DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – August 5

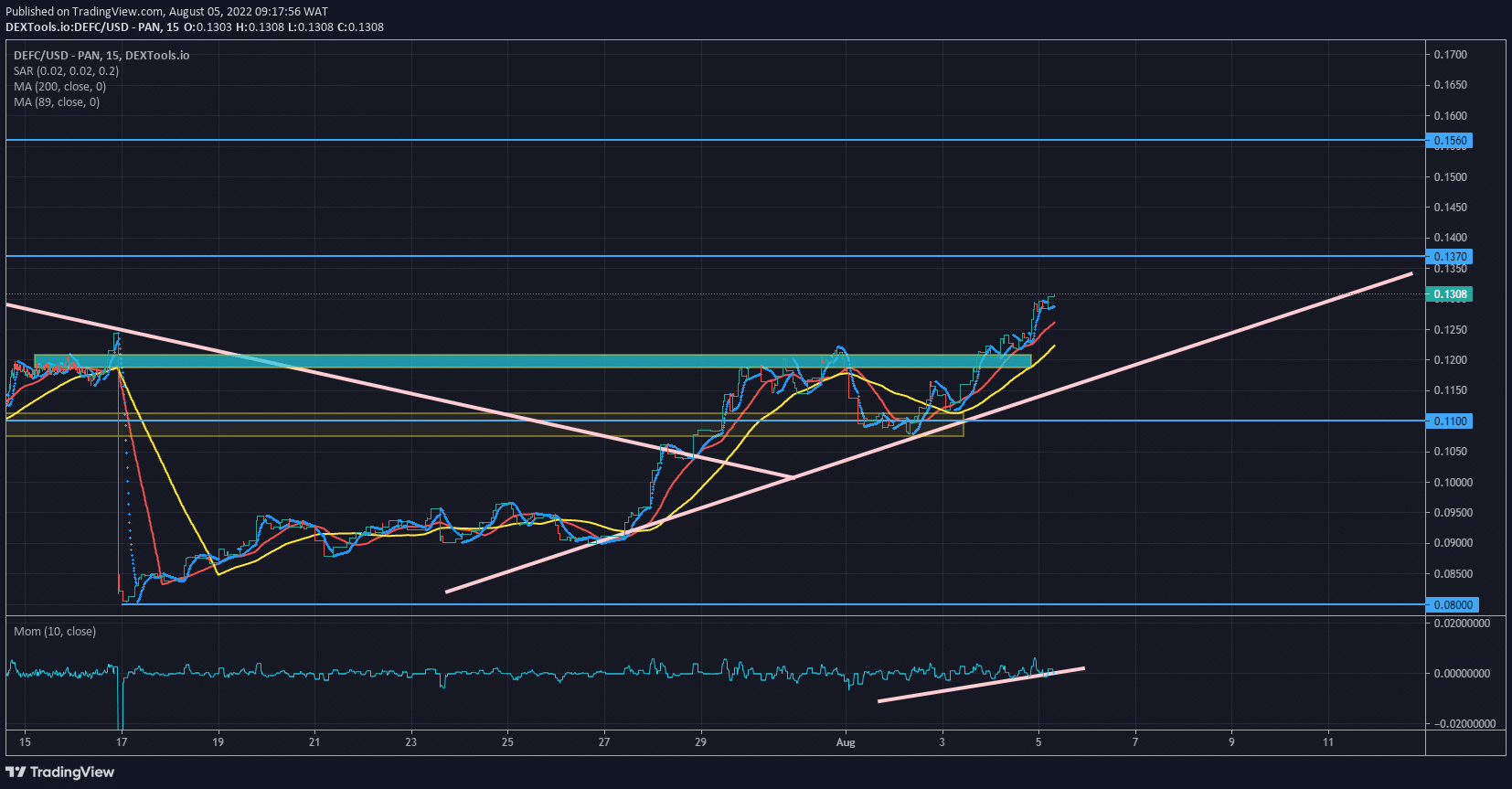

DeFI Coin price forecast is bullish. The market has experienced a change of character (CHoCH) at the major demand level of $0.0800. The price is currently rising towards the supply level at $0.1560.

DEFCUSD Long-Term Trend: Bullish (1-hour chart)

DEFCUSD Significant Levels:

Supply Level: $0.1560, $0.1370

Demand Level: $0.1100, $0.0800.1560 Resistance Value" width="1654" height="863" data-lazy-src="https://learn2.trade/wp-content/uploads/2022/08/DEFC-1Hr-4.png"/>

DeFI coin is currently in a bullish trend. The breakout above the $0.1100 major level was a confirmation to reveal that the bulls had seized control at the $0.0800 demand level.

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

On the 17th of July, the market price rose to fill the imbalance created by the bears. The Moving Averages of period nine (red) and period twenty-one (yellow) crossed to signify the initiation of a new bullish trend. The Moving Averages crossed after the test of the major demand level at $0.9800.

The bullish momentum has been rising steadily since the beginning of this month. This shows the willingness of the buyers to break the resistance level at $0.1560. Higher highs and higher lows have formed since the bulls used the demand level at $0.0800 to go long in the market.

The market is rising with the support of the ascending trend line on DEFC. The Parabolic SAR (Stop and Reverse) has also formed points below the intraday candles to reveal the market’s uptrend.

DEFC Medium-Term: Trend Bullish (15-minute chart)

The market broke through the major level at $0.1100. The test of the demand level formed a bullish confluence with the rising trend line.

You can purchase DeFI Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.