DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade- June 29

DeFI Coin price forecast calls for a bullish breakout towards $0.1650.

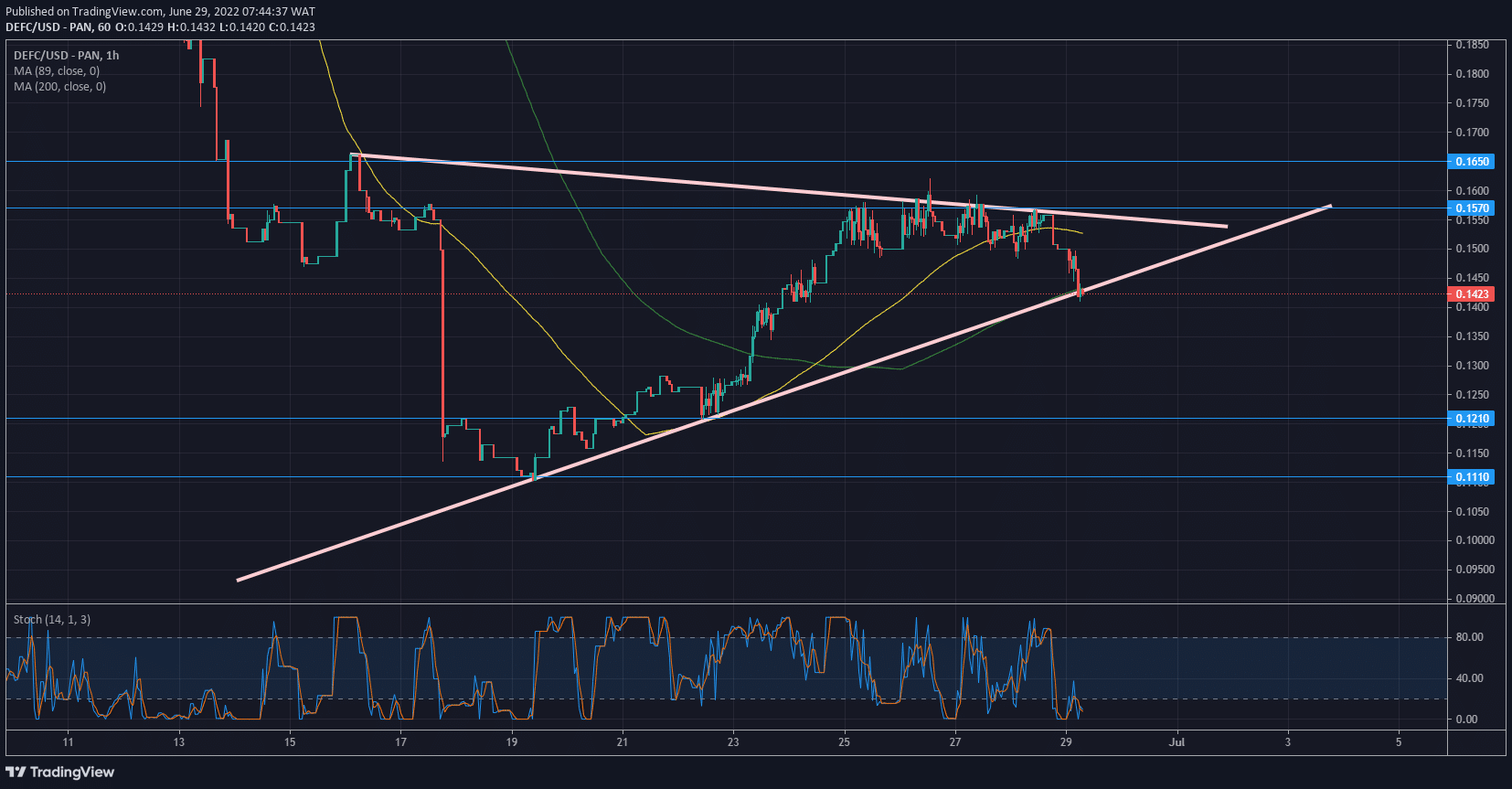

DEFCUSD Long-Term Trend: Bullish (1-hour chart)

DEFCUSD significant Levels:

Zones of supply: $0.1650, $0.1570

Zones of demand: $0.1210, $0.1110

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

DeFI coin has ascended on the bullish trend line towards the resistance level at $0.1570. The impulsive move that reached the demand level at $0.1210 created a wide range of market inefficiencies. On the hourly chart, a single bearish candle formed the majority of the move from $0.1570 to $0.1210.

DEFCUSD market reversed from bearish to bullish on the 19th of June. The upward movement of the market has filled up the market inefficiency created on the 17th of June. The market was well oversold at $0.1110. This led to the engagement of the bulls at the demand level. The market has formed higher highs and lower lows to reach the bearish trend line at $0.1570.

The market has formed a symmetrical triangle on the hourly chart. The Moving Average period eighty-nine has crossed above the Moving Average two hundred to signify a change in the market trend from bearish to bullish. The market is also currently oversold on the Stochastic, which means the bulls are expected to continue the ascending trend.

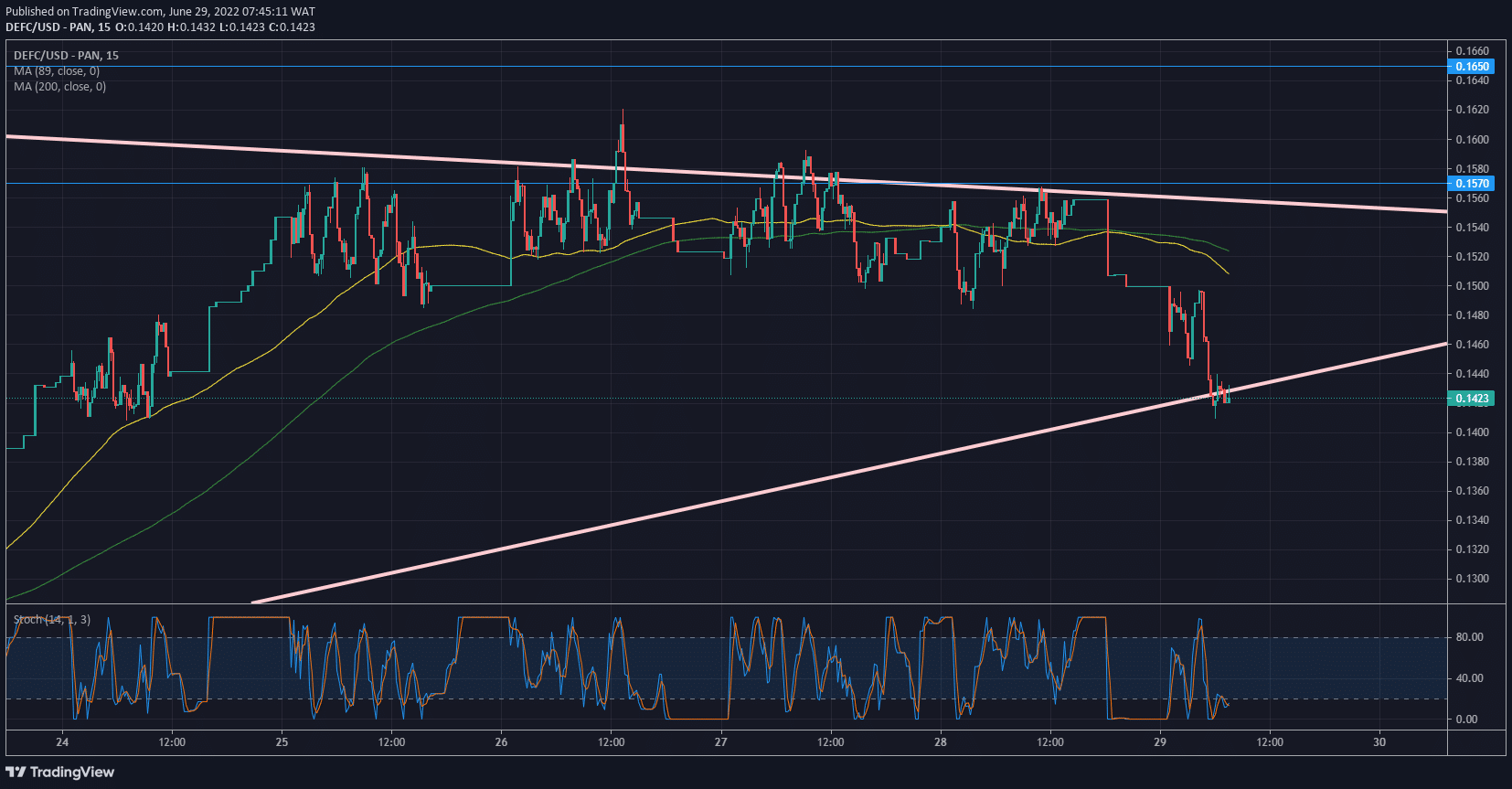

DEFC Medium-Term: Trend Bullish (15-minute chart).

The supporting trend line of the symmetrical triangle has been reached. The bulls are expected to take off from this point to reach for higher prices.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.