EUR/JPY Significant Levels

Resistance Levels: 164.00, 166.00, and 168.00

Support Levels: 158.00, 156.00 and 154.00

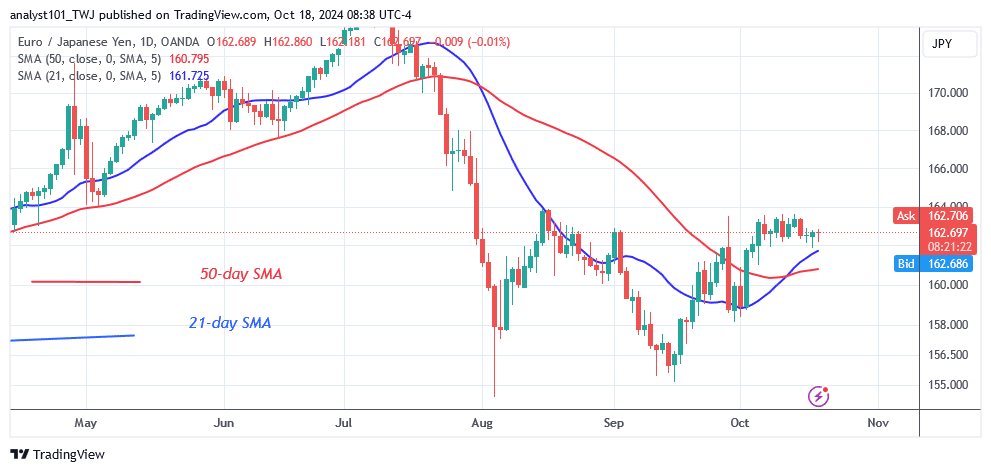

EUR/JPY Price Long-term Trend: Ranging

The EUR/JPY currency pair remains above 158.00 after the August 5 price decline. The selling pressure subsided as the currency pair entered a sideways trend between levels 158.00 and 164.00. Since August 15, the rising trend has been halted by resistance at 164.00. The extended candlestick wick on September 27 points to the resistance at level 164.00.

It suggests considerable selling pressure at the higher price point. On the upside, a break above the barrier around 164.00 will indicate the return of the uptrend. The couple will go up to level 174.00. If the current resistance level is not broken, the Yen will continue to trade in a range. It is currently trading at level 162.44.

Daily Chart Indicators Reading:

The price bars are above the upward-sloping moving average lines. This will cause the currency pair to rise. The moving average lines exhibit a bullish crossover, indicating a likely gain in the Yen. That is, the 21-day SMA is higher than the 50-day SMA.

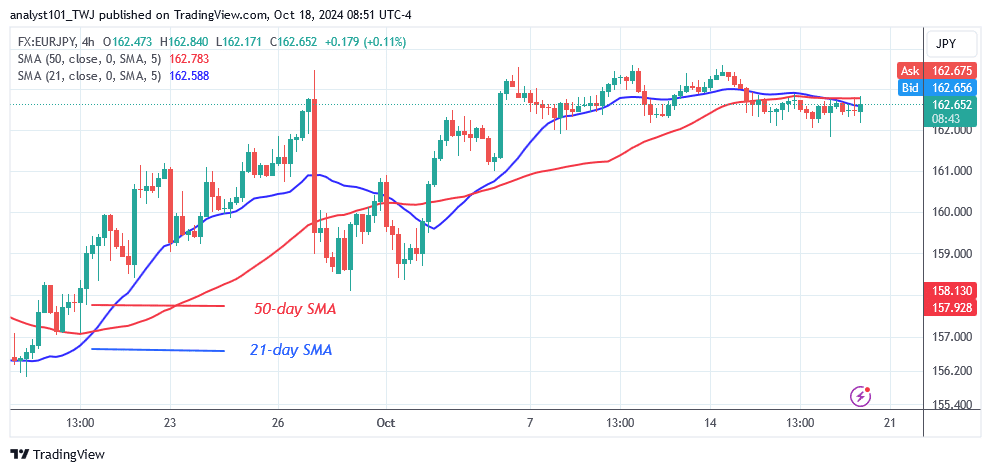

EUR/JPY Medium-term Trend: Ranging

On the 4-hour scale, the Yen trades sideways below the resistance level of 164.00. It moves in a narrow range above level 162.00 and below resistance at level 164.00. The Yen is stabilizing above 162.00. The price action is typified by a little, uncertain candlestick known as a Doji. The Doji candlestick has kept the Yen sluggish due to traders’ hesitation.

4-hour Chart Indicators Reading

The moving average lines are horizontally flat, implying a sideways trend. The 21-day SMA is below the 50-day SMA, signaling a bearish crossover. It suggests that the Yen is going to fall. The Yen has long candlestick tails that indicate the current support at level 162.00. This signals considerable buying pressure at lower price levels.

General Outlook for EUR/JPY

The EUR/JPY remains above 158.00 as the bearish trend reaches bearish exhaustion. The Yen trades in a narrow range above 162.00, but below resistance at 164.00. Due to the creation of Doji candlesticks, the Yen price has remained static above its current support. The forex signal is range-bound due to a hurdle at 164.00.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.