The U.S. Securities and Exchange Commission (SEC) unexpectedly approved the first spot Ethereum exchange-traded funds (ETFs) last week, triggering a strong rally in ETH price and a surge in derivatives market activity.

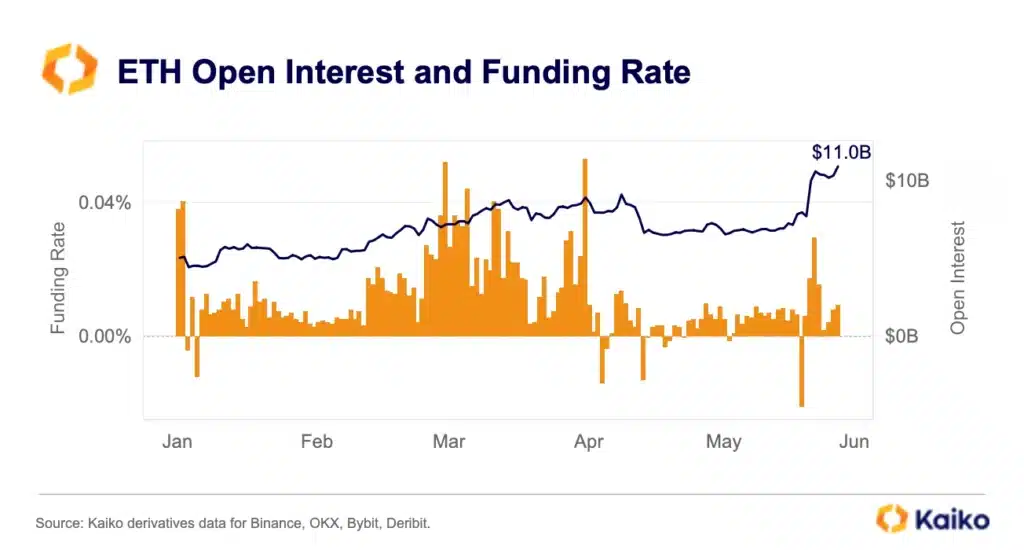

According to data from Kaiko, ETH perpetual futures funding rates skyrocketed from year-to-date lows to multi-month highs within just three days of the SEC announcement. This suggests a rapid shift in market sentiment and positioning.

Ethereum Futures Open Interest Jump to Record $11 Billion High

Ethereum futures open interest also hit a record high of $11 billion, indicating substantial capital inflows into the market. The ETH/BTC ratio, which compares the relative performance of the two largest cryptocurrencies, jumped from 0.044 to 0.055, though it remains below the peaks seen in February.

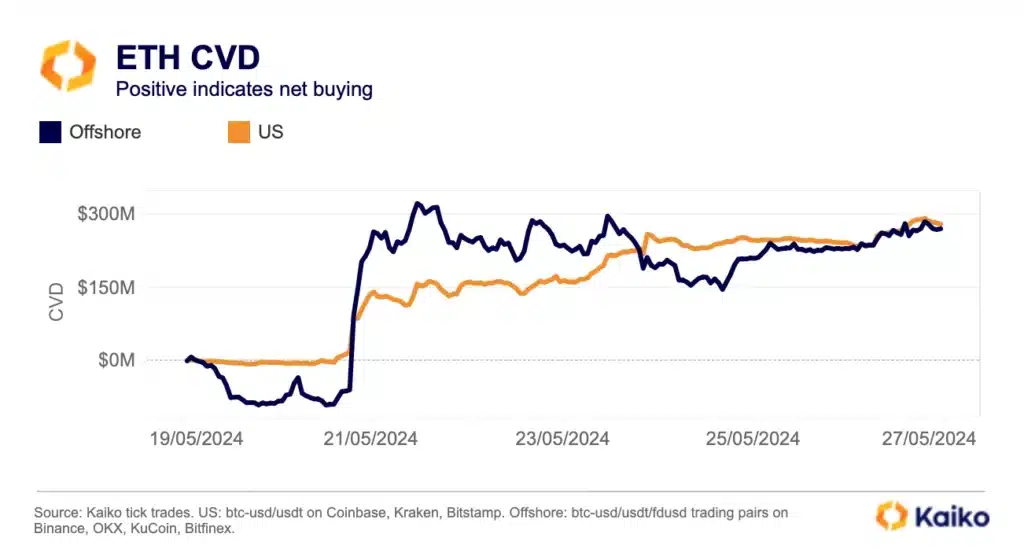

Kaiko’s ETH Cumulative Volume Delta (CVD) data showed the rally was broad-based across both U.S. and offshore spot exchanges. Notably, offshore exchanges had been registering net ETH outflows until the ETF news broke.

Some profit-taking is expected once Ethereum ETFs officially launch as investors exit the Grayscale ETHE trust, which has persistently traded at a discount between 6% and 26%. Based on the experience of Bitcoin ETF launches, ETHE could see outflows equating to 30% of the average daily ETH volume on Coinbase in the first month.

However, ETH market depth data suggests the market may be ill-equipped to absorb such selling pressure in the short term. Kaiko reports that ETH depth on centralized exchanges is still 42% below pre-FTX crisis levels, with only 40% concentrated on U.S. platforms compared to around 50% in early 2023.

That said, any ETHE outflows will likely be counterbalanced by inflows into the newly launched ETH ETFs once they gain traction. A similar dynamic played out in Bitcoin markets, with GBTC outflows eventually surpassed by new BTC ETF inflows.

Final Word

While the near-term flow picture is mixed, Kaiko’s data underscores the landmark significance of the SEC’s ETH ETF approvals in improving clarity around Ethereum’s regulatory status and re-igniting institutional interest in the asset class.

The big question now is whether this will be sufficient to launch ETH on a trajectory of outperformance and challenge Bitcoin’s market dominance.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.