Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The price of Curve (CRV) has risen by 9.52% today. However, despite this upward movement, the market remains below crucial technical levels that could strengthen bullish sentiment. Let’s take a closer look at the key statistics for further insight.

Curve Statistics:

CRV’s Current Price: $0.4862

Market Capitalization: $624.07M

Circulating Supply: 1.28B

Total Supply: 2.22B

CoinMarketCap Rank: 103

Key Price Levels:

Resistance: $0.5000, $0.5250, $0.5500

Support: $0.4500, $0.4250, $0.4000

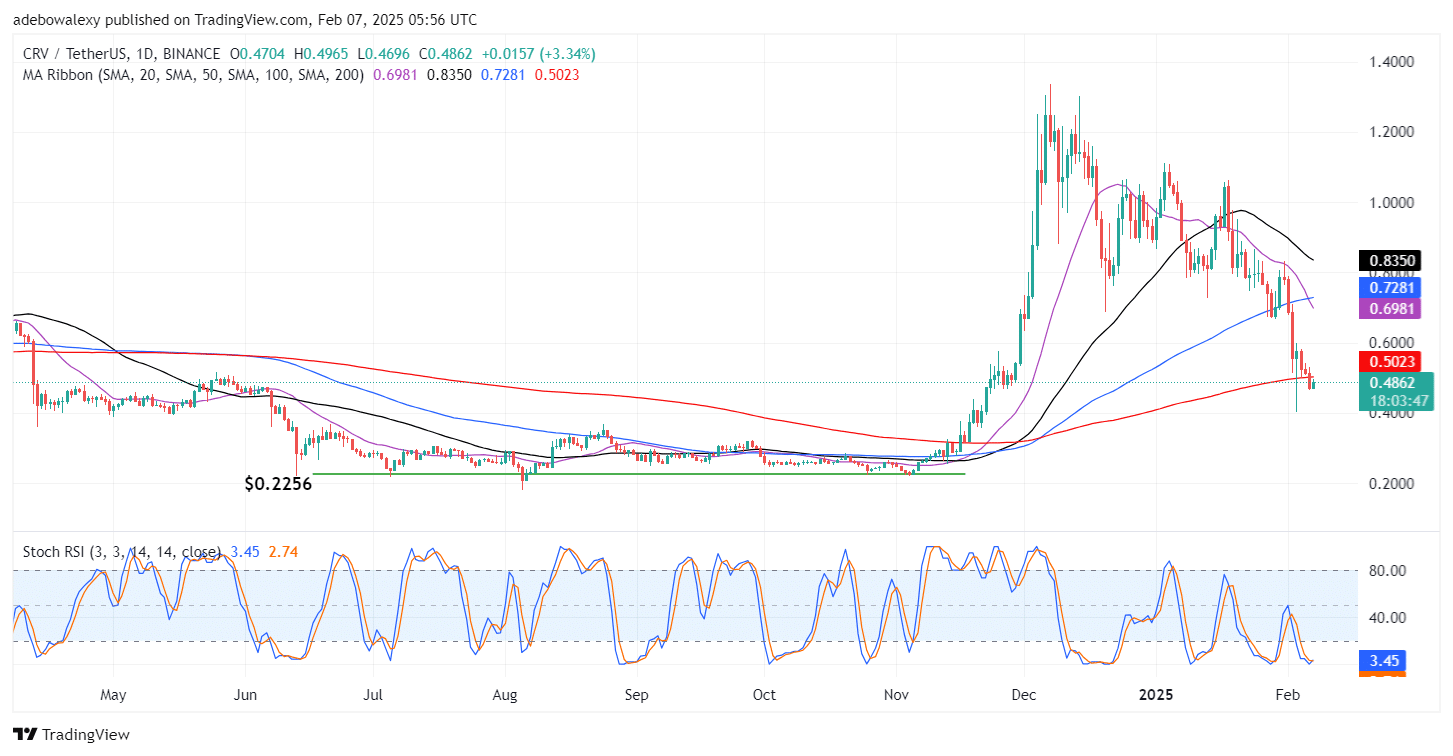

Curve Attempts Recovery After Dropping Below MA Lines

The ongoing downward retracement in CRV’s daily market began after price action neared the $1.4000 level but failed to sustain momentum. Following this rejection, CRV entered a downtrend, falling through the Moving Average (MA) lines one by one.

The latest price candle on the chart is green but remains below all MA lines. Meanwhile, the Stochastic Relative Strength Index (Stochastic RSI) lines have reached the oversold region and are now converging in that zone. This technical setup, combined with the appearance of the most recent price candle, suggests the possibility of an upside retracement. However, market conditions indicate that price action may still struggle to gain strength.

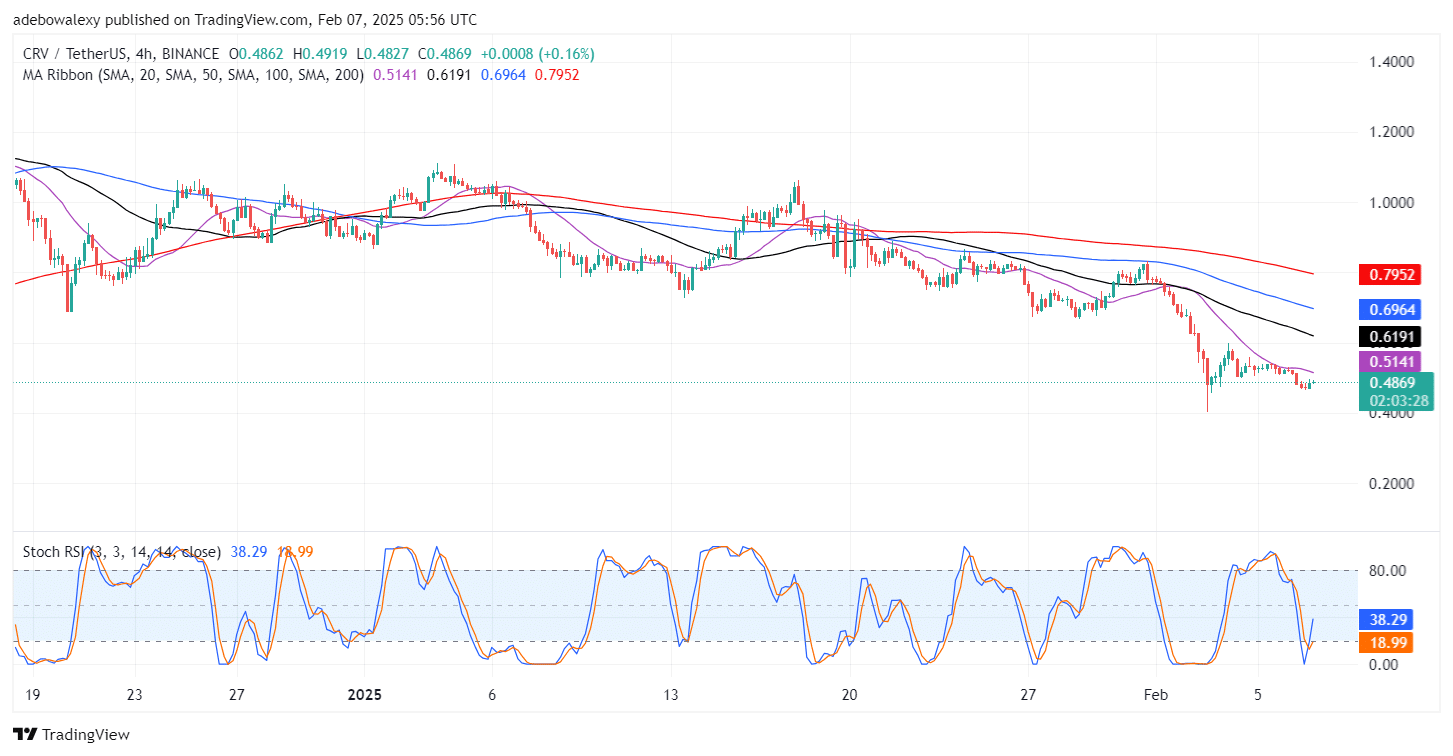

CRV Market Still Appears Vulnerable

On the 4-hour chart, CRV continues to struggle below key resistance levels. The last two price candles are green but remain below all MA lines. Notably, the most recent candle appears smaller, suggesting weakening upside momentum.

This aligns with broader market sentiment, as the Stochastic RSI lines are climbing rapidly following a downward crossover in the oversold region. However, the sharp movement of the Stochastic RSI also signals that bullish momentum may be short-lived. Given these conditions, traders should consider targeting small gains around the $0.5141 mark.

Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.