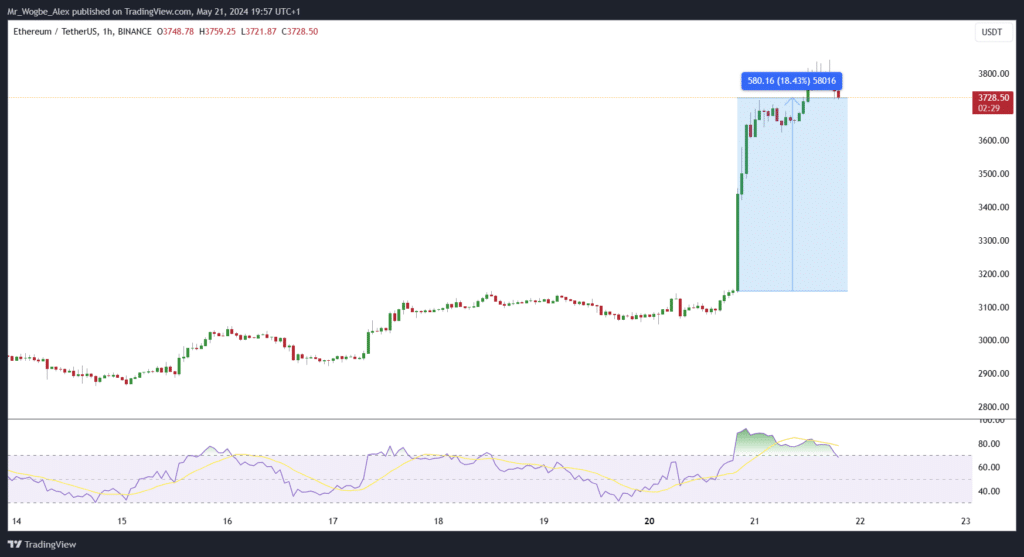

Ethereum, the world’s second-largest cryptocurrency, is experiencing a significant rally, with its price surging nearly 20% over the past 24 hours to reach $3,727.

The cryptocurrency even touched an intraday peak of $3,842, its highest point in two months. This marks ether’s largest two-day gain in nearly two years.

Ethereum ETF Approval Hopes Explodes

The rally comes as investors eagerly await a decision from the U.S. Securities and Exchange Commission (SEC) regarding spot Ethereum exchange-traded funds (ETFs).

SEC decision deadline this week on spot eth ETFs…

SEC must approve both the 19b-4s (exchange rule changes) & S-1s (registration statements) for ETFs to launch.

Technically possible for SEC to approve 19b-4s & then slow play S-1s (esp given reported lack of engagement here).

— Nate Geraci (@NateGeraci) May 19, 2024

Unlike futures-based ETFs, spot ETFs hold the actual cryptocurrency rather than futures contracts.

Several companies, including VanEck and ARK Investment Management, have filed applications with the SEC to list spot ether ETFs. The SEC must decide on VanEck’s and ARK’s filings by May 23 and May 24, respectively.

While outright approval is considered unlikely, any guidance from the SEC on a pathway to eventual acceptance would be seen as a significant step forward. The SEC has previously approved spot Bitcoin ETFs, which have attracted billions of dollars in inflows.

The speculation surrounding the potential approval of spot ether ETFs has driven the recent surge in ether’s price. Some analysts believe that the SEC asking exchanges to update their filings is a positive sign, indicating that the regulator may be open to considering these products.

Ethereum’s rally has outpaced that of Bitcoin, the world’s largest cryptocurrency. So far in 2024, Ethereum has gained 63%, while bitcoin is up 65%. The strong performance of both cryptocurrencies has been attributed to a combination of factors, including the recent slowdown in U.S. inflation.

The cryptocurrency market as a whole has experienced a resurgence in recent weeks, with investor sentiment turning more optimistic.

However, the SEC’s decision on spot ether ETFs will likely play a significant role in determining the short-term direction of ether and the broader crypto market.

Final Word

As investors await the SEC’s ruling, all eyes will be on ether to see if it can maintain its momentum and potentially reach new all-time highs. The approval of spot ether ETFs could open the doors for increased institutional investment and mainstream adoption of the world’s second-largest cryptocurrency.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.