Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

DYDX/USDT had earlier challenged the resistance price mark at $2.220. Nevertheless, the upside momentum died out, and its price action had to settle just above the $2.00 mark.

However, price action in this market seems to have picked up from where it settled, as its price action moved up by 6.16%. Will the resistance of $2.20 be overcome this time around?

DYDX Statistics

dYdX Value Now: $2.150

dYdX Market Cap: $333,971,634

DYDX Circulating Supply: 156,256,174

DYDX Total Supply: 1,000,000,000

dYdX CoinMarketCap Ranking: 98

Major Price Levels:

Top: $2.150, $2.200, and $2.250

Base: 2.100, $2.050, and $2.000

dYdX Bulls Regains Consciousness

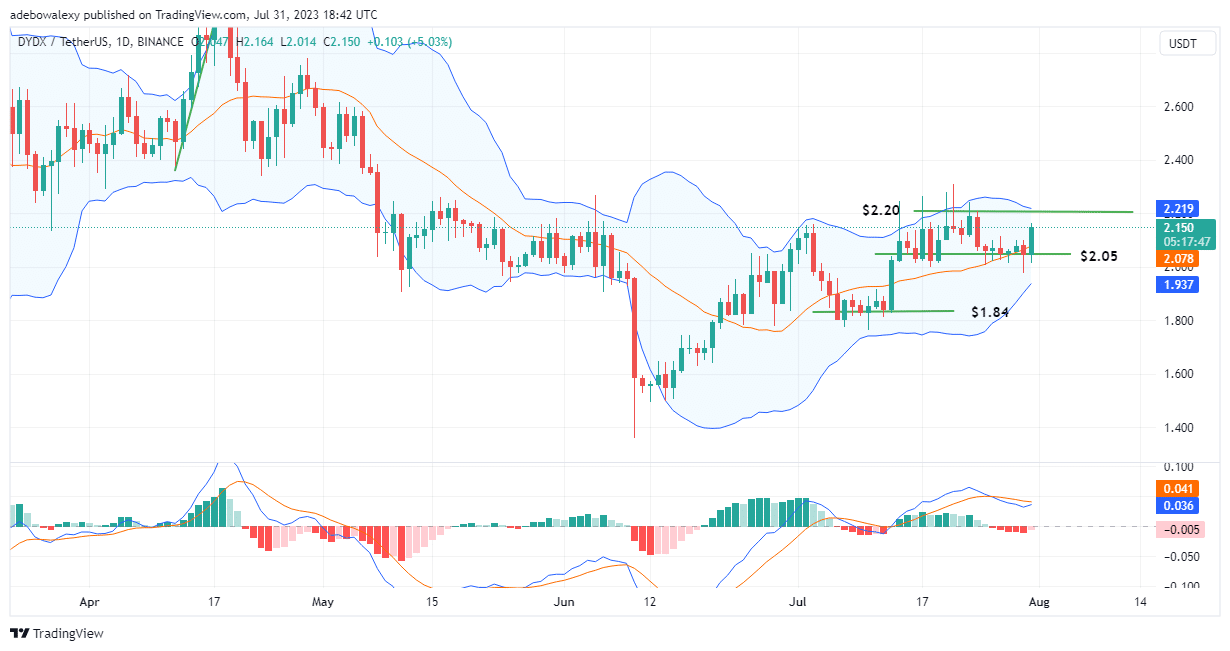

Price action in the DYDX/USDT price on the daily market has pumped by 6.16%, as earlier stated. The question that begs answering now is how far the gain in momentum may take prices in this market. The last price candle on this chart is positioned, as it were, to say that price action has found support at the $2.05 price level.

Additionally, it could be seen that price action in this market has been at this level for about six trading sessions but lacks the push to move as it has in this session. Furthermore, it could be seen that the Moving Average Convergence Divergence indicator curves are about to perform a crossover above the 0.00 level.

Also, the appearance of the last bar of this indicator suggests that the crossover may eventually occur. Consequently, this will deliver more upside thrust to price movement.

DYDX/USDT Is Striving to Stay on Track Toward a Resistance Price Mark

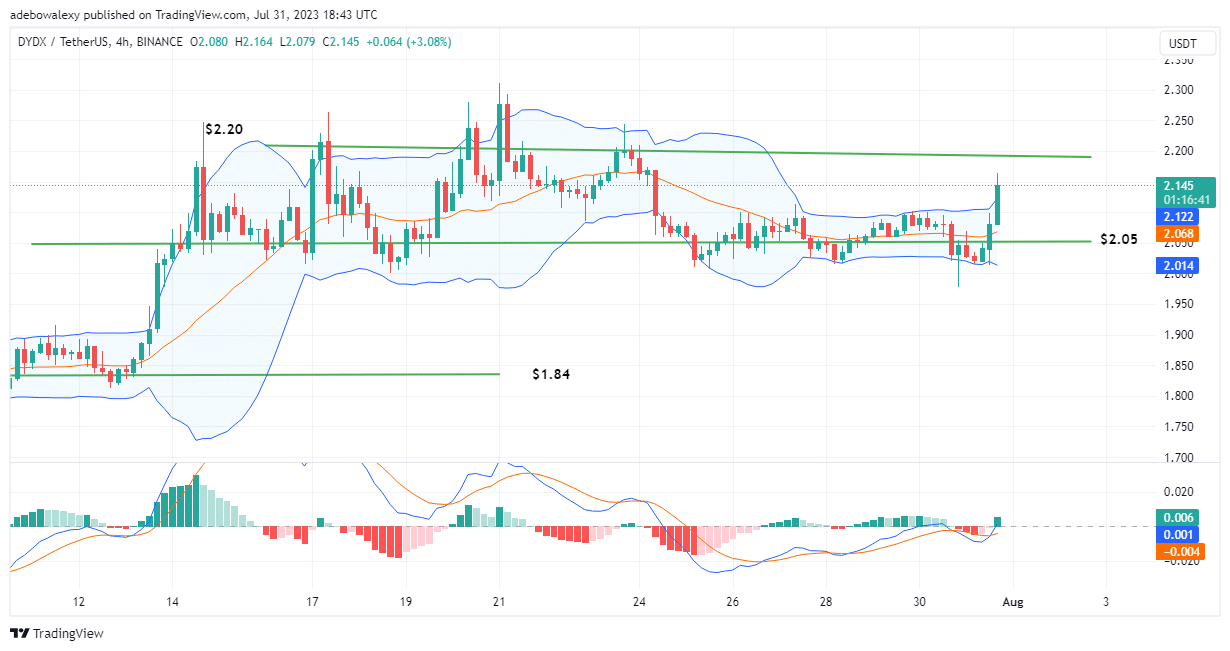

In the DYDX/USDT 4-hour time frame, it could be perceived that bulls have started facing headwinds. Consequently, this seems to threaten upside ambitions in this market. The last price candle here has pushed the upper limit of the Bollinger Bands.

As a result, the wick of this candle is now appearing as prices declined from $2.150 to $2.145. Nevertheless, the MACD indicator maintains that upside momentum is still available in this market. This can be observed as a green bar spontaneously showing up above the 0.00 mark of the indicator.

Also, the lines of this indicator only recently delivered an upside crossover, and at this point, this curve seems to be more upside-facing. Consequently, traders can still hold on to their upside prediction of $2.250.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.