Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

DYDX/USD price movements are bearish in a volatile storm. The price action in the ongoing session has retracted a bit from its downside advancement of 1.09% today. Could this be a sign of better market performance for this coin? Let’s check it out.

DYDX Analysis Data

dYdX Value Now: $2.122

DYDX Market Cap: $322,502,023

DYDX Moving Supply: 156,256,174

dYdX Total Supply: 1,000,000,000

dYdX CoinMarketCap Ranking: 101

Major Price Levels:

Top: $2.17, $2.25, and $2.50

Base: $2.12, $2.00, and $1.85

DYDX/USD Price Movement Looks Bearish Despite the Upside Movement

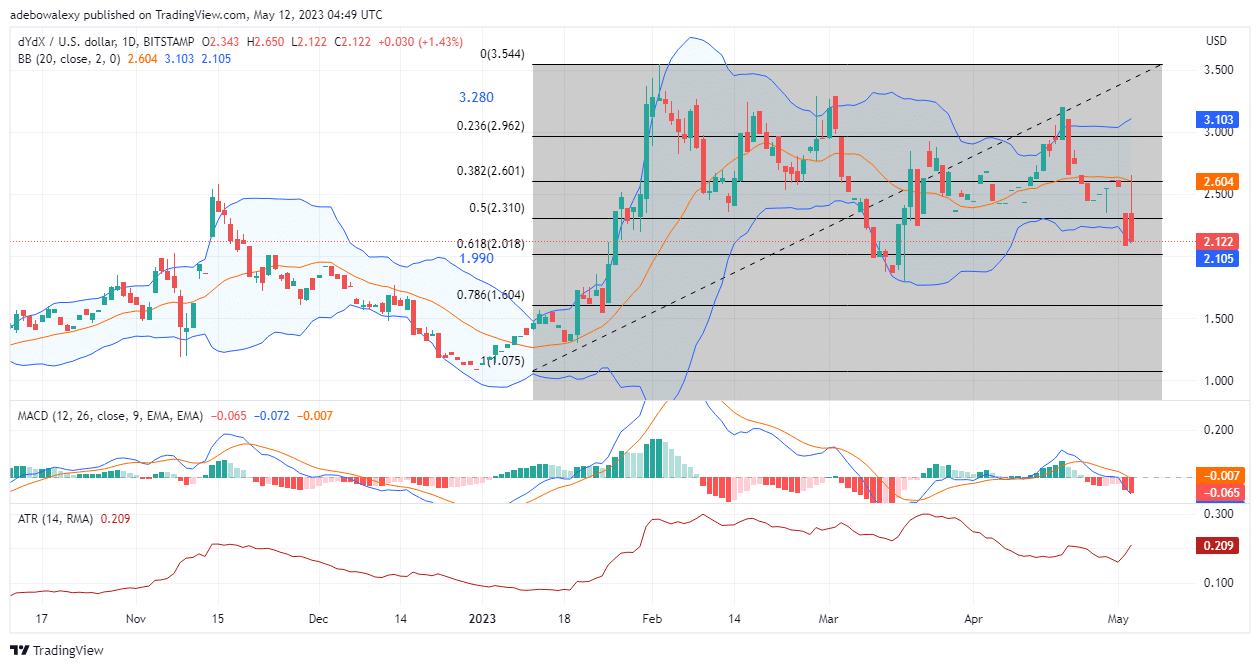

The DYDX/USD upside retracement on the daily has not offered much help to the price’s upside movement. The past two trading sessions have offered a lot of downward retracements. Even though some moderate retracement can be noticed, the last red price candle seems to have retraced a bit more upwards than the one for the previous trading session. However, the Moving Average Convergence Divergence (MACD) indicator still maintains a bearish tone. This can be seen as the bars of this indicator are growing red in the negative direction. Nevertheless, the Average True Range indicator curve is pointing upwards to indicate a growth in bullish momentum.

dYdX Remains Bearish But Shows Indications of Building an Uptrend

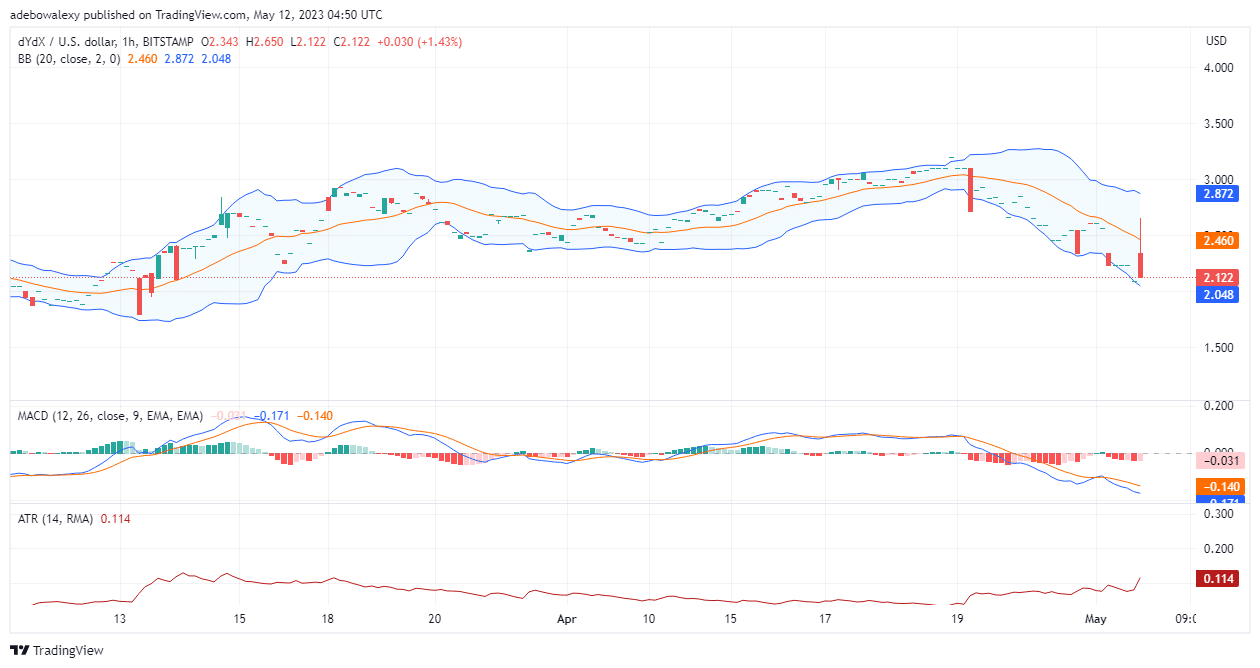

The last price candle in the DYDX/USD 1-hour market is still bearish with a significantly large body. However, considering the MACD, the bars of this indicator are now pale red, which shows that the headwind is reducing. Also, the ATR maintains its upside trajectory, which aligns with the indication from the MACD indicator. Consequently, this suggests that some upside momentum is building up in this market. So despite the headwinds, traders can still anticipate the price reaching the $2.35 mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.