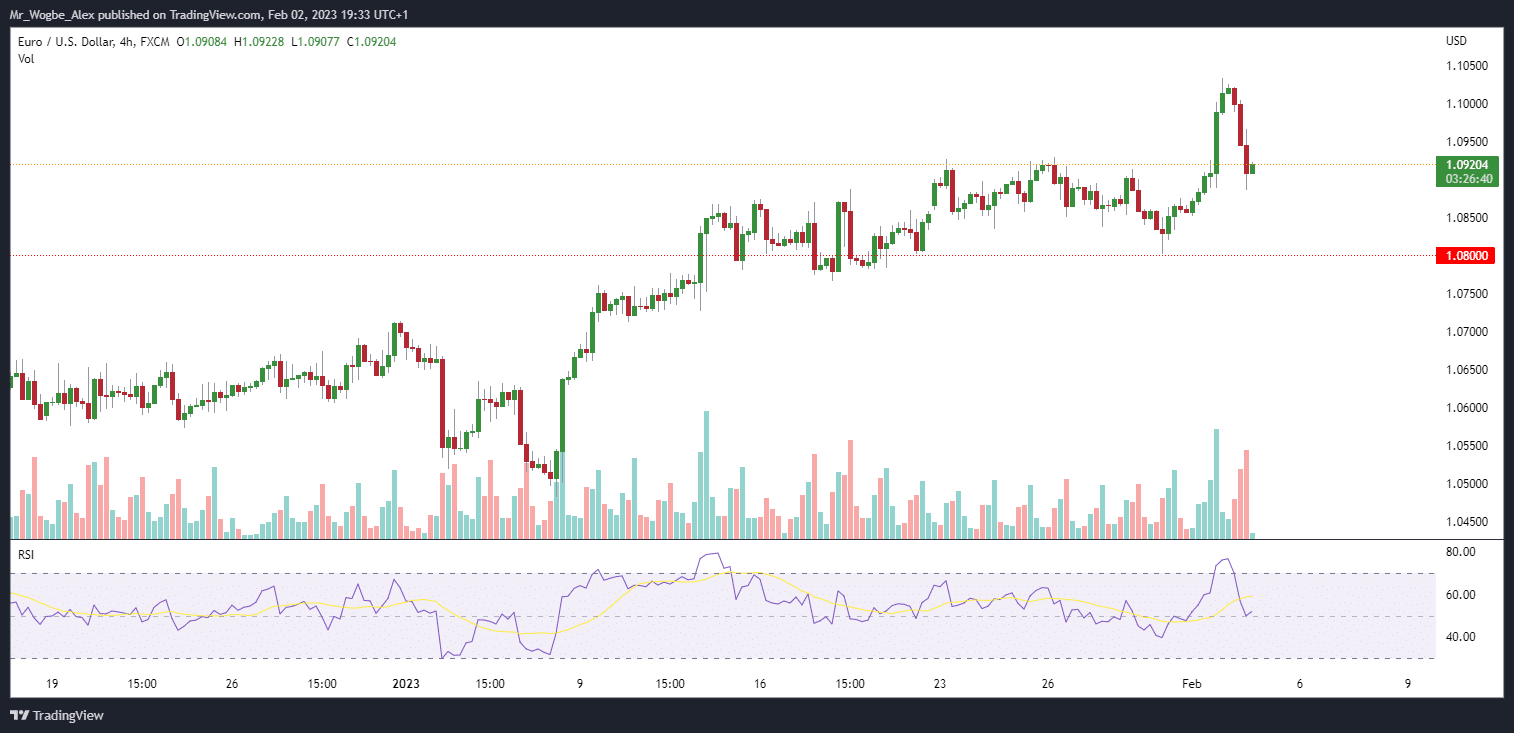

In the short term, EUR/USD saw a 20-pip drop following the ECB’s announcement, but the currency quickly stabilized and was trading flat ahead of the press conference. The EUR/USD has reached the psychological 1.1000 level, and there is limited resistance to the 1.1200 level.

However, the RSI on both the 4H and D timeframes suggests that a pullback may be on the horizon before the currency continues higher. So far, the forex pair trades down by 0.6%.

Overall, the ECB’s monetary policy decisions and the inflation outlook will continue to impact the EUR/USD in the coming months. The central bank’s hawkish approach and focus on inflation will be closely watched by currency traders as they seek to understand the direction of the market.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.