DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade- June 30

DeFI Coin price forecast calls for the continuation of the bullish trend with the test of the bullish order block.

DEFCUSD Long-Term Trend: Bullish (1 hour chart)

DEFCUSD significant Levels:

Zones of supply: $0.1650, $0.1570

Zones of demand: $0.1210, $0.1110

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

DeFI coin market reached the oversold region on the 18th of June in the one-hour timeframe. The market reached the major demand level at $0.1110 on the 20th of June. The MACD (Moving Average Convergence Divergence) crossed below the point of zero on the indicator phase. The Stochastic was also oversold at the test of the demand zone. This led to a bullish reversal.

The market formed higher highs and higher lows consistently till the market reached the supply level at $0.1570. The immediate push above $0.1210 left an imbalance in the market. At the supply zone, a head and shoulders reversal pattern formed. This initiated the retracement of the market to the fair value gap above the demand level at $0.1210.

The gap above the $0.1210 support zone was reached on the 29th of June. The market reacted immediately as the market bounced on the bullish trend line. The MACD (moving average convergence and divergence) indicator is oversold. The Stochastic is also oversold on the one-hour chart. The market is set to resume its bullish course.

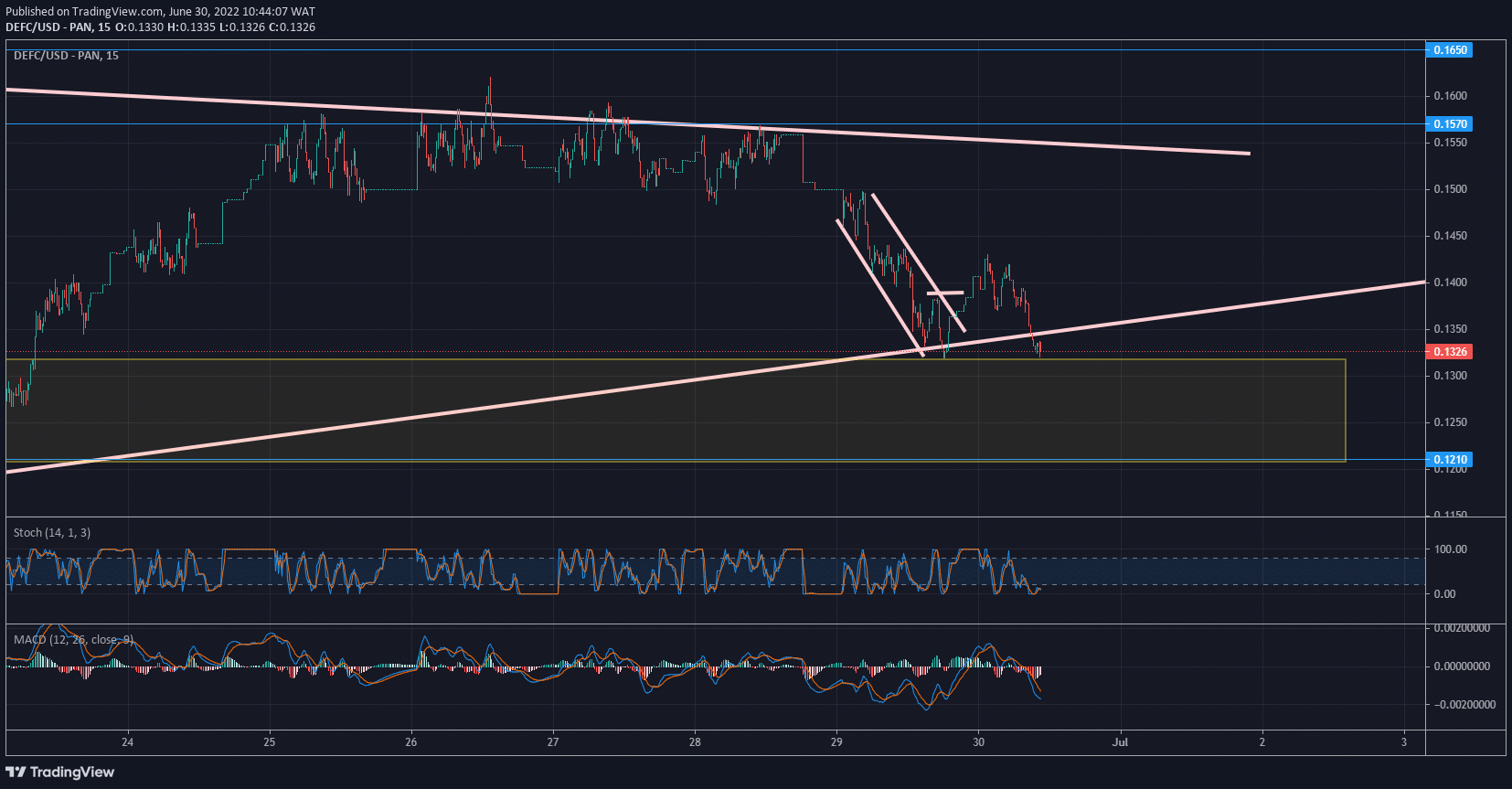

DEFC Medium-Term: Trend Bullish (15 minute chart).

On the 15-minute chart, a bullish creek has been violated. The Stochastic and the MACD are also oversold on the lower time frame. The test of the bullish order block is expected to cause an increment of the Lucky Block – Guide, Tips & Insights | Learn 2 Trade value. The price is expected to ascend to $0.1650.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.