DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: September 21

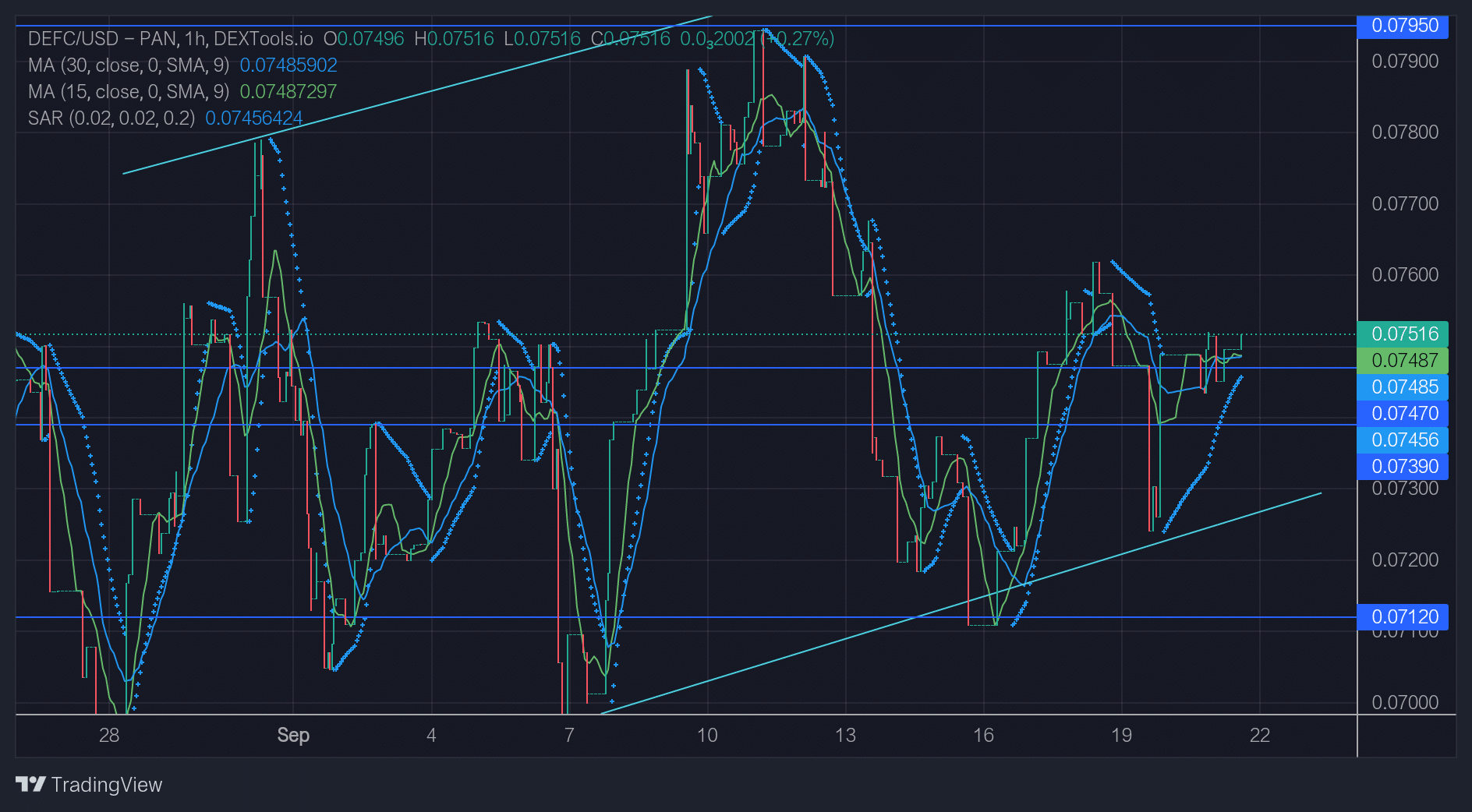

The DeFi Coin price forecast confirms that the DEFC price is again on the rise after the retest of the $0.07200 level. The momentum generated by the retest has led to a swift rise through the closest supply and demand zones.

DEFCUSD Long-Term Trend: Bullish (1-Hour Chart)

Significant Levels:

Supply zone: $0.07950, $0.07390

Demand zone: $0.07470, $0.07120

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

The Parabolic SAR indicator shows an impressive bullish market. The swift rise from the $0.07200 level is expected to continue after the market corrects upward from the consolidation phase it is in at the moment.

The Moving Average (MA) period 15 agrees that the market’s uptrend is holding on well. The MA’s period 30 indicates support for the market’s recent bullish move.

On the 31st of August, the DEFCUSD market initiated the formation of a bullish channel. Ever since the low that formed at $0.07000 on the 7th of the month, there have been new higher lows that have formed successively. This implies that the market is in a long position.

DEFC Medium-Term: Trend Bullish (15-Minute Chart)

The DEFC price, while trying to enter the demand zone-turn-restriction zone, experienced consolidation. However, the Parabolic SAR (Stop and Reverse) shows that the market is gradually leaving this phase.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.