The EUR/AUD traded on a very bullish momentum in the early European session on Thursday, as the prevailing market risk mood has sent the Aussie on a bearish spiral against other major currencies.

Germany reported yesterday that the country’s Business Confidence has dropped from 92.2 in December to 90.1 in January. This decline has placed some pressure on the euro over the past few hours.

Today, market participants will be looking at the Euro Area Consumer Confidence report for January. Speculators expect the Consumer Confidence report to drop from -13.9 in December to -15.5 in January because of the economic fallout from the second wave of the coronavirus in Europe.

The price dynamics of the euro is now at the mercy of the upcoming economic reports from the EU.

Meanwhile, ECB Governing Council Member, and Dutch Governor, Klass Knot has made some comments that suggest that the ECB is ready to implement further negative rates if needed.

In other news, Australia’s Import Price Index and Export Price Index for the fourth quarter should give Aussie traders some insight into what the currency could do in the near-term. It is worth mentioning that the price dynamics surrounding the AUD will be dictated by developments on the ongoing US-China tussle, coronavirus updates, and vaccine news.

EUR/AUD Value Forecast — January 28

EUR/AUD Major Bias: Bullish

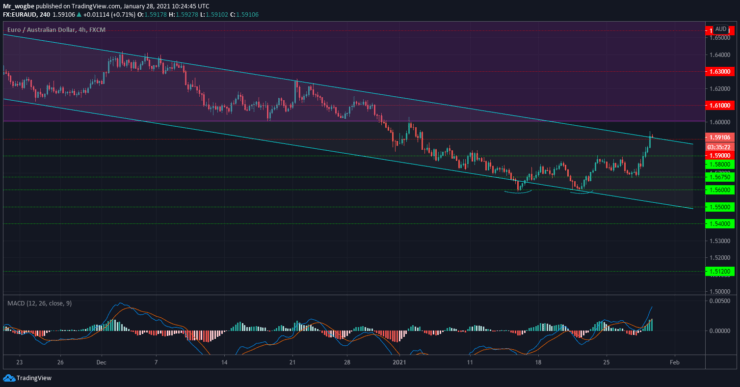

Supply Levels: 1.6000, 1.6100, and 1.6200

Demand Levels: 1.5800, 1.5675, and 1.5600

The EUR/AUD has maintained a bullish streak since the emergence of the double-bottom pattern last week. Following a modest retrace from the 1.5800 resistance (now support) to the 1.5675 level, the currency pair initiated a strong rebound to the 1.5900 area where it currently lies.

However, the pair has now reached the top of our descending channel, suggesting that a significant decline could be just around the corner. That said, the EUR/AUD could negate this channel if this bullish momentum takes it back into the 1.6000 pivot zone.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.