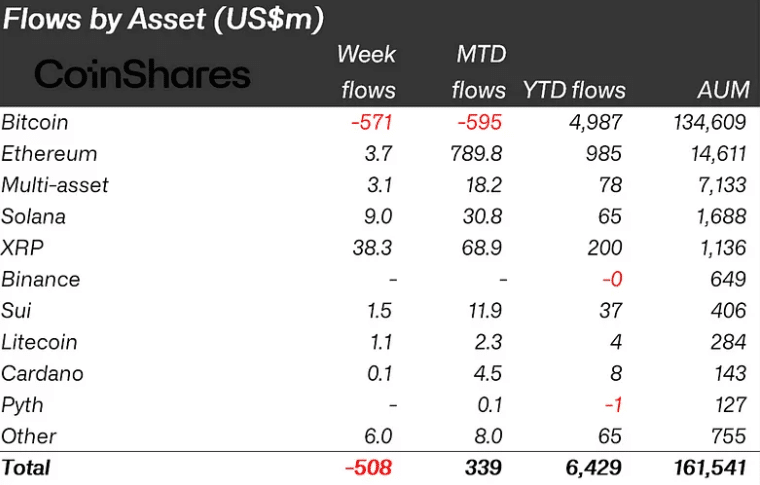

Digital asset investment products experienced significant crypto outflows totaling $508 million last week, according to the latest CoinShares report.

This marks the second consecutive week of negative flows, bringing the two-week total to $924 million. The pullback follows an impressive 18-week streak that had generated $29 billion in inflows.

Bitcoin bore the brunt of investor caution, accounting for $571 million in outflows. Some investors even added to short positions, with short-Bitcoin products seeing $2.8 million in inflows.

Why Crypto Outflows Are Happening Now

Several factors are driving the current exodus from crypto funds:

- Political uncertainty: Investor caution following the US Presidential inauguration and concerns about potential trade tariffs

- Economic concerns: Growing uncertainty around inflation and monetary policy direction

- Recent market events: The double impact of the LIBRA scam and Bybit hack has damaged investor confidence temporarily

- US economic slowdown: Last week’s US Services PMI release showed the lowest reading in 22 months, suggesting GDP growth of only 0.6%

Trading volume has also declined substantially, falling from $22 billion two weeks ago to just $13 billion last week.

Regionally, the outflows were concentrated in the US market, which recorded $560 million in withdrawals. In contrast, European markets showed continued confidence, with Germany and Switzerland recording inflows of $30.5 million and $15.8 million, respectively.

The Ethereum ETF market wasn’t spared either, seeing $78 million in outflows, bringing its three-day outflow streak to $100 million.

Despite these recent setbacks, the total cumulative inflows into Bitcoin funds remain impressive at over $39 billion, with assets under management across spot ETFs totaling $111 billion.

Altcoins showed surprising resilience amid the broader market retreat. XRP led with inflows of $38.3 million, bringing its total inflows since mid-November to $819 million. Investors remain optimistic that the SEC will drop its lawsuit against Ripple.

Other altcoins also saw positive flows, with Solana, Ethereum, and Sui recording inflows of $8.9 million, $3.7 million, and $1.47 million, respectively.

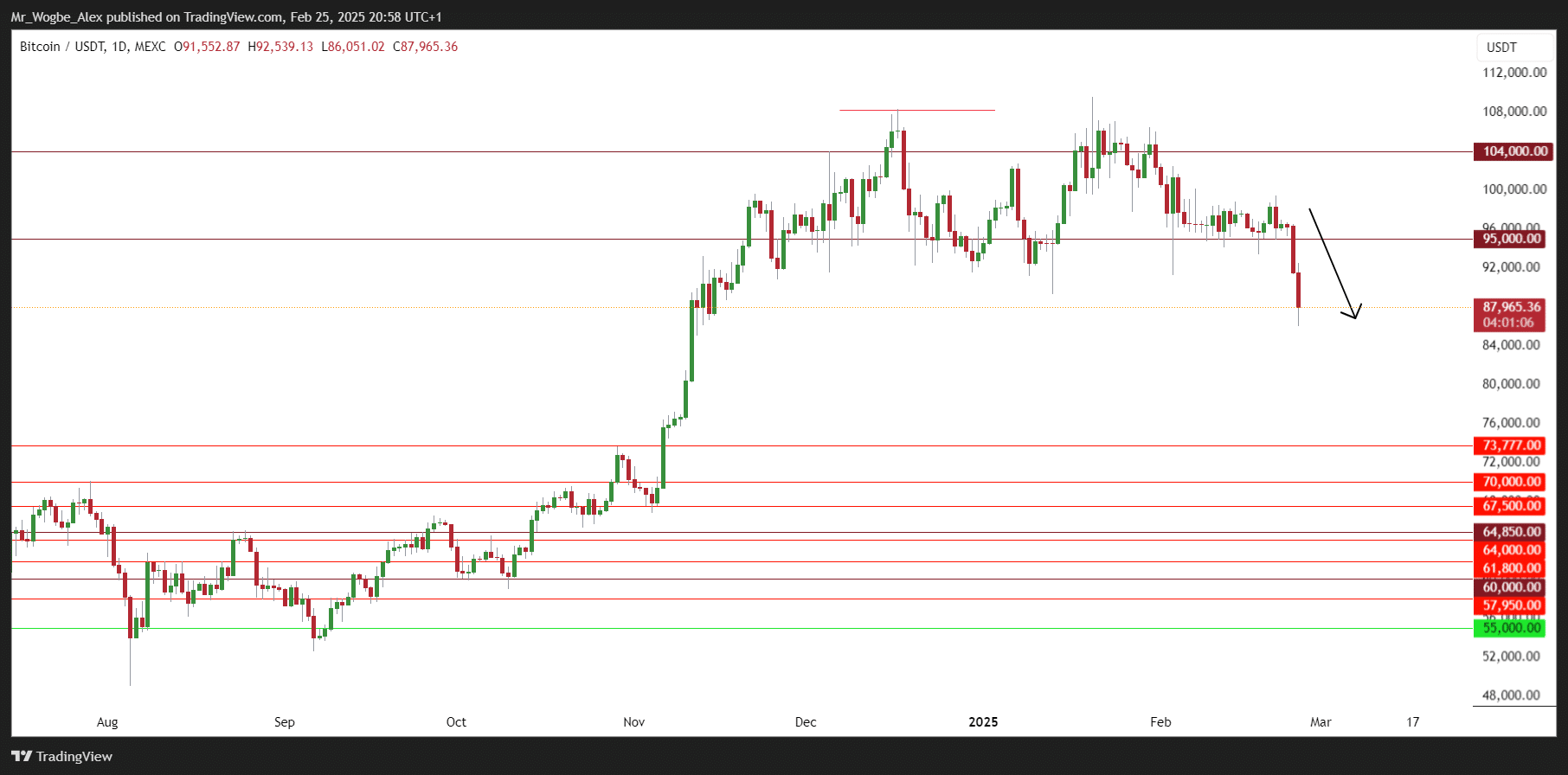

The crypto market as a whole has seen significant price declines, with Bitcoin bottoming at $85,930 and Ethereum falling to a low of $2,330 over the past 24 hours.

Despite the current negative sentiment, some analysts maintain a bullish long-term outlook, suggesting that delays in potential state and national Bitcoin strategic reserves under the Trump administration present accumulation opportunities for forward-thinking investors.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.