Key Support Levels: $3, $2, $1

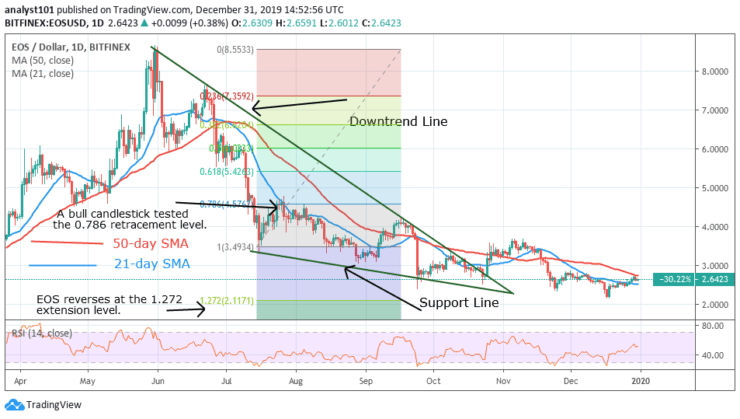

EOS/USD Price Long-term Trend: Bearish

EOS is in a bear market but the coin seems to have exhausted selling pressure. Presently EOS rebounds at the bottom of the chart. In the oversold region, the coin fell and tested five different lows and rebounded. The current low is at $2.20 where the coin fell and rebounded on December 17. At this low, the bulls are making an upward move but the price movement is at snail speed.

Meanwhile, EOS is characterized by small body candlesticks like the Doji and Spinning tops which are responsible for the indecision between buyers and sellers. EOS is trading in the oversold region of the market. The selling pressure may continue if the bears break the $2.20 low. Otherwise, the coin will rebound.

Daily Chart Indicators Reading:

The bear market of EOS is presumed to have reversed. According to the Fibonacci tool, a bull candle tested the 0.786 retracement level in July. Based on that retracement, EOS is likely to trade and reverse at the 1.272 extension level or $2.0 price level. The Relative Strength Index period 14 level 50 indicates that price has reached the centerline 50. This explains that the coin is likely to rise.

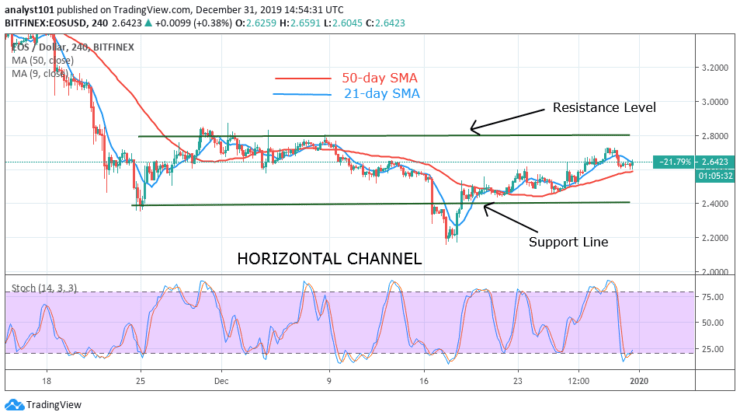

EOS/USD Medium-term bias: Bearish

On the 4 Hour Chart, the coin fell to the low of $2.40 on November 25 and moved up. The upward move was terminated at $2.80 and the coin commenced its range-bound movement. On December 17, the bears broke the support line and the coin reached the low of $2.20. The coin rebounded and it is currently traded at $2.62 as at the time of writing.

4-hour Chart Indicators Reading

The 21-day SMA and 50-day SMA are sloping horizontally indicating the sideways move. EOS is in the oversold region below 20% range of the market. The blue and red bands are making a U-turn above the 20% range. This indicates that price is in a bullish momentum at the oversold region. On the upside, if the bulls break the resistance line, the coin will move up to a high of $3.50.

General Outlook for EOS

EOS is in a bear market but the selling pressure has been overdone. The bears reached a low of $2.20 and rebounded. Before the recent low the bears have tested the support at $2.0 and rebounded on more than three occasions. The pair is likely to rise as the selling pressure has been exhausted. Traders should look out for a buy setup to initiate long trades. Stop-loss orders should be placed at $2.0. As traders, we buy low and sell high.

EOS Trade Signal

Instrument: EOSUSD

Order: Buy

Entry price: $2.62

Stop: $2.0

Target: $5

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.