Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The price of Curve has increased by 6.51% today. Nevertheless, the price movement of the token hasn’t taken on a bullish tone. To that effect, let’s take a moment to conduct further study on this market.

CRV Statistics

Curve Value Now: $0.575

Curve Market Cap: $541,863,833

CRV Circulating Supply: 883,423,044

CRV Total Supply: 1,989,800,417

Curve CoinMarketCap Ranking: 72

Major Price Levels:

Top: $0.579, $0.600, and $0.650

Base: $0.520, $0.500, and $0.450

Downward Prospects Seem Well Pronounced in the Curve Market

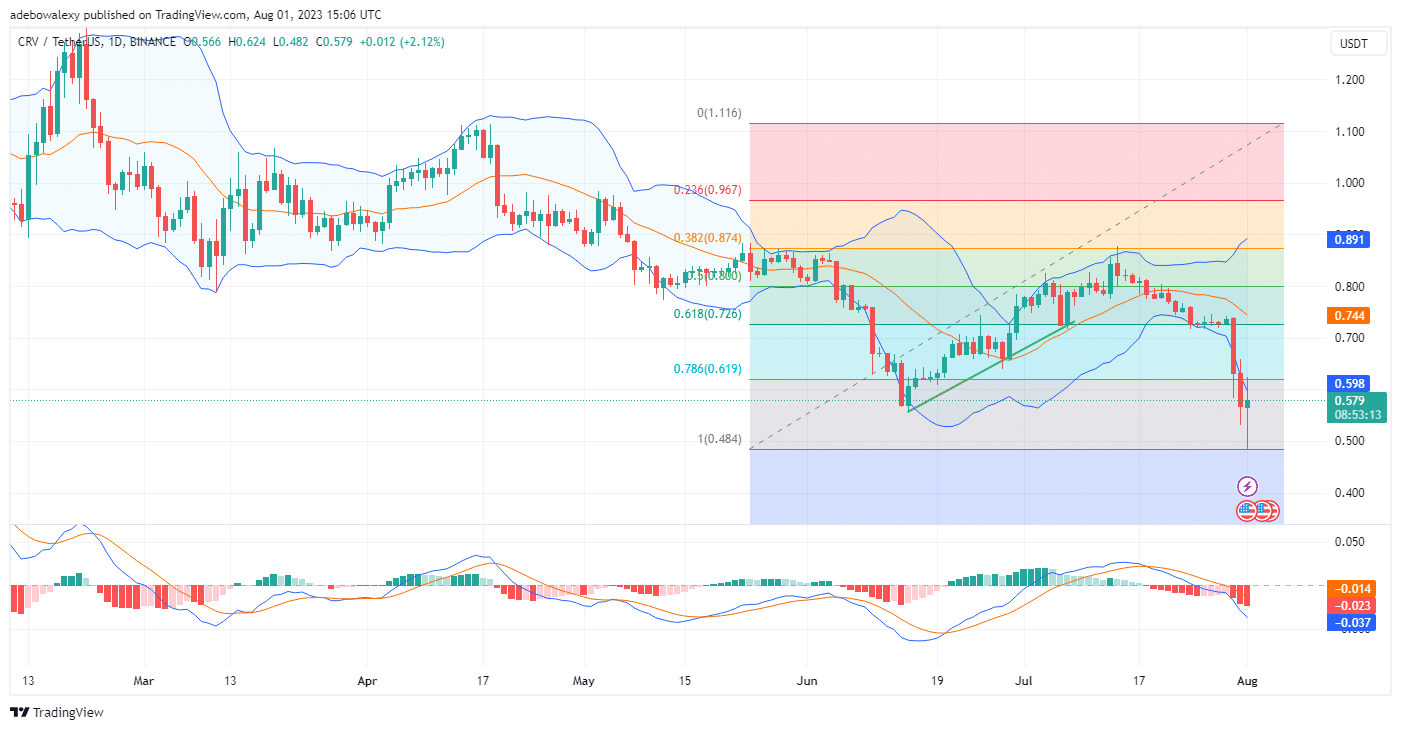

A quick look at the Curve daily market reveals that bears are maintaining firm control of price movements. Price action has significantly pushed the lowest limit of the Bollinger Bands, and the resultant rebound isn’t so viable at this point.

Plus, the volatility is high, going by the dilation of the Bollinger Bands’ upper and lower bands. As a result, this seems to be a drowning bullish effort at this point.

Furthermore, we can see that the Moving Average Convergence Divergence (MACD) indicator bars below the equilibrium level are solid red and growing taller on the negative axis. Consequently, this further sets a strong bearish tone for this market.

CRV Upside Hope Meets a Blockade

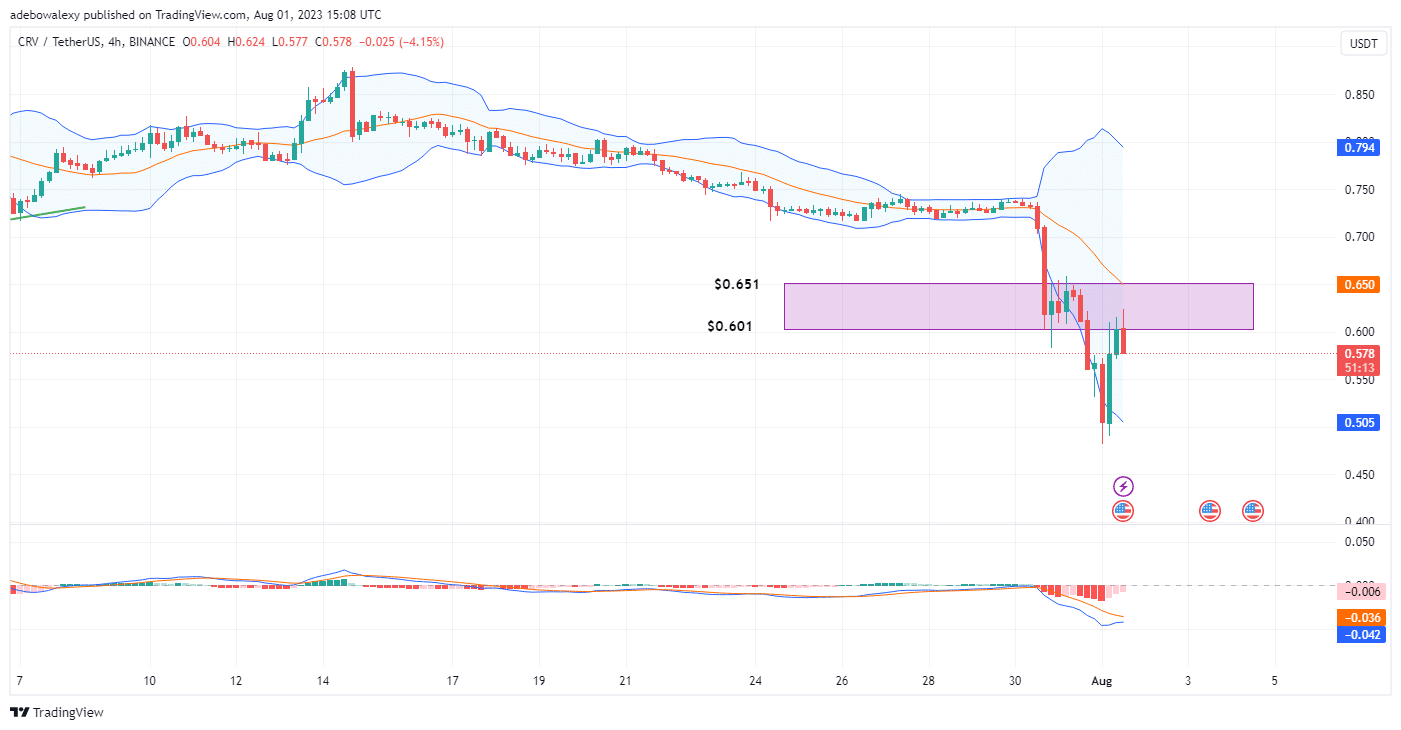

The behavior of price action in the CRV 4-hour market seems to suggest that bear traders appear to have mounted a price blockade at the price region of $0.601 to $0.651. This can be seen as price action corrected off the resistance formed at the $0.601 price level.

Furthermore, the effect of the earlier-mentioned price gains can be seen on the MACD indicator. The bars of this indicator had earlier turned pale red and approached a bullish crossover during the price increase. However, the current downward price correction seems to have influenced the direction of the lines of the MACD.

This can be perceived as the lines having now taken a sideways path. Therefore, unless bulls are able to overcome the resistance at $0.601, price action will retrace lower support toward the $0.520 mark. However, the blockade is broken, then, further correction may occur towards the $0.6400 mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.