In the rapidly evolving world of cryptocurrency, stablecoins have emerged as a cornerstone, melding the volatility of digital assets with the reliability of traditional currencies.

Among these, Tether (USDT) has surged to the forefront, becoming an indispensable tool in bridging the gap between fiat and digital currencies.

This article explores the trajectory of Tether’s growth, its role in the global financial landscape, and the challenges it faces.

The Unstoppable Expansion of Stablecoins (Tether)

Tether has carved out a dominant position in the stablecoin market, holding over 75% of the market’s total capitalization, which exceeds $137 billion.

Its journey to the top hasn’t been without controversy, especially regarding the transparency of its reserves. Yet, recent endorsements by financial leaders have begun to quell these concerns, spotlighting USDT’s expanding influence.

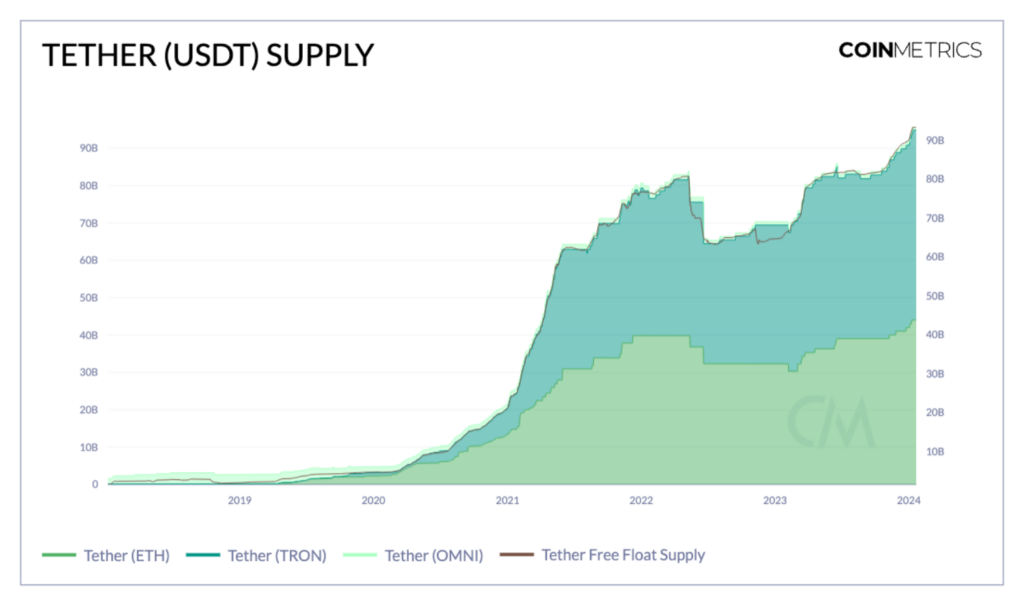

With a supply that recently eclipsed $96 billion, marking a 35% increase from the previous year, Tether’s ubiquity is undeniable. Its distribution spans several blockchains, with notable allocations on Ethereum and Tron, showcasing Tether’s adaptability to the multi-chain reality of today’s crypto ecosystem.

Tether’s Role Amid Financial Uncertainty

The appeal of Tether has grown in response to global financial instabilities, such as bank collapses and regulatory pressures. This trend is evident in the shifting dynamics within the DeFi sector, where Tether has overtaken other stablecoins in smart contract engagements.

The pivot towards USDT in the aftermath of the Silicon Valley Bank fallout underscores its resilience and growing trust among users.

Tether’s adoption in DeFi platforms, particularly in lending and exchange operations, illustrates its crucial role in enabling secure, dollar-pegged transactions without traditional banking intermediaries. This has not only enhanced access to financial services but also solidified USDT’s status as a preferred medium for transactional activities.

Understanding Tether’s User Base

Tether’s transaction patterns reveal a compelling narrative of its utility and reach. With an adjusted on-chain transfer value in the billions, USDT is a lifeline in regions plagued by economic instability. Here, it serves as a digital stand-in for the US dollar, offering a semblance of financial stability and access to global markets.

The average transaction size on different networks hints at diverse use cases, from substantial trades on Ethereum to everyday transactions on Tron. This versatility has positioned USDT as a critical asset across the spectrum of crypto activities, from trading to remittances.

Navigating Stablecoins: Challenges and Looking Forward

Despite its success, Tether navigates a landscape rife with skepticism concerning its reserves. Efforts to demystify its financial backing, including quarterly attestations, have shed some light, though calls for greater transparency persist. The inclusion of Bitcoin in its reserves marks a bold step towards diversification and resilience.

As Tether continues its ascent, its journey is emblematic of the broader stablecoin ecosystem’s challenges and potential. Amid evolving regulatory landscapes and the advent of new competitors, Tether’s ability to maintain its leadership position will hinge on its adaptability, transparency, and the enduring value it provides to users worldwide.

Final Word

Tether’s ascent is more than a story of market dominance; it is a testament to the transformative power of stablecoins in global finance.

By offering a bridge between the traditional and digital economies, Tether has not only facilitated the growth of the cryptocurrency market but also provided a lifeline for those in economically volatile regions.

As the landscape evolves, Tether’s journey will continue to be a focal point for discussions on innovation, regulation, and the future of money.

For those navigating the crypto markets, understanding the nuances of stablecoins like Tether is essential. However, leveraging crypto signals can provide invaluable insights, guiding trading strategies to capitalize on market trends and movements effectively.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.