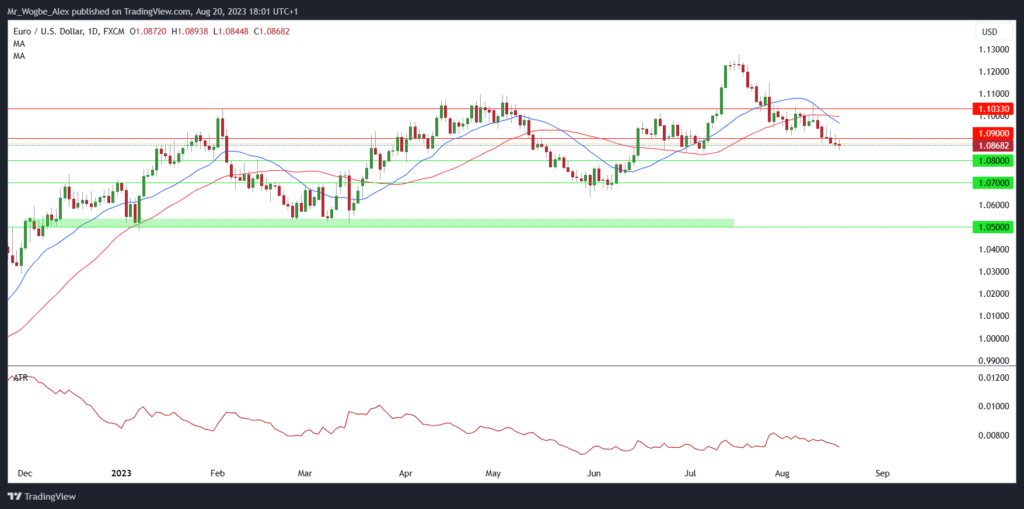

The EUR/USD forex pair, much like a seesaw, continued its downward tilt, wrapping up the week just a hair’s breadth above the ominous 1.0833 mark, a low last seen in July. In a twist of fate, as macroeconomic data took a vacation, all eyes were fixed on China, where the real estate realm was performing a rather dramatic dance that cast shadows over the already tepid global economic stage.

Over the weekend, the financial world had a collective jolt as Country Garden, a real estate bigwig, played a surprising card: it announced that the loan repayment party might be off this time. To add more drama to the mix, Zhongrong International Trust, a “shadow” bank, decided it had better things to do than settle its bond payments. Result? Cue protests in Beijing and a general sense of “what’s next?” hanging in the air.

EUR/USD Traders Will Keep an Eye on the Macroeconomic Docket This Week

As the market prepares for the coming week, all eyes are now on S&P Global’s upcoming PMI estimates, poised to drop like a thrilling plot twist. In the EU, it’s the manufacturing sector that’s stealing the limelight, while the US has its own dance with a Manufacturing PMI of 49 and a Services index grooving at 52.3.

Meanwhile, the US is ready to unveil its July Durable Goods Orders, and Germany is all set to provide an encore performance of its Q2 GDP, which was last seen standing still at 0% QoQ.

And let’s not forget the grand finale: the Jackson Hole Symposium. Starting with a crescendo next Thursday, this financial opera promises insights from global central banks, with Jerome Powell, the Fed Chair, set to take the stage on Friday.

With bated breath, EUR/USD traders and the general market are waiting for him to drop some hints on what the future holds. Expectations are that he might just keep it data-dependent and remind us that higher rates are here to stay.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.