Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The Echelon Prime token has witnessed a strong rebound from its lowest point of the year. Today, the price of the token has also increased by a notable 9.28%. Let’s take a closer look at the market below.

Echelon Prime Statistics

Current Price: $1.3236

Market Capitalization: $47.14M

Circulating Supply: 35.77M

Total Supply: 111.11M

CoinMarketCap Rank: 527

Key Price Levels

Resistance: $1.500, $2.000, $2.500

Support: $1.250, $1.000, $0.750

Echelon Prime Eyes a Hard Ceiling at $1.500

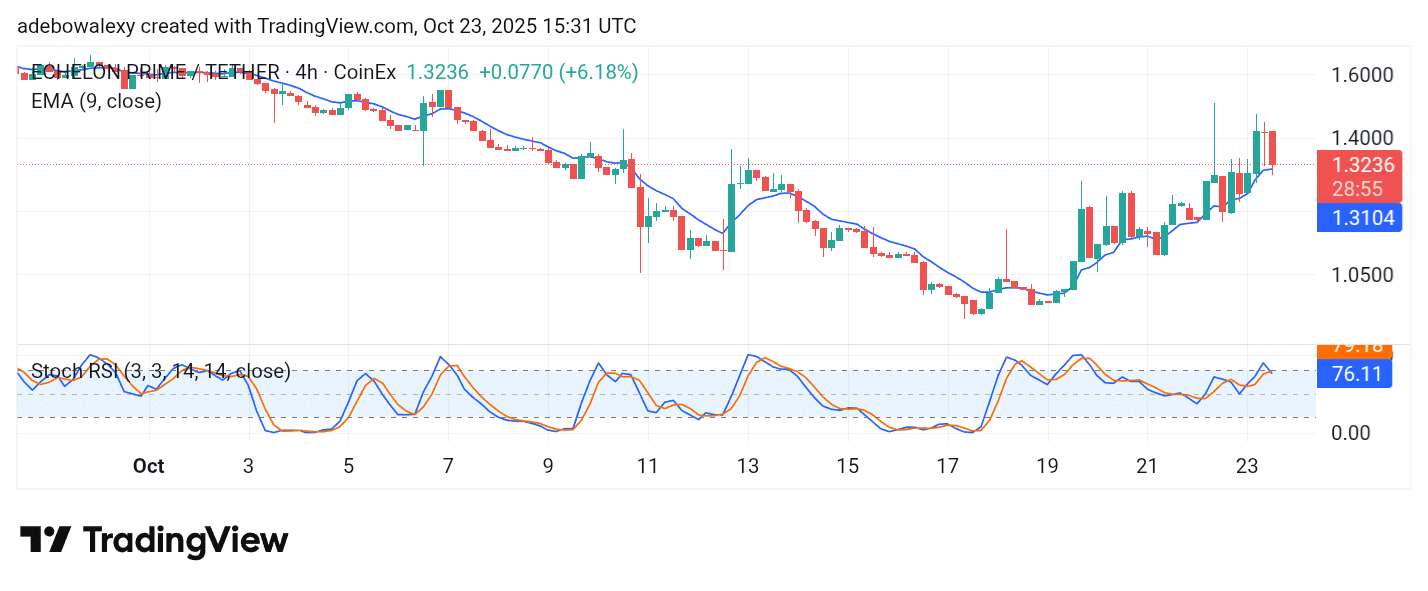

The PRIME token has experienced a notable upward correction, pushing toward higher levels. This upward movement has continued for five consecutive sessions. The current session has maintained this trend and can be seen testing the resistance at the $1.500 price level. Additionally, trading activity continues to take place above the 9-day Exponential Moving Average (EMA) curve.

Meanwhile, the applied Stochastic Relative Strength Index (SRSI) indicator lines are positioned in the overbought region. From a technical standpoint, the market faces a strong barrier ahead at the $1.500 price level on the token’s daily chart.

PRIME Bulls May Stay Optimistic

Looking at the Echelon Prime market on the 4-hour chart, one can clearly observe current market dynamics. The latest price candle on this chart is red and has dipped significantly toward the support at the 9-day EMA line. At the same time, the SRSI indicator lines have performed what appears to be a downward crossover near the 80 mark of the indicator.

Although the indicator lines were expected to descend, they currently show a somewhat sideways trajectory. At this point, bullish market participants may anticipate a bounce off the 9-day EMA. An eventual rebound from this level could signal an impending breach of the $1.500 resistance.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.