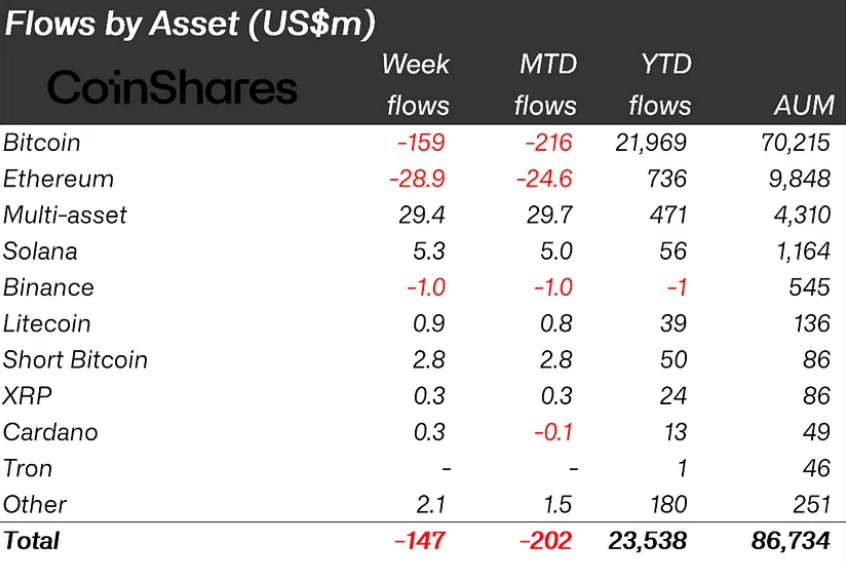

The cryptocurrency market experienced significant crypto outflows last week, with investors withdrawing $147 million from digital asset investment products, according to the latest report from CoinShares.

This shift in sentiment comes amid stronger-than-expected economic data, which has led to a reevaluation of investment strategies in the crypto space.

Bitcoin, the largest cryptocurrency by market cap, bore the brunt of the exodus, with outflows totaling $159 million. Ethereum, the second-largest crypto asset, also saw substantial withdrawals, losing $29 million. These movements reflect growing uncertainty among investors as they reassess the potential impact of economic indicators on the crypto market.

US Economic Data Responsible for Crypto Outflows: Experts

Industry analysts point to recent economic reports as the primary catalyst for these outflows. The unexpectedly robust economic data has reduced expectations for significant interest rate cuts, which typically boost appetite for riskier assets like cryptocurrencies.

This shift in monetary policy outlook appears to have prompted some investors to move their funds out of the crypto market.

Interestingly, while major cryptocurrencies faced withdrawals, some segments of the market showed resilience. Multi-asset investment products, which offer exposure to a diverse range of cryptocurrencies, recorded inflows of $29 million.

This marks their 16th consecutive week of positive flows, suggesting that some investors are opting for a more diversified approach to crypto investments in the face of market uncertainty.

The recent outflows have raised questions about the short-term outlook for the crypto market. Some market observers suggest that this could be a temporary reaction to economic data, while others see it as a sign of broader market repositioning.

The continued inflows into multi-asset products, however, indicate that investor interest in the crypto space remains, albeit with a preference for diversification.

Trading volumes in crypto investment products saw a modest increase of 15% to $10 billion for the week, despite the outflows. This suggests that while some investors are withdrawing funds, overall market activity remains robust.

Looking Ahead

As the crypto market navigates these choppy waters, all eyes will be on upcoming economic reports and central bank decisions.

These factors are likely to play a crucial role in determining whether the current outflows represent a short-term blip or the beginning of a more prolonged trend in the volatile world of cryptocurrency investments.

Interested in Trading the Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.