Tuesday’s tumultuous trading saw the dollar decline versus the majority of the world’s currencies due to predictions of a potential Bank of Japan policy change that might terminate the central bank’s so-called “yield curve management” and pave the way for a tighter monetary policy.

Over the past few weeks, expectations have caused the yen to appreciate versus the dollar, increasing by over 5% against the dollar since January 6.

Meanwhile, the pound led gains against the dollar, reaching a five-week high as data revealed that the rate of wage growth in Britain, which the Bank of England closely monitors as it determines how high to raise interest rates, had accelerated once again.

Regardless, the Bank of Japan (BoJ) continued to dominate the market. Given that investors have pushed 10-year bond rates over a ceiling set by the BOJ of 0.5% and the amount of bond buying to defend it is becoming astounding, there is growing speculation about a change or end to Japan’s yield curve control (YCC) policy.

To sustainably reach 2% inflation, the BOJ uses the YCC policy, which sets some short-term interest rates at -0.1% and the yield on the 10-year government bond at 0.5% above or below zero.

After a two-day meeting, the BOJ is anticipated to announce a significant policy decision on Wednesday.

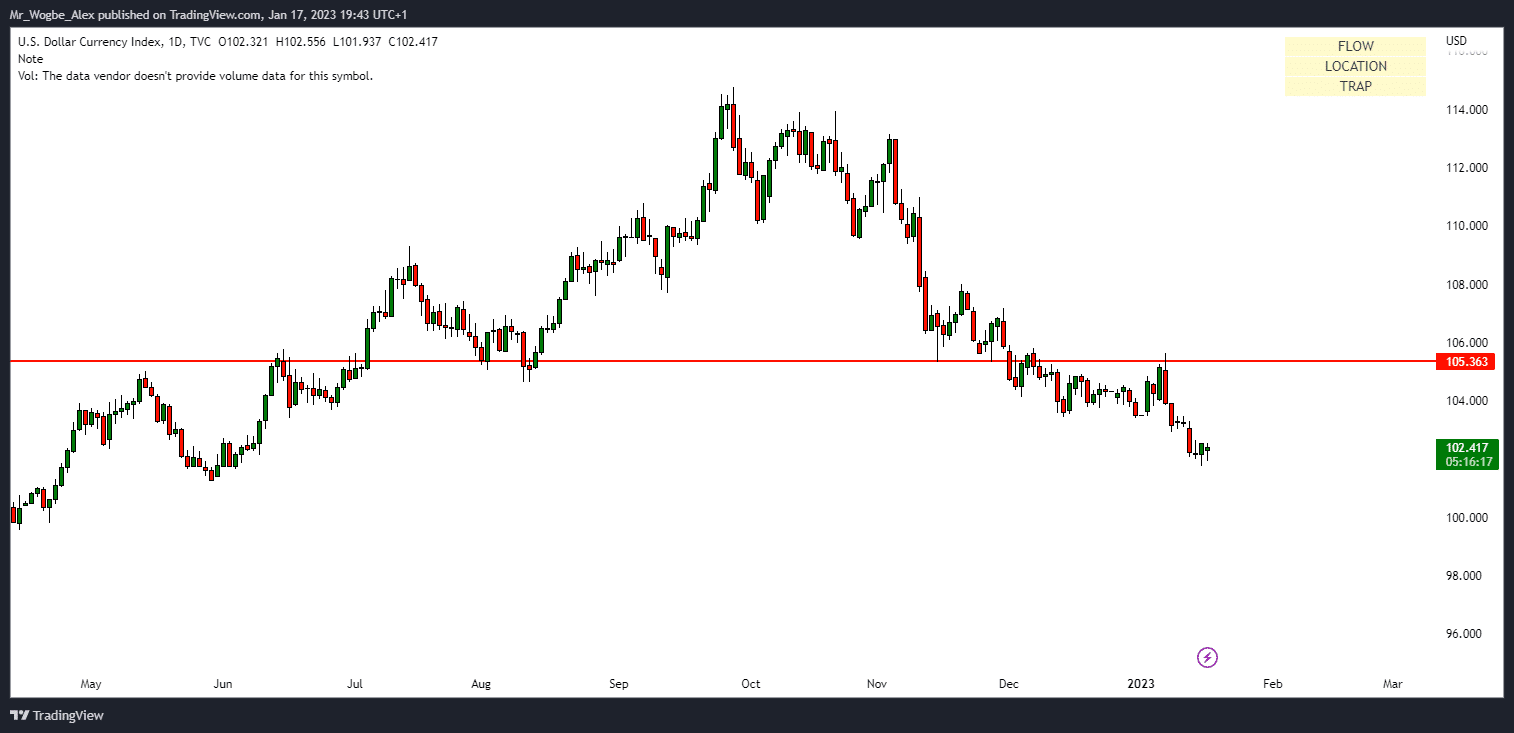

Dollar Falls Across the Board

The dollar’s value against the yen was 128.30 yen in late North American trading on Tuesday, down by 0.14%. Also, the dollar fell 0.5% to $0.9218 against the Swiss franc.

The Australian and New Zealand dollars both increased in value relative to the US dollar, rising 0.34% and 0.74%, respectively, to US$0.6982 and US$0.6423.

After rising to a five-week high of $1.2299 due to statistics showing UK pay growth accelerated in the three months leading up to November and employment increased by a faster-than-anticipated 27,000, the pound increased 0.7% against the dollar to $1.2275.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.