DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: October 14

The DeFi Coin price forecast is that the price will retrace after retracing the price level at $0.06740. That is taking a cue from the market’s reactions, after the most bullish runs since August.

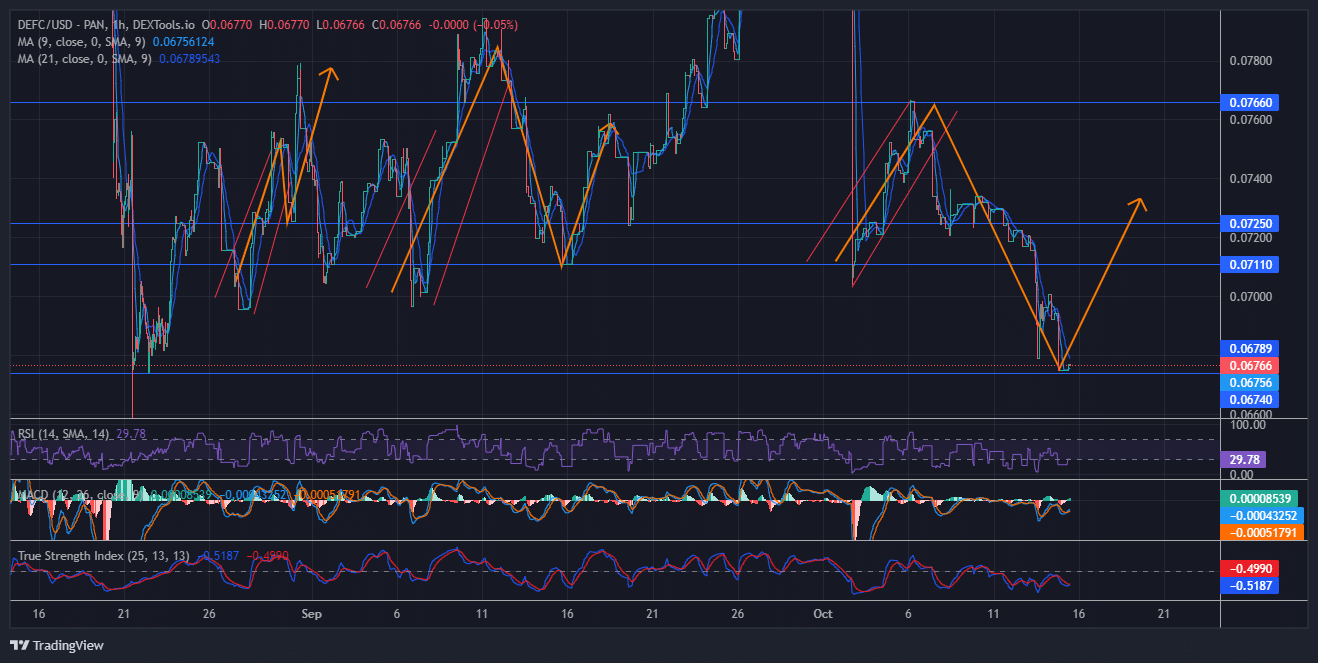

DEFCUSD Long-Term Trend: Bullish (1-Hour Chart)

Significant Levels:

Supply zone: $0.07660, $0.07110

Demand zone: $0.07250, $0.06740

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

Early in September, a similar pattern formed on the chart. After the price had climbed from $0.07000 and gone above $0.07800, the price had to retest $0.07110 to gain the momentum that pushed the price to its highest range ($0.09500) in recent times.

A similar pattern appears to have been formed after the market had reached $0.07660, the market has made a retest to the current price to garner enough buys, to drive the market up again. The True Strength Index indicates that the market is already oversold at the current level, and a change of direction can readily be affected by the bulls.

The Relative Strength Index (RSI) also indicates that the market has sold excessively. This provides a great avenue for buying traders to enforce a retracement from the current price.

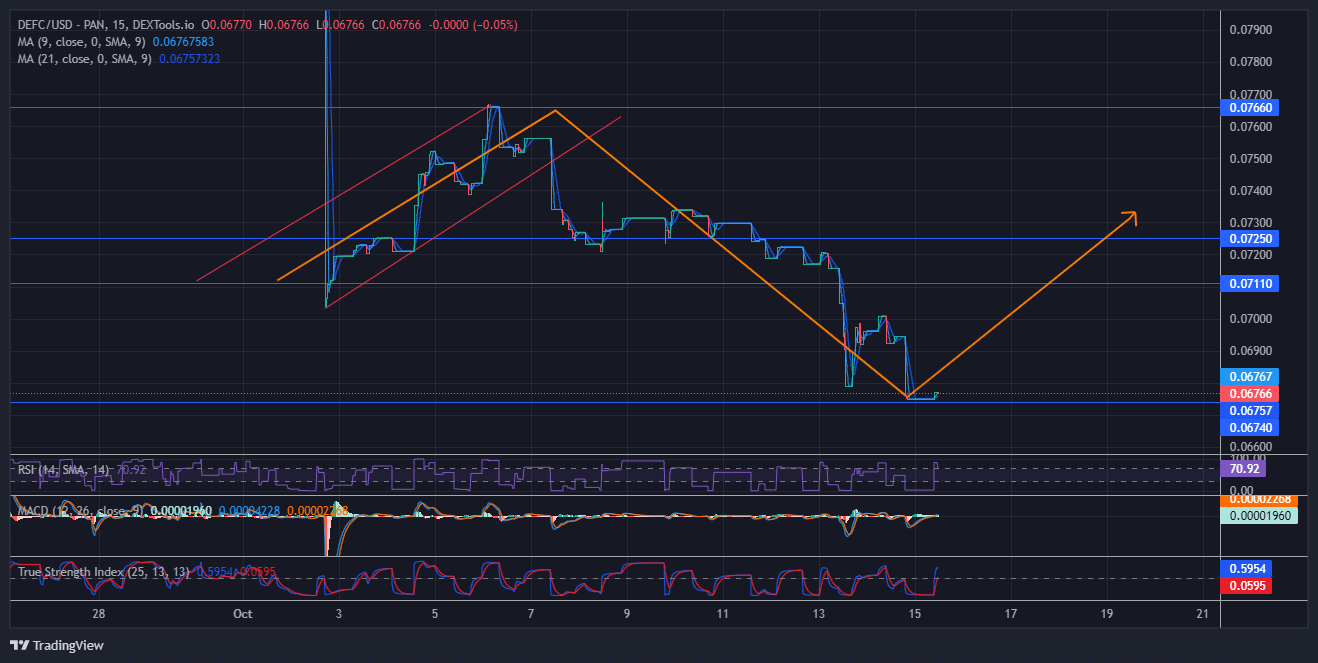

DEFC Medium-Term: Trend Bullish (15-Minute Chart)

In the short term, however, MACD suggests that the price is now ranging on this support level that has refused to cave in. The market is mostly moving sideways. Although the MA, period 9, and 21 seem to be finding their way under the candlesticks, suggesting an upward retracement.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.