EUR/NZD rallies in the short term after ending its temporary correction. The price has found strong support and now it has turned to the upside again.

The pair is strongly bullish and it could approach and reach other upside targets. The Euro-zone Final Services PMI increased from 48.8 to 49.6 beating the 48.8 estimates, while the German Final Services PMI increased unexpectedly from 50.8 to 51.5, even if the specialists have expected to see the indicator steady at 50.8.

Euro could resume its appreciation versus the NZD as the economic figures have come in better than expected.

EUR/NZD H1 Chart Analysis!

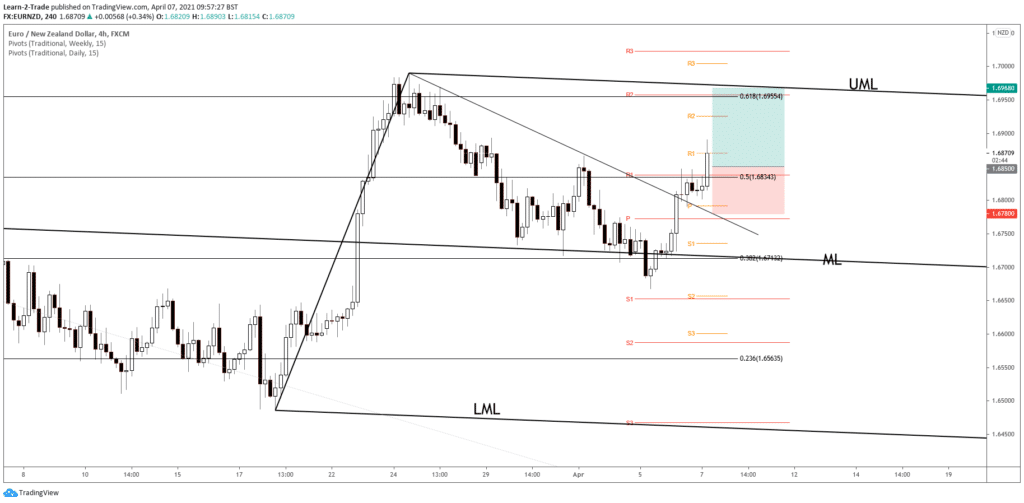

EUR/NZD has found support right below the descending pitchfork’s median line (ML) and under 38.2%. The aggressive breakout through the weekly pivot point and above R1 signals more gains.

Still, we could get a new chance to go long if the rate decreases a little to retest the weekly R1 (1.6838). R2 (1.6958), 61.8%, and the upper median line (UML) are seen as upside targets.

Conclusion!

Today’s aggressive breakout through 50% and above R1 (1.6838) confirms further growth. A minor decline could help us to catch a new upside momentum.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.