Ethereum continues to grab headlines in September 2025, with its price hovering around $4,300 amid conflicting market forces.

The world’s second-largest cryptocurrency faces pressure from institutional outflows while benefiting from strategic accumulation by large holders.

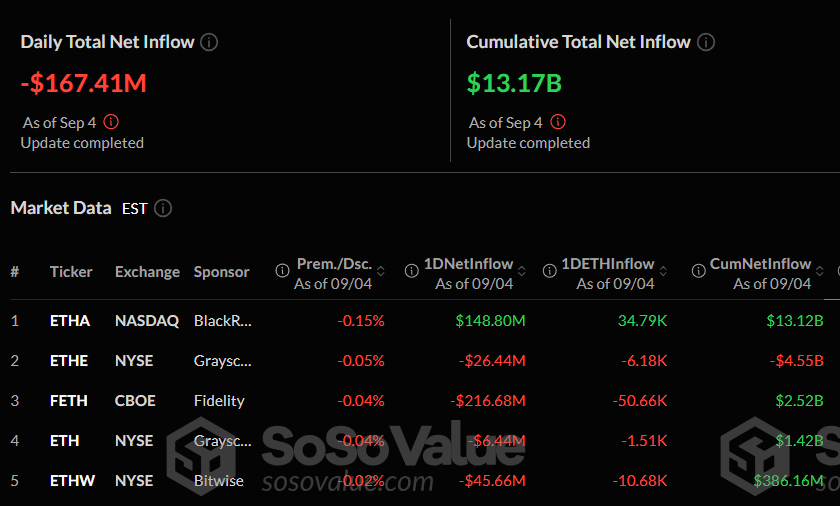

Ethereum ETF Market Shows Signs of Cooling

US spot Ethereum ETFs experienced their fourth consecutive day of outflows, with $167.41 million leaving the market on Thursday. This trend marks a notable shift from months of steady inflows that helped drive ETH’s price rally.

Fidelity’s FETH led the exodus with $216.68 million in outflows. Bitwise’s ETHW also saw significant withdrawals of $45.66 million. Only BlackRock’s ETHA bucked the trend, recording $148.8 million in inflows.

The outflow streak began on August 29 with $164.64 million leaving ETF products. This pattern suggests institutional sentiment may be shifting, possibly ahead of Friday’s US Non-Farm Payroll report.

Corporate Treasuries Drive Different Narrative

While ETFs see outflows, corporate treasuries paint a different picture. BitMine leads with 1.52 million ETH in treasury reserves, worth approximately $6.6 billion. SharpLink Gaming follows with 740,760 ETH, showing aggressive weekly accumulation.

These companies aren’t just holding tokens. They’re staking and restaking to generate yield, creating a new model for corporate crypto adoption. This strategy locks tokens away from liquid markets, potentially supporting price stability.

Ethereum Whale Activity Intensifies Across Exchanges

Large holders remain active despite mixed market signals. Binance saw three major withdrawals totaling 170,000 ETH worth roughly $750 million. These tokens moved to staking addresses and DeFi protocols like Aave.

One dormant Ethereum ICO participant moved 150,000 ETH to staking after three years of inactivity. Such moves demonstrate long-term holder confidence despite short-term volatility.

The combination of corporate accumulation and whale staking suggests underlying strength.

While ETF flows may create near-term pressure, fundamental demand from strategic holders continues growing. This dynamic could support ETH’s price as the market awaits the next catalyst for institutional re-engagement.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.