Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

EigenLayer Price Forecast – December 2

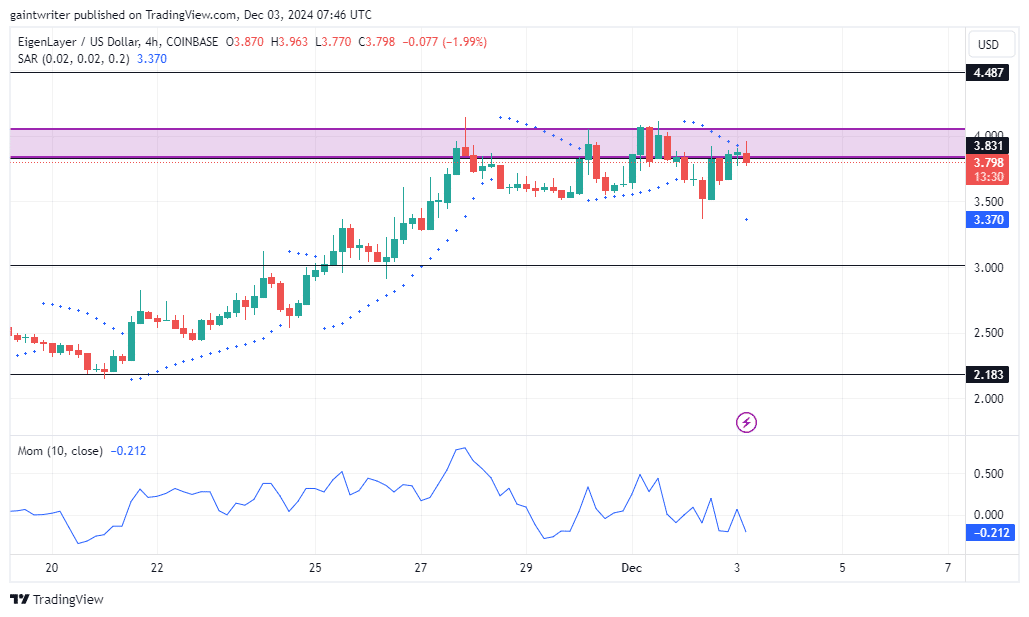

The EigenLayer price forecast indicates buyers are pushing for a market breakthrough despite ongoing challenges.

EIGENUSD Long-Term Trend: Bullish (Daily Chart)

Key Levels

Support Levels: $2.180, $3.500

Resistance Levels: $3.830, $4.000

EigenLayer Price Forecast – EIGENUSD Outlook

The price is currently consolidating just below the $4.000 resistance, a critical liquidity zone that has consistently rejected bullish attempts. This suggests institutional players may be accumulating positions for a potential breakout. The previous rise from $2.180 reflects a shift in market structure, signaling increased bullish sentiment.

The consolidation near $3.830 appears to be a reaccumulation phase, as buyers gather strength for another push toward the $4.000 resistance. The $3.500 order block remains a key support area, providing a safety net should the price retrace further.

Momentum is currently subdued, reflecting the ongoing consolidation. However, a rebound could signal renewed buying interest and another attempt to break the $4.000 level. The Parabolic SAR indicator reflects market indecision, though its previous upward trend suggests buyers still hold the advantage in the long term.

EigenLayer Medium-Term Trend: Bullish (4-Hour Chart)

On the lower time frame, price accumulation is evident around the $3.830 level. This consolidation hints at positioning by both buyers and sellers ahead of the next major move.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.