DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: October 10

The DeFi Coin price forecast the coin price is being set up to break out of the symmetrical triangle after retesting the bullish trendline on which it has been threading for a while now.

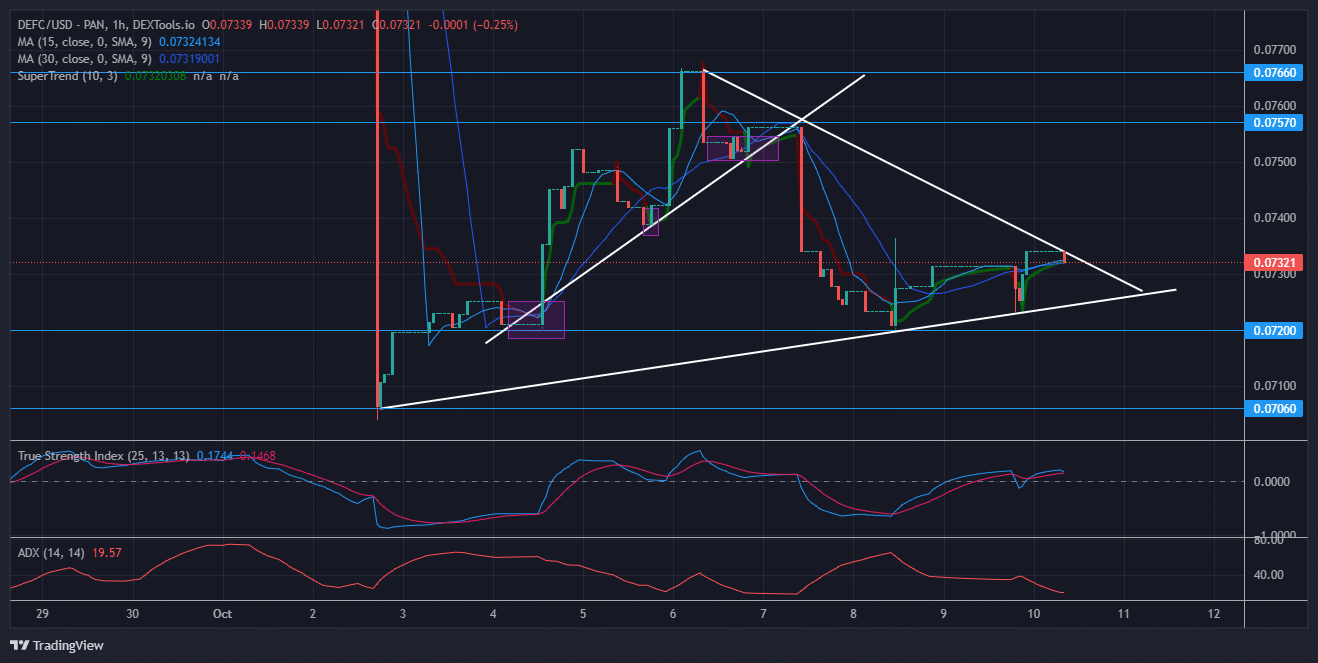

DEFCUSD Long-Term Trend: Bullish (1-Hour Chart)

Significant Levels:

Supply zone: $0.07660, $0.07200

Demand zone: $0.7570, $0.07060

On the 7th of October, a structural market shift occurred that saw the price breakout from its previous bullish pattern. After a series of higher lows were formed, the price had a sharp decline due to the bears’ pressure on the market caused by the consolidation. However, the DEFC was finally able to retest the price level at $0.07200, which has given the market the right momentum for more buy traders to come in.

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

The Moving Average (MA) indicator indicates that the market is held by the bulls, as the trendline indicates. After the rejection that occurred on the 2nd, the market has continued to thread on the bullish trendline line, making significant touch downs on the 8th and 9th consequently. Hence, the reason period 15, and 30 of the MA indicator lay beneath the candles, showing support for the bullishness.

The True Strength Indicator has just recently crossed above the signal line since the retest motion on the 7th. This suggests that the market has returned to its bullish ways. Bulls in the DEFI market are known to be daring of the general bearish pressure in the cryptocurrency market. They are expected to push prices back up with their buying actions as time unfolds.

The Average Directional Index, on the other hand, considers the bearish forces behind the recent market direction to have waned. However, the market is expected to test the bullish trendline below before it breaks out of the symmetrical triangle.

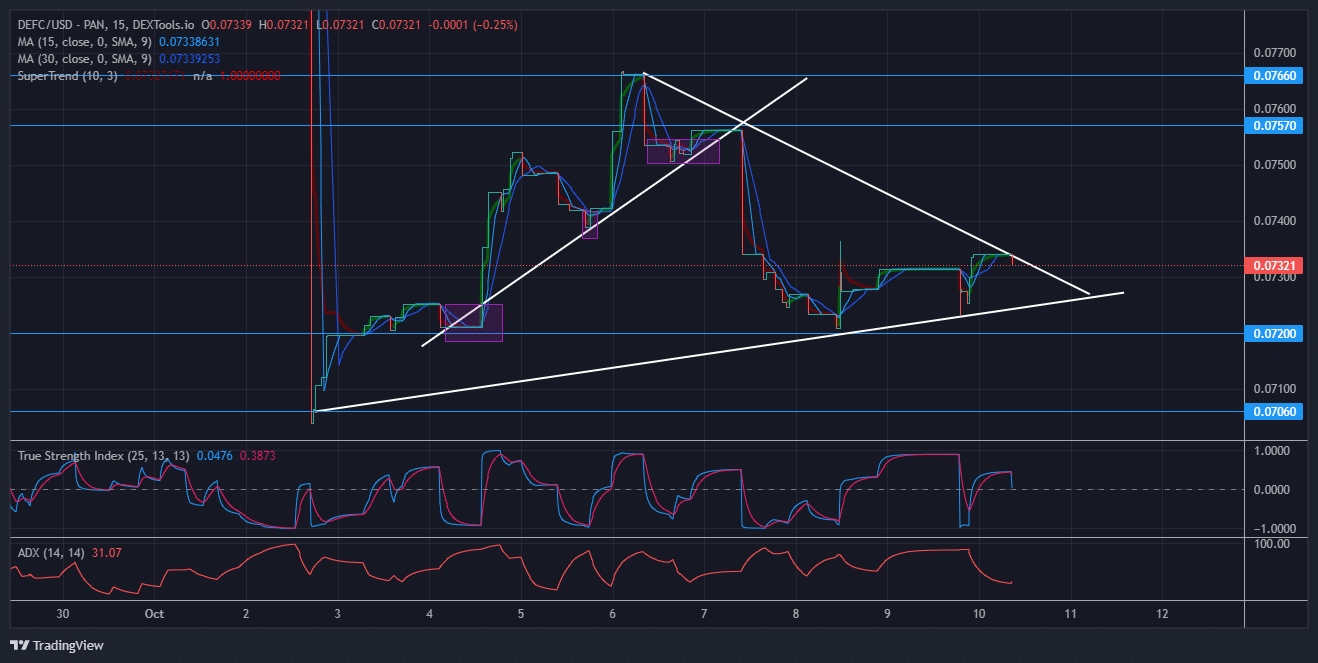

DEFC Medium-Term: Trend Bullish (15-Minute Chart)

On the 15-minute chart, however, the TSI is returning below the signal line implying the market’s need to return to the trend line below it, for a bounce off that will see the coin price breakout of the triangular pattern it has been moving.

The ADX indicator also suggests the same market motion. This bearish motion should bring more buying pressure into the DEFC market.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.