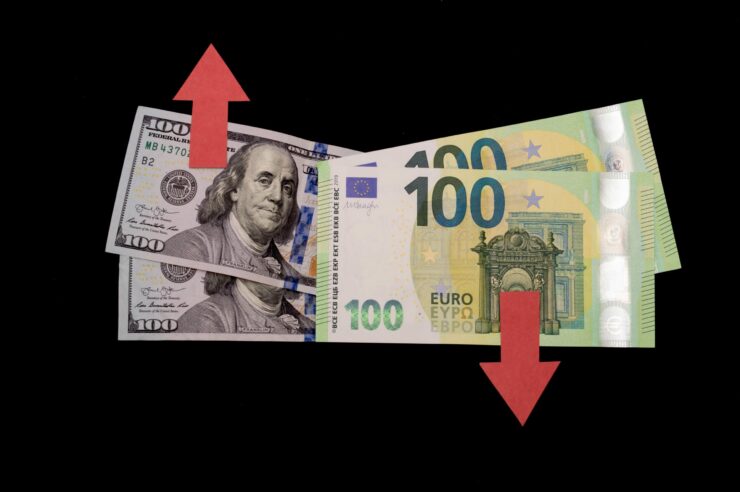

The EUR/USD pair has maintained a downward trend for the past few days, although this trend follows a non-linear pattern.

The pair traded around the 1.1000 mark in the London session on Tuesday as investors remained on the sidelines ahead of the speech from the European Central Board (ECB)’s President Christian Lagarde and the announcement of the European Union (EU)’s Unemployment Rate due to drop on Wednesday and Thursday, respectively.

Lagarde’s speech should infuse some insights into the possible monetary policy steps to be adopted by the ECB in April. The ECB’s monetary policy is expected to have a critical effect on the market, considering that the institution has yet to adjust its interest rates amid hawkish policy turnaround by other counterparts.

EUR/USD On the Back Foot as ECB Contemplates Rate Hike

Meanwhile, the ongoing Russia-Ukraine crisis has made matters even more difficult for ECB policymakers. The Russian invasion of Ukraine has raised fresh worries of stagflation in the eurozone, with an inflation figure of 5.9%, a significantly higher level than the desired 2%.

That said, ECB think tanks are in a tough spot as they have to decide between hiking the interest rate or “taking the bullet.”

On the other end. the US dollar index (DXY), which tracks the dollar’s performance against other top currencies, saw a sharp rebound following increased buying around the 99 support level. Also, dollar investors have resisted placing aggressive bets ahead of the US Nonfarm Payrolls (NFP) as traders wait for clues. The upcoming NFP report should dictate the US Federal Reserve’s next interest rate move. That said, underperformance in the NFP data will force the Fed to keep its rate hike in the 0.25% region.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.