DeFi Coin Price Forecast: October 3

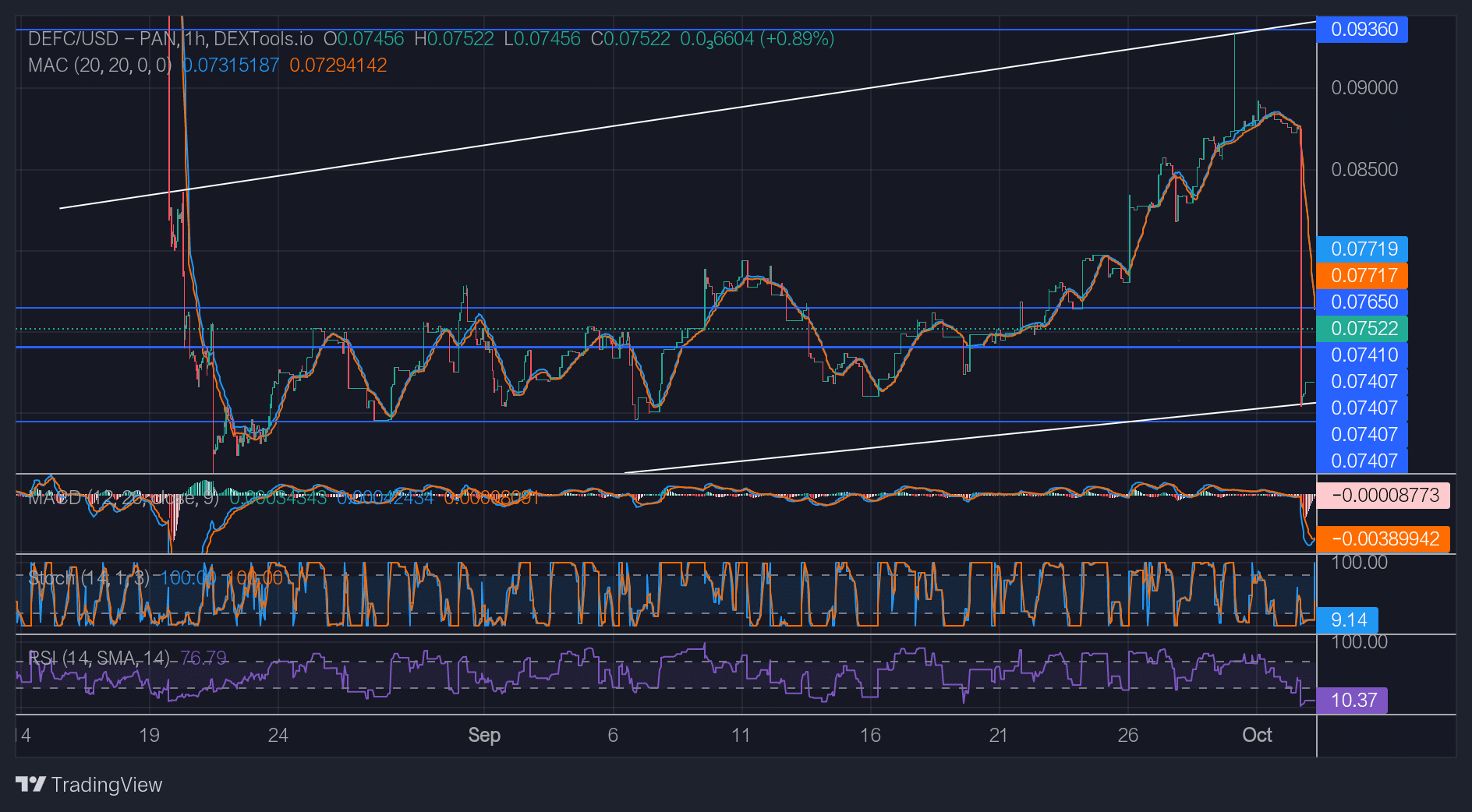

The DeFi Coin price forecast says that the coin market has made a move to mitigate the effect of the bullish order block that led DEFC price to $0.09360. The market retraced its steps back to the lower demand level to stimulate more organic growth this time.

DEFCUSD Long-Term Trend: Bullish (1-Hour Chart)

Significant Levels:

Supply zone: $0.09360, $0.07650

Demand zone: $0.08250, $0.06950

Another attempt by the big-boy buyers to drive DEFC up again after hitting the current hallmark failed. The market fought for balance, which is what led to the consolidation, and eventually, the market corrected its direction.

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

The MACD (Moving Average Convergence and Divergence) indicates that the DEFC market has been oversold after the retracement attempt. Although the price failed to retest the lower zone exactly, the bearish pressure has created an overly sold market situation.

The Stochastic indicator gives the same indication as the MACD indicator. However, the indicator shows that the price is already starting to rise back up, slowly but progressively. RSI (Relative Strength Index) signals that the market is heading for an oversold situation, which is expected to cause a redirection. As the sellers’ market seems to be wrapping up.

DEFC Medium-Term: Trend Bullish (15-Minute Chart)

On this chart, the RSI has reached the 6.00 mark, showing that the downtrend has no more backing from its movers.

In any case, the market can be expected to start retracing and breaking through the nearest resistance zone soon. A new realistic market can thus be created from this retracement.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.