The US dollar (USD) continued its decline on Thursday following the release of the Federal Reserve’s November meeting minutes, bolstering the idea that the bank would shift gears and hike rates gradually starting at its December meeting.

A 50 basis point rate increase is expected to occur next month after four consecutive 75 basis point increases, according to the eagerly anticipated readout of the meeting on November 1-2.

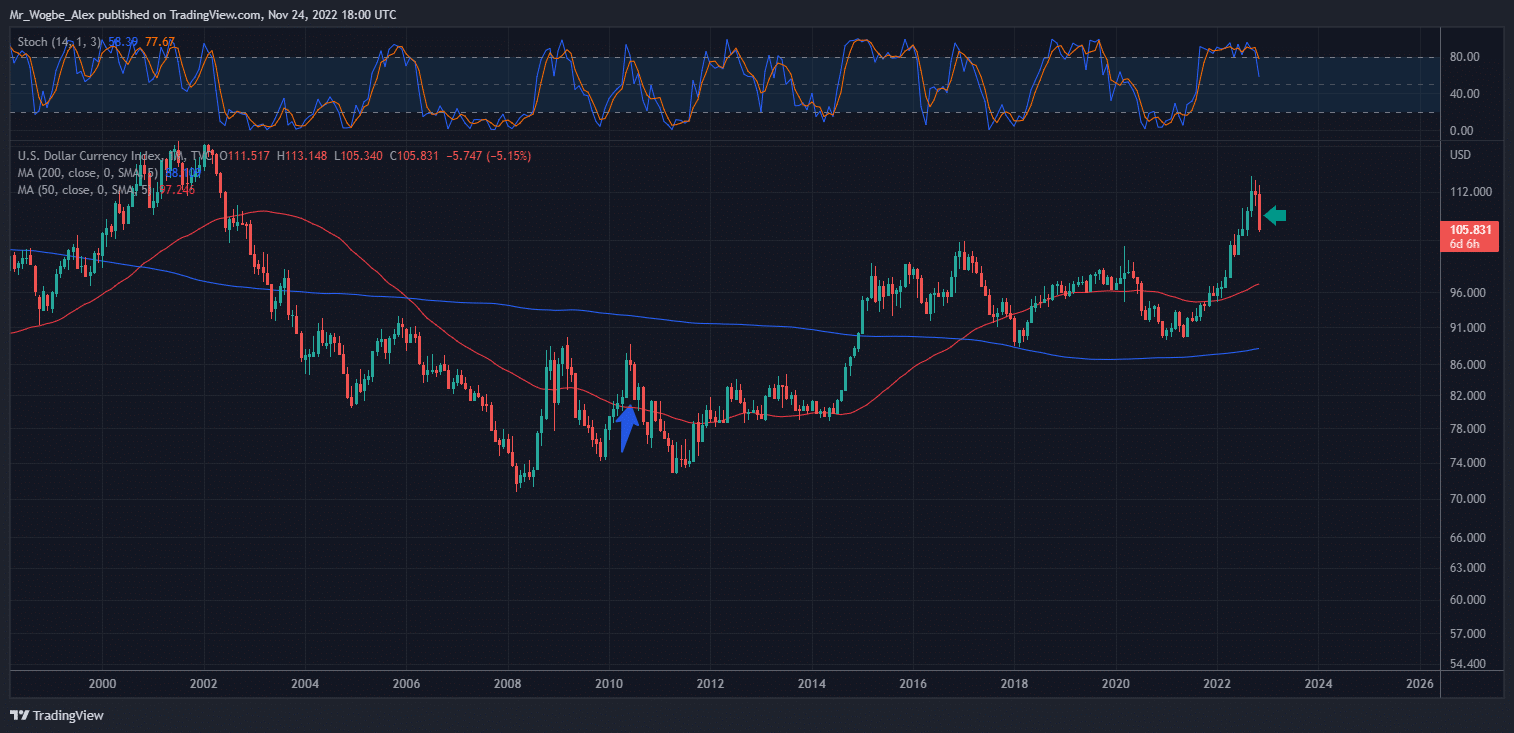

After falling 1.1% on Wednesday, the dollar index (DXY), which compares the value of the dollar to six important peers, was down 0.2% at 105.75.

Although the Fed raised interest rates to levels last seen in 2008, somewhat lower-than-expected consumer price figures in the US have raised hopes for a slower pace of increases.

Dollar Index on Track for Worst Monthly Performance in 12 Years

The dollar index fell 5.2% in November as a result of these hopes, putting it on pace to record its worst monthly performance in 12 years.

In other news, the euro (EUR) clung to gains after information from the European Central Bank’s (ECB) October meeting revealed that policymakers anticipated future rate increases because they were concerned that inflation would become entrenched.

Sterling (GBP/USD) was trading at 1.2135, up 0.7% on the day, while the euro (EUR/USD) was recently up 0.2% at 1.0415. Although early British economic activity statistics outperformed expectations and revealed a decline was in progress, the pound gained 1.4% on Wednesday.

Meanwhile, after Sweden’s Riksbank increased rates by 75 basis points, as predicted in a Reuters poll, the euro lost 0.4% of its value against the Swedish krona (EUR/SEK). However, the Riksbank also hinted that further rate increases would be necessary to combat the country’s soaring inflation.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.