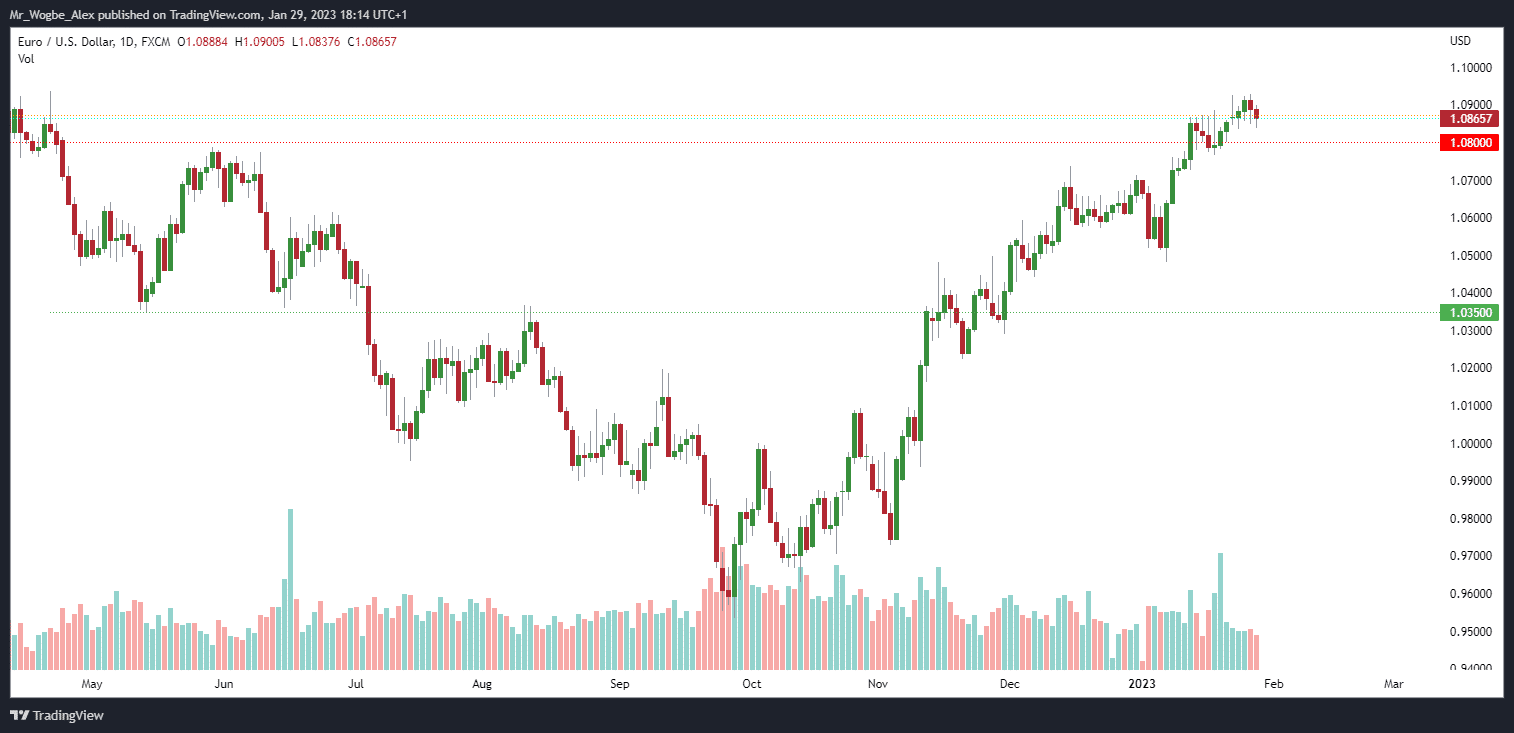

On Friday, the EUR/USD currency pair experienced a two-day reversal last week, moving closer to 1.0850. This was primarily due to a negative shift in risk sentiment and expectations of profit-taking before the weekend.

Support for the US Dollar was strengthened by positive US macroeconomic data released on Thursday. The US Commerce Department reported an impressive 2.9% annualized pace of GDP growth in the fourth quarter, surpassing the consensus estimate of 2.6%. Additionally, the Initial Jobless Claims showed a surprising drop to 186K for the week ending January 21, compared to 192K in the previous week.

The Durable Goods Orders also exceeded expectations, growing by 5.6% in December. While orders excluding transportation items saw a slight decrease of -0.1% MoM, the overall data indicates a resilient US economy. This, in turn, has led to a recovery in US Treasury bond yields and has boosted investor confidence, further supporting the US Dollar.

Despite these trends, the market expects a more hawkish stance from the European Central Bank, which could limit further losses for the EUR/USD pair. Traders are advised to wait for confirmation of a near-term top before positioning for any corrective decline.

EUR/USD Traders to Keep an Eye on Super-Central Bank Week

Next week’s central bank events, including the Federal Reserve’s policy decision on Wednesday and the ECB monetary policy meeting on Thursday, are expected to play a crucial role in determining the direction of the EUR/USD pair. The market will also closely monitor the Core PCE Price Index, as it may have an impact on the USD price dynamics.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.