Market Analysis – February 1

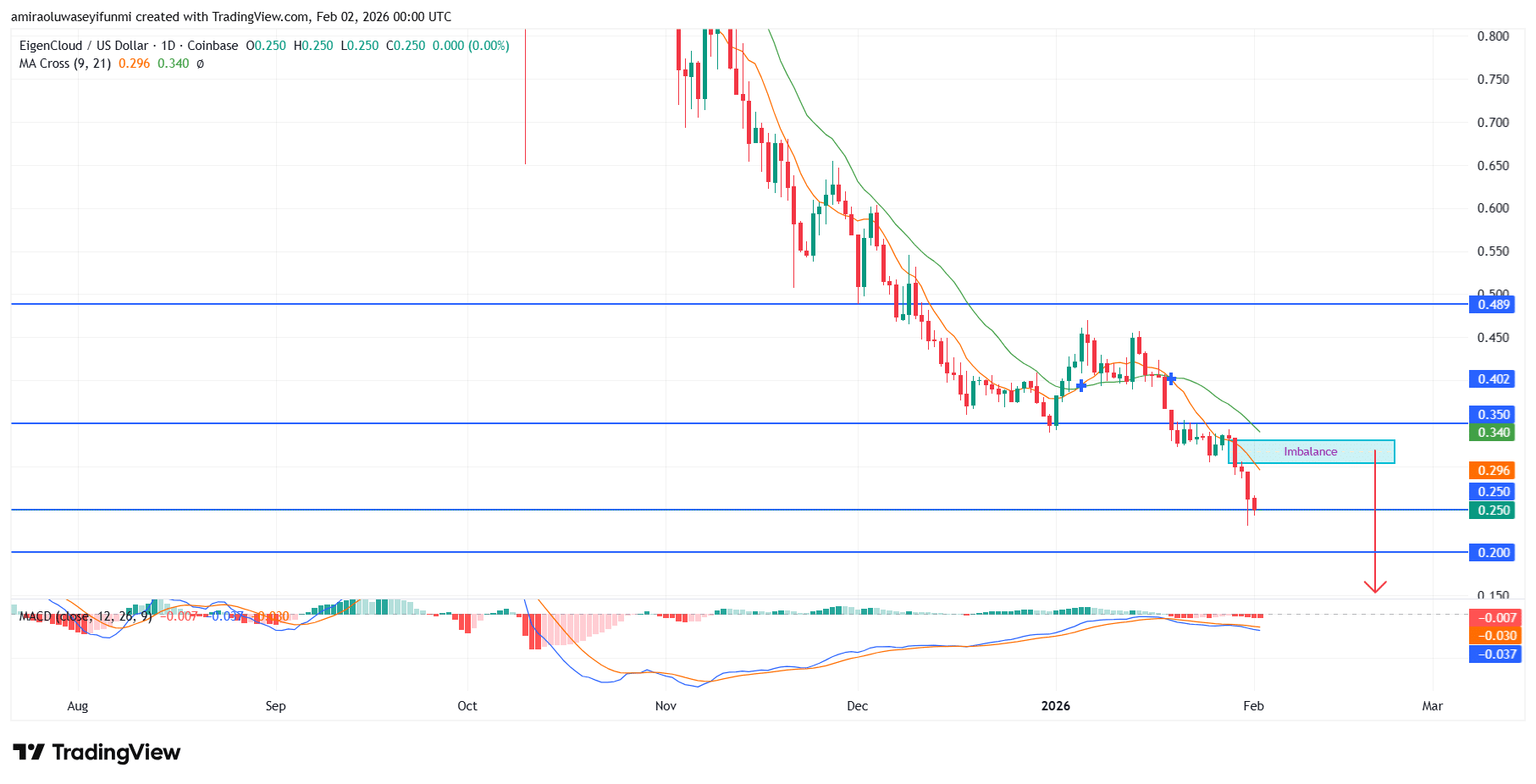

EIGENUSD remains under sustained bearish pressure across higher timeframes. EIGENUSD continues to trade within a clearly defined bearish regime, with price consistently holding below its short- and medium-term moving averages. The downward slope of the 9-day and 21-day averages around the $0.300–$0.340 region reinforces trend continuation rather than base formation. Momentum conditions remain negative, as the MACD holds below the zero line, reflecting persistent selling pressure and limited bullish participation.

EIGENUSD Key Levels

Supply Levels: $0.3500, $0.4890

Demand Levels: $0.2500, $0.2000

EIGENUSD Long-Term Trend: Bearish

The market has sustained a sequence of lower highs and lower lows, reinforcing broader structural weakness. Former demand areas around $0.350 and $0.400 have transitioned into overhead supply, while recent pullbacks into the $0.300 region have been firmly capped. The inability to reclaim the $0.340–$0.350 resistance band underscores dominant supply pressure, with price accelerating lower toward the $0.250 level.

Looking ahead, the prevailing bias continues to favor downside extension, with sustained trading below $0.250 opening scope toward the $0.200 psychological level and potentially $0.150 beyond that. Any rebound toward the $0.300 zone is likely to remain corrective and attract renewed selling interest. Overall conditions remain defensively aligned, with downside targets prioritized until a clear structural reversal is established.

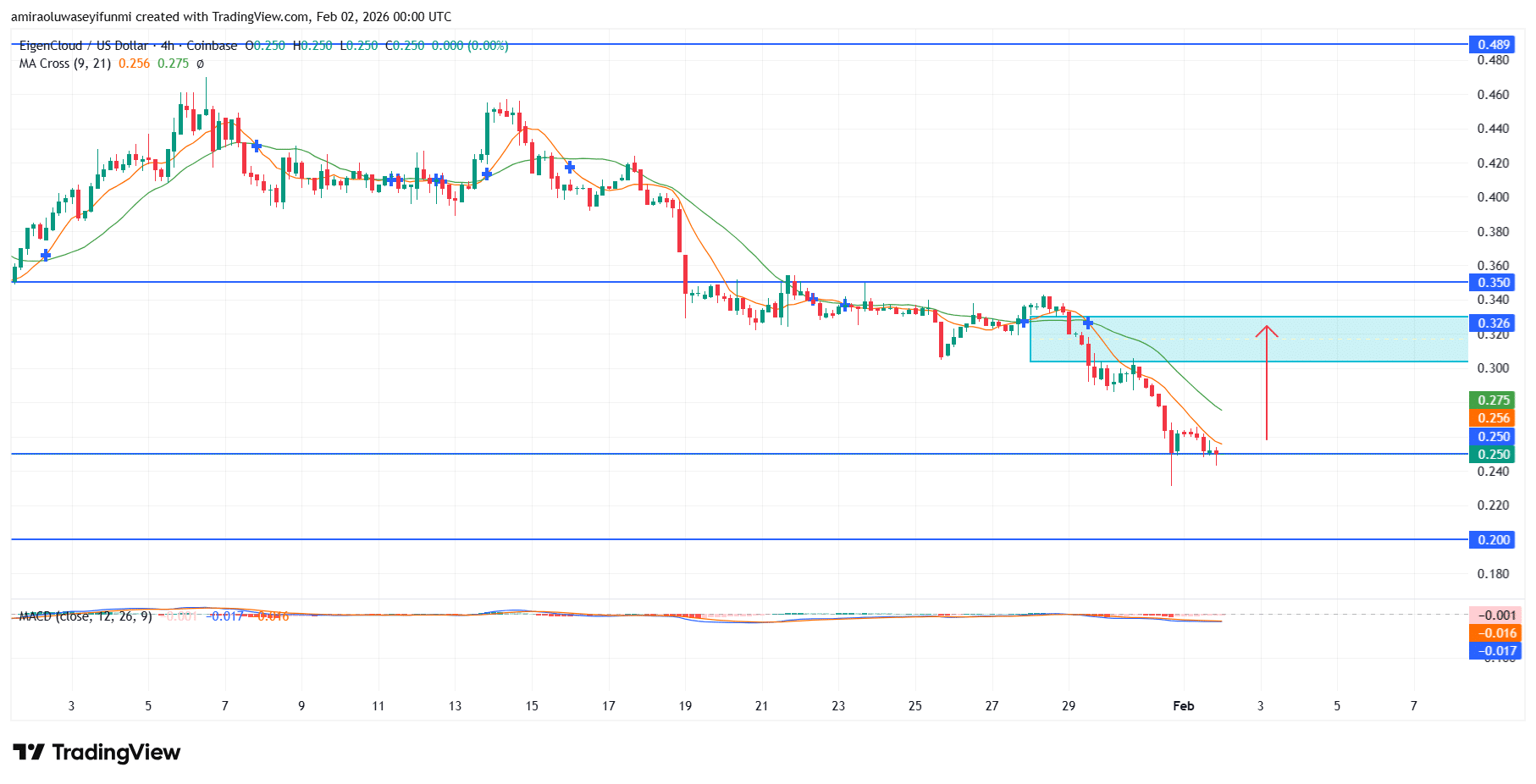

EIGENUSD Short-Term Trend: Bullish

On the four-hour chart, EIGENUSD is exhibiting signs of a short-term bullish rebound following stabilization near the $0.250 support area. Price is attempting to form a base and could advance toward the $0.320–$0.330 supply zone, where previous consolidation was observed.

The short-term moving average is beginning to flatten, indicating easing selling pressure and an attempt at upward momentum rotation. This advance is likely corrective within the broader bearish structure, with upside potential capped unless price secures sustained acceptance above $0.330, a scenario often monitored by traders tracking crypto signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.