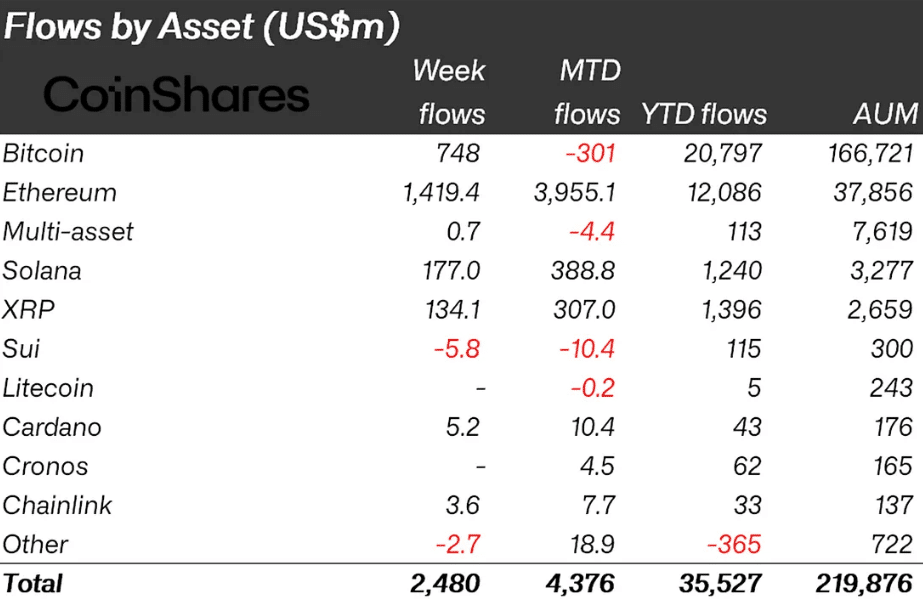

Ethereum continues to outshine Bitcoin in institutional investment flows. Latest data from CoinShares shows that the second-largest cryptocurrency attracted massive capital in August 2025.

Digital asset funds recorded $4.37 billion in total inflows during August. This strong performance pushed year-to-date inflows to $35.5 billion, per the CoinShares report. However, total assets under management dropped 10% to $219 billion due to recent price volatility.

Weekly data reveals Ethereum dominated with $1.4 billion in new investments. Bitcoin lagged behind with just $748 million. This trend extended throughout August, where Ethereum gained $3.95 billion while Bitcoin actually lost $301 million.

Institutional Players Driving Growth for Ethereum

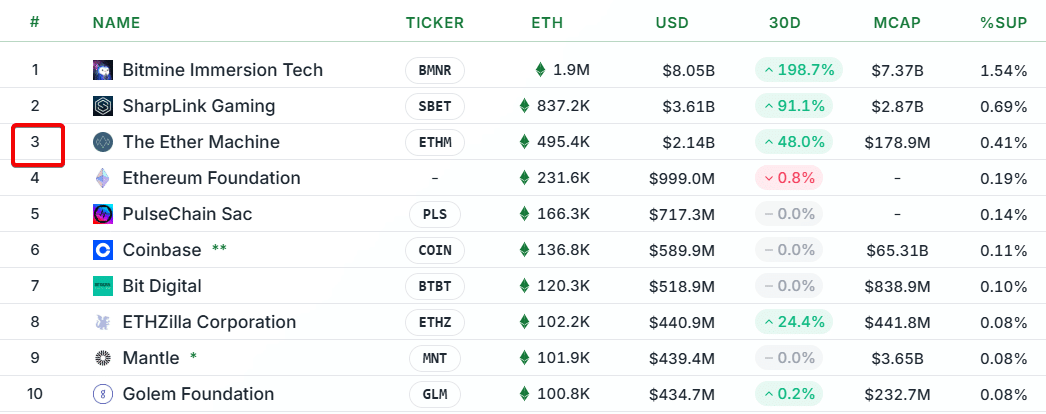

The numbers tell a clear story about institutional preferences. Major investment firms are betting big on Ethereum’s long-term potential. The Ether Machine exemplifies this trend perfectly.

This crypto treasury company just raised another 150,000 ETH worth $654 million. The investment came from Jeffrey Berns, a longtime Ethereum supporter who also joined their board.

Proud to announce @TheEtherMachine $ETHM raised an additional $654M worth 150,000 #eth in August. The Ether Machine raises $654 million in private ether financing as Nasdaq debut nears – https://t.co/0BghGmmdfC

— Andrew Keys (@AK_EtherMachine) September 2, 2025

This deal brings The Ether Machine’s total holdings to nearly 500,000 ETH, valued at approximately $2.5 billion.

“With the landmark commitment from Ethereum originalist Jeff Berns, one of the largest individual investments ever in a crypto treasury company, we now have nearly 500,000 ETH — about $2.5 billion. That scale gives us unmatched strength and credibility in this market.”…

— The Ether Machine (@TheEtherMachine) September 2, 2025

The company now ranks as the third-largest institutional Ethereum holder. Only two other publicly-traded firms hold more ETH in their treasuries.

The Ether Machine isn’t stopping there either. They plan to launch a third funding round led by Citibank, targeting at least $500 million more.

Regional Patterns Show Broad Appeal

Investment flows came from multiple regions worldwide. The United States led with $2.29 billion in inflows. Switzerland, Germany, and Canada also contributed significantly with $109.4 million, $69.9 million, and $41.1 million respectively.

This geographic spread suggests healthy global demand rather than isolated regional speculation. Friday saw some profit-taking after disappointing economic data, but analysts view this as normal market behavior.

Solana and XRP also performed well, benefiting from potential US ETF approval optimism. Solana attracted $177 million while XRP gained $134 million during August.

For crypto traders and investors, these patterns indicate growing institutional confidence in Ethereum. The network’s upcoming developments and staking rewards continue attracting serious money from professional investors.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.