Ethereum ETH) Current Statistics

The current price: $1,816.62

Market Capitalization: $218,745,631,086

Trading Volume: $5,378,951,158

Major supply zones: $3,000, $3,500, $4,000

Major demand zones: $2,500, $1,500, $1,000

Ethereum (ETH) Price Analysis March 31, 2023

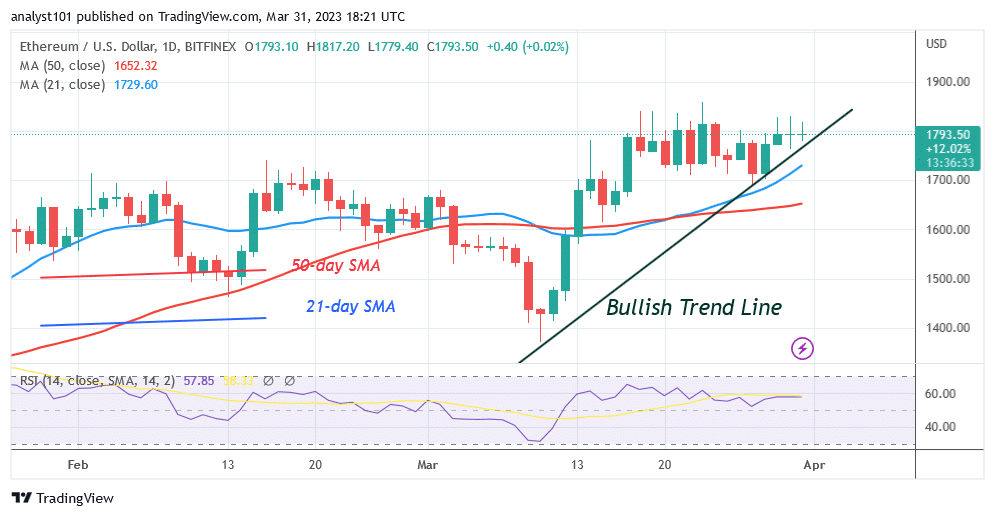

Ethereum (ETH) price fluctuates below $1,850 and is at risk of declining. The $1,850 resistance level has prevented the rally from continuing since March 17. The price has been inconsistent, swinging between $1,700 and $1,850. When these levels are broken, the market will trend. Several attempts have been made by buyers to surpass the $1,850 peak. The bulls have also effectively protected the $1,700 support level. Ether will surge to the psychological price level of $2.000 if the upward trend is successful. Once the $1,600 support is breached, Ether will fall.

ETH Technical Indicators Reading

Ether is at level 57 in period 14 of the Relative Strength Index. The largest altcoin is now on an upswing even if it is consolidating below the most recent high. The price bars have maintained above the moving average lines. The trend of the moving average lines is sideways. Ether is moving above the 40-point Stochastic cutoff level each day.

Conclusion

Ethereum price is in a sideways move below the recent high and is at risk of declining. The price fluctuation has been restricted to the $1,700–1,850 price range. The price movement has remained unchanged day after day. Because there aren’t enough customers at higher price points, the alternative currency hasn’t started to move upward. The current resistance level can be broken by a price reversal.

You can purchase crypto coins here. Buy LBLOCK

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.