DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – June 8

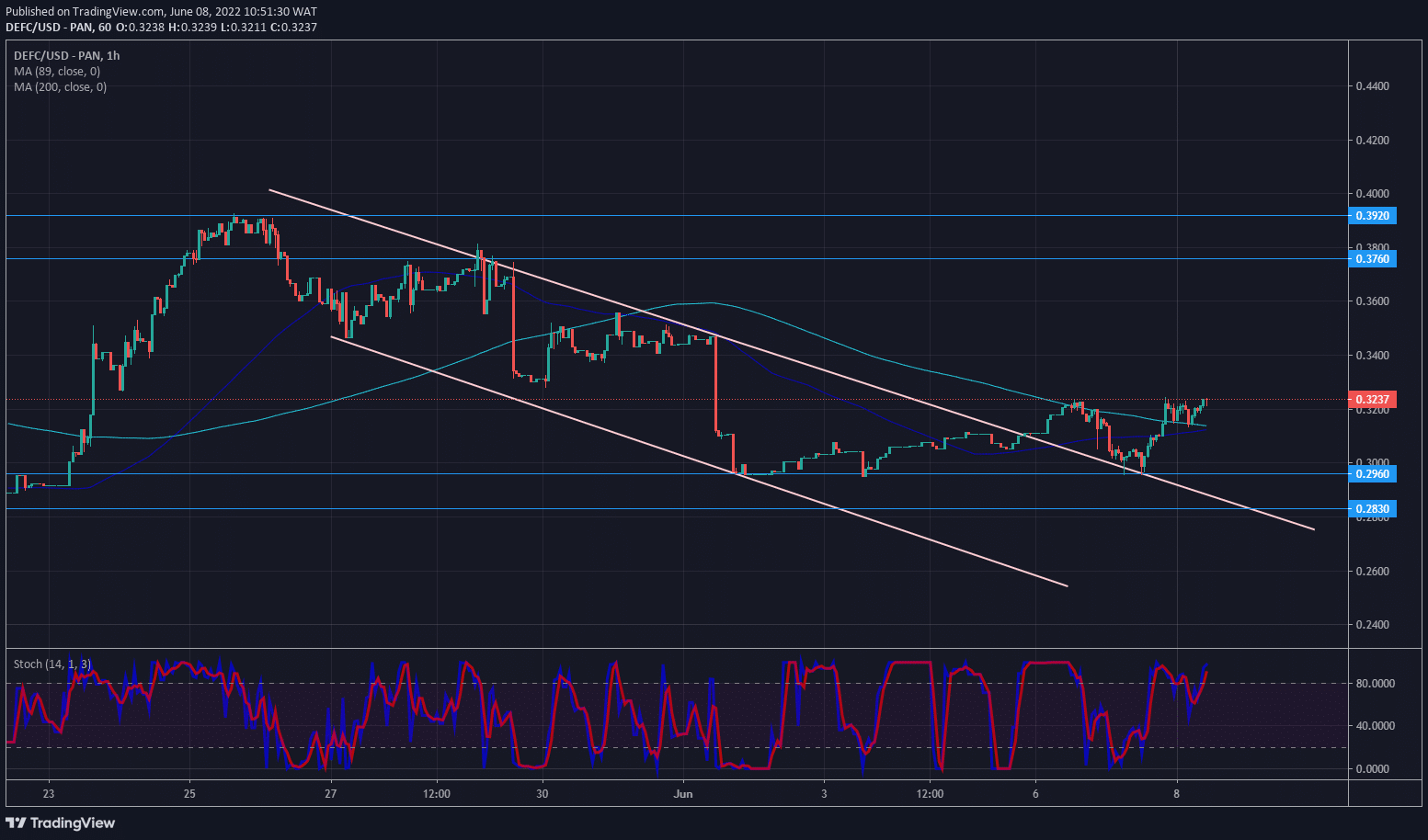

The DeFI Coin price forecast calls for $0.3760 as the bulls’ next target. The bullish divergence on the RSI (Relative Strength Index) has led to a leap over the $0.2960 resistance level. The DeFI Coin price forecast is bullish. The Moving Average Period eighty-nine and two hundred has shifted below the intraday candles to support the bullish reversal.

DEFCUSD Long-Term Trend: Bullish (1-hour chart)

DEFCUSD significant Levels:

Resistance level: $0.3920, $0.3760

Support Level: $0.2960, $0.2830

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

The Moving Averages descended through a creek. The key level at $0.3760 acted as resistance. The Moving Average period eighty-nine resisted bullish movement at $0.3760. The Moving Averages period eighty-nine and the Moving Average Period two hundred crossed on the 31st of May to confirm the sell to buy price action.

The support level at $0.2960 prompted the bullish reversal on the 3rd of June. The bearish trend line formed a bullish confluence with the support level.

There was a break out of the bearish channel on May the third. The market retraced to retest the descending trendline on the 7th of May to aid the bullish rally.

DEFC Medium-Term: Trend Bullish (15-minute chart)

On the 15-minute chart, the Moving Average period eighty-nine has crossed below the candles. The Moving Averages are supporting prices on the higher time frame and the lower time frame.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.