EUR/JPY Significant Levels

Resistance Levels: 164.00, 166.00, and 168.00

Support Levels: 158.00, 156.00 and 154.00

EUR/JPY Price Long-term Trend: Bearish

The EUR/JPY currency pair has been falling below the moving average lines but risks decline below level 156.00. Buyers tried to keep the price above the moving average lines but were unsuccessful. The Yen has remained above 154.00 and below the moving average lines. On the downside, if the bears violate the present support level of 154.00, the Yen would fall even more.

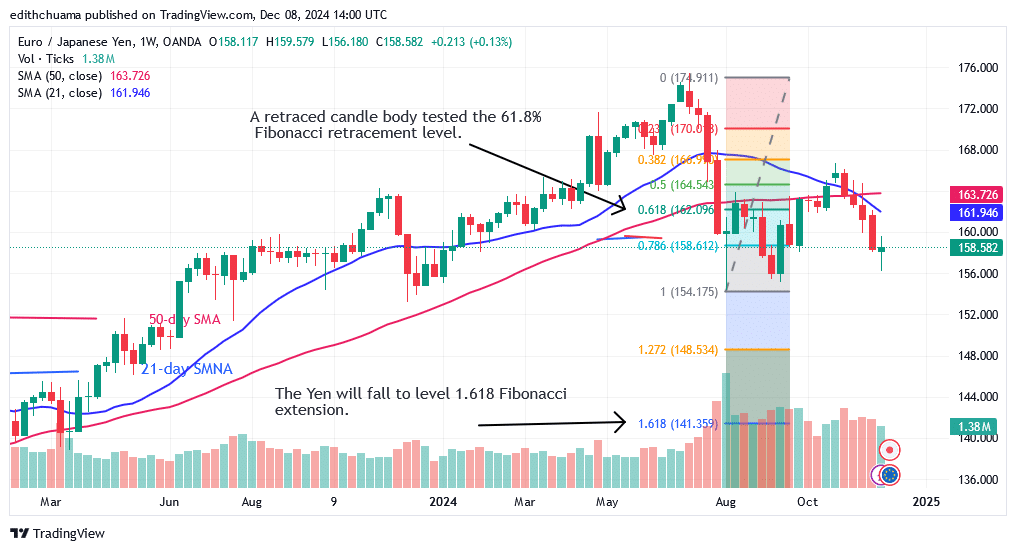

Furthermore, the Fibonacci tool has predicted a likely downward trend in the currency pair. On July 29, a retraced candle body approached the 61.8% Fibonacci retracement line. It implies that the Yen will fall to level 1.618 Fibonacci extension, or level 141.20.

Weekly Chart Indicators Reading:

The 21-day and 50-day SMAs are trending downward, indicating a bearish crossover. This indicates that the Yen will decrease. Since July 29, the Yen has formed a long candlestick tail pointing to level 159.00 support. It suggests considerable buying pressure at a lower price point.

EUR/JPY Medium-term Trend: Bullish

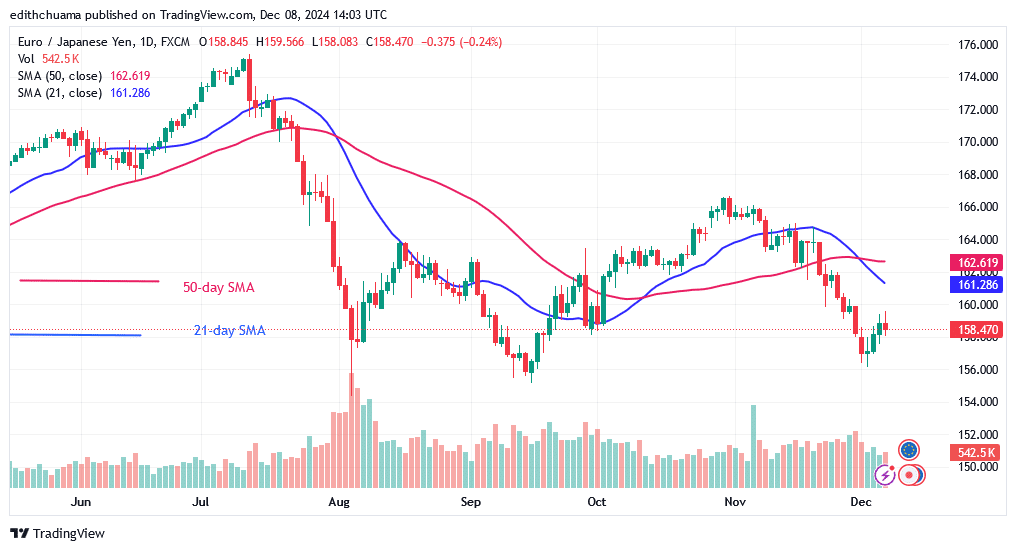

On the daily chart, the Yen has been trading sideways since August 5. The currency pair is trading within a narrow range of 156.00 to 164.00. Currently, the Yen is decreasing as it reaches a level of 156.00. Doji candlesticks have dominated the price action, controlling its movement. If the current support level is breached, selling pressure will resume. Otherwise, the sideways movement will continue within its defined range.

Daily Chart Indicators Reading

The moving average lines are sloping horizontally, indicating a sideways trend. The price bars have fluctuated both below and above the moving average lines. The 21-day SMA crossed below the 50-day SMA, giving a bearish indication. When the range-bound levels are broken, the market begins to trend.

General Outlook for EUR/JPY

The EUR/JPY pair is trading within a range of 156.00 to 164.00 but risks decline below level 156.00. The price indication predicts Yen will resume selling pressure if the support level is broken. This will force the Yen to fall further, reaching 141.00. The forex signal is range-bound as the pair maintains its horizontal trend.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.