DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: September 28

The DeFi Coin price forecast indicates that the DEFC market has resumed its bullish run after the price retest at $0.08200. The price needed enough pressure that could sustain its vigorous upbound motion. Hence the retracement that occurred on the 27th of the month drove late-arriving traders to buy more, as the DEFCUSD is expected to rise higher.

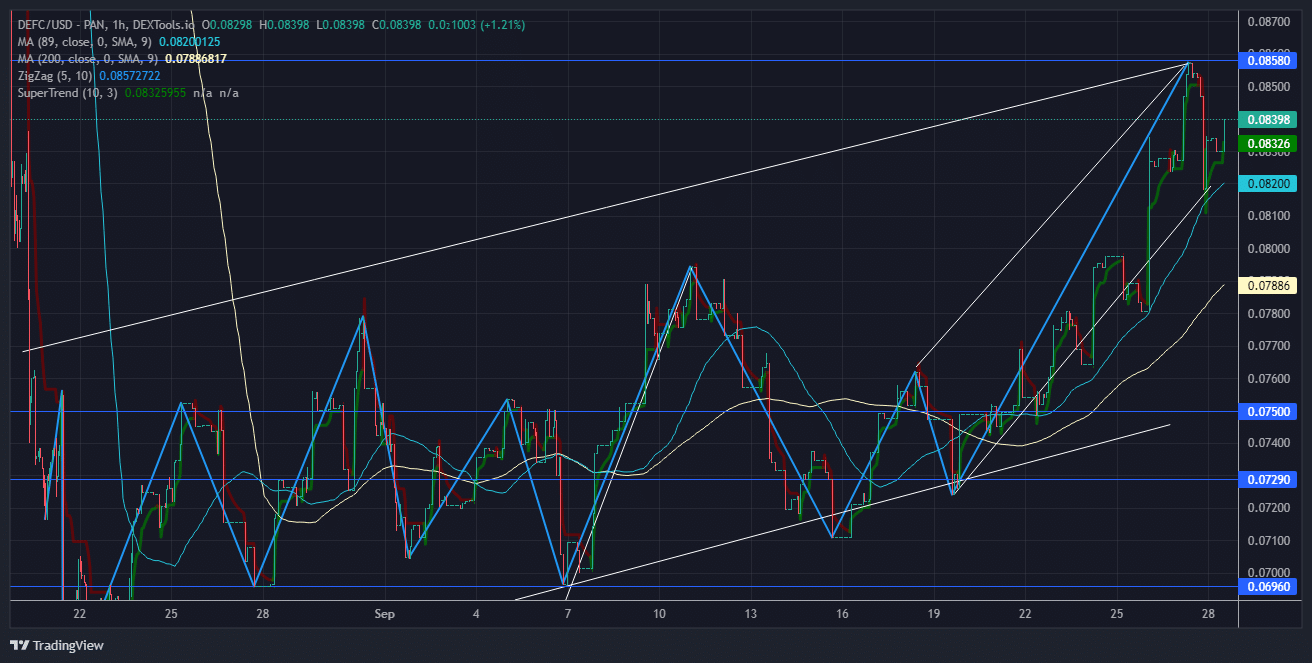

DEFCUSD Long-Term Trend: Bullish (1-Hour Chart)

Significant Levels:

Supply zone: $0.08580, $0.07290

Demand zone: $0.07500, $0.06960

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

The Moving Average indicator, using period 89, suggests that the market maintains its bullish run despite the sellers’ frequent attempts. The MA’s period 200 also shows that the DEFC market has largely been on the run over the space of time captured, breaking new ceilings with each candle.

The Super-trend indicator, much like the MA, shows that the market remains on course in its uprise against the previous restriction zones. The indicator indicates that the current market is firmly in the hands of buy traders.

The Zigzag indicator shows that the market has largely maintained a bearish course since the 19th. This is despite the massive bearish pressure forced into the market on the 27th of this month.

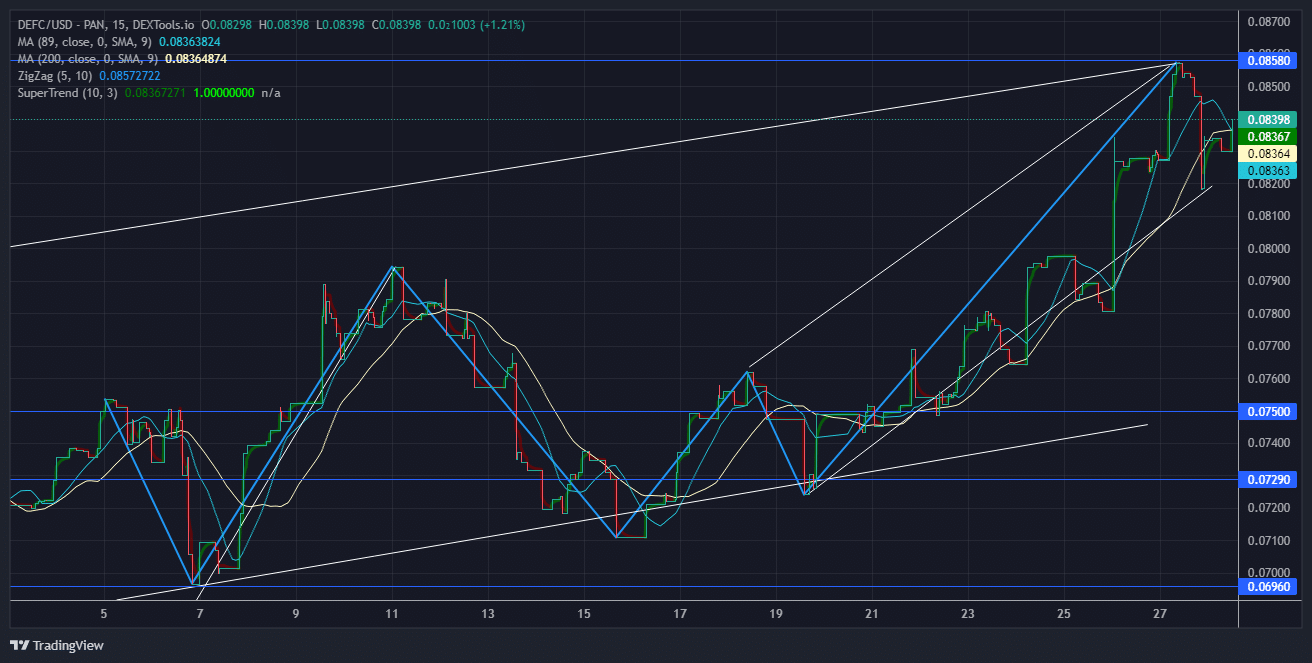

DEFC Medium-Term: Trend Bullish (15-Minute Chart)

On this 15-minute chart, the MA period 89 shows that the market is swiftly recovering from the bearish attack the day before. The same can be said of the period 200, as both gradually retrace downward to line up beneath the bullish candles forming.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.