Ethereum remains stuck in a price range between $2,476 and $2,681, but beneath the surface, significant developments suggest the network is building strength for future growth.

Despite market uncertainty, key metrics point to increasing investor confidence and institutional adoption that could drive the next major price movement.

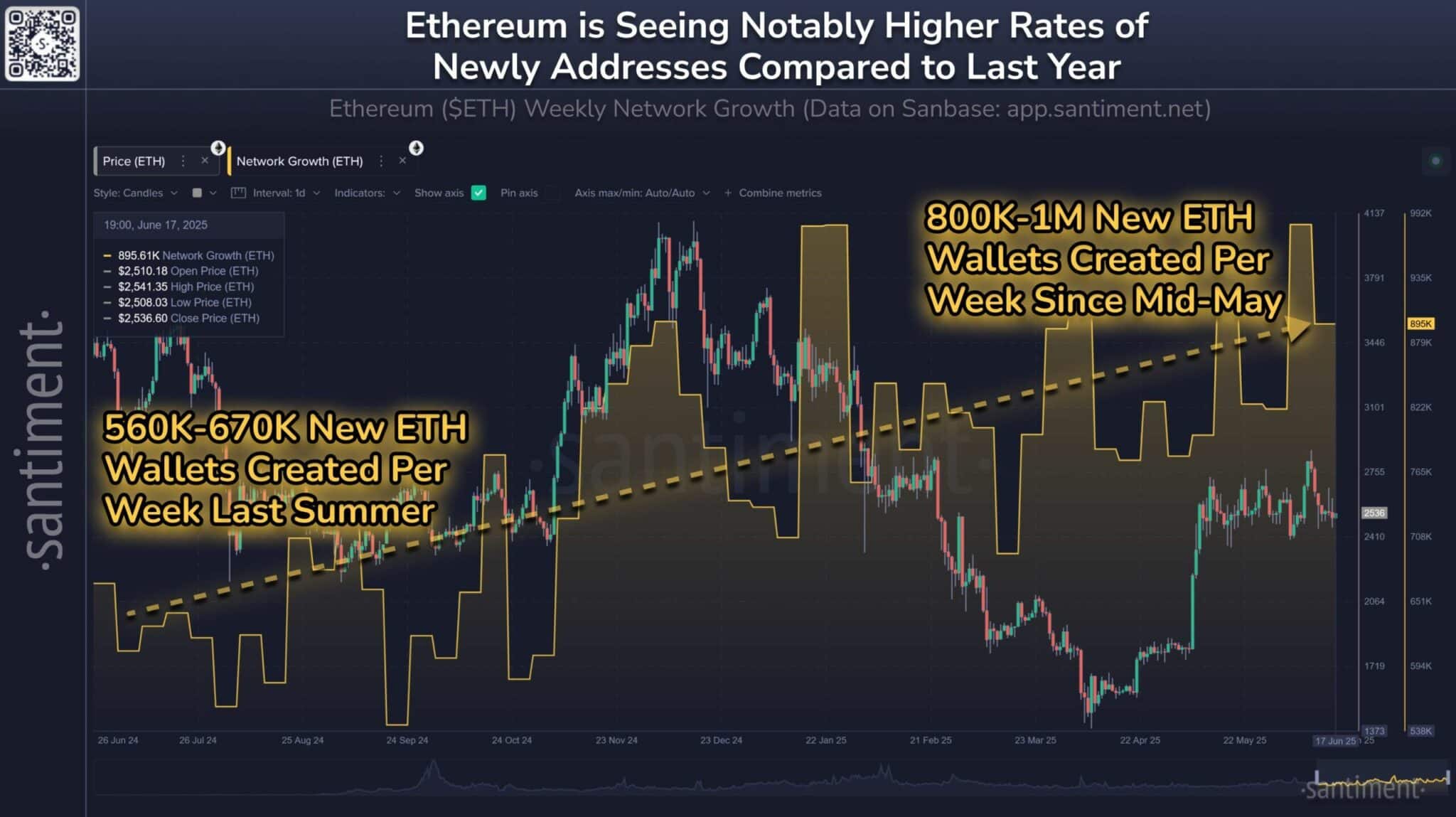

The most striking development is the surge in network participation. New wallet creation has jumped dramatically from 800,000 to 1 million weekly since mid-May.

This represents a substantial increase compared to the 560,000-670,000 new wallets created during the same period last year. This growth indicates that retail investors are actively entering the Ethereum ecosystem, positioning themselves for potential gains.

Ethereum Staking Reaches Record Levels

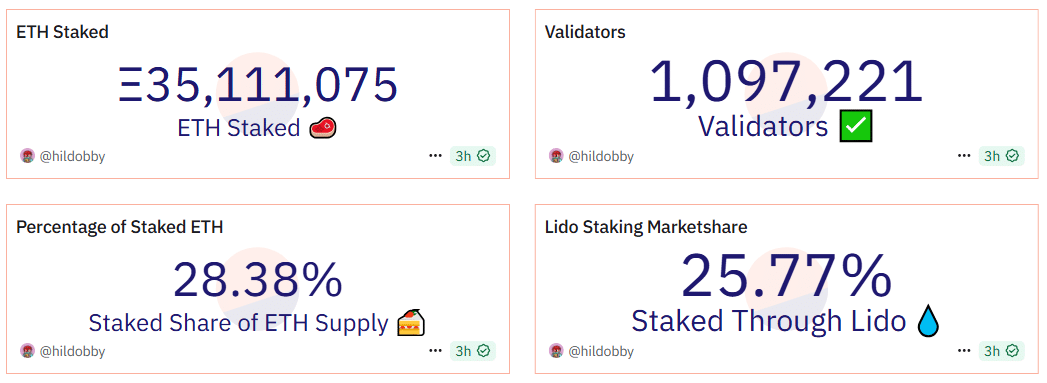

The staking landscape tells an even more compelling story. Over 35 million ETH tokens are now locked in staking contracts, representing more than 28% of the total supply.

This marks an all-time high and signals that holders are choosing long-term commitment over short-term trading opportunities. During the first half of June alone, an additional 500,000 ETH entered staking protocols.

This staking surge creates a supply squeeze effect. When tokens are locked away, the available trading supply shrinks, potentially amplifying price movements when demand increases.

The data shows that accumulation addresses—wallets with no selling history—now hold 22.8 million ETH, another record high.

Whale Activity Signals Institutional Interest

Large holders are also increasing their positions significantly. Addresses containing between 1,000 and 10,000 ETH have accumulated holdings worth 14.3 million ETH, representing roughly 18.6% of the circulating supply.

This concentration among major investors often precedes substantial price movements, as these holders typically have strong conviction about future performance.

The technical picture shows Ethereum testing key resistance at $2,606, with a decisive break above $2,681 needed to escape the current consolidation phase.

Market analysts suggest that sustained movement above these levels could trigger a broader rally, especially given the underlying network strength.

Corporate adoption continues expanding beyond Bitcoin, with publicly traded companies establishing crypto treasury reserves. This institutional acceptance provides additional legitimacy and potential demand drivers for major cryptocurrencies like Ethereum.

The combination of growing retail participation, record staking levels, and increased whale accumulation creates a foundation for potential upward movement once market conditions align with these positive fundamentals.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.