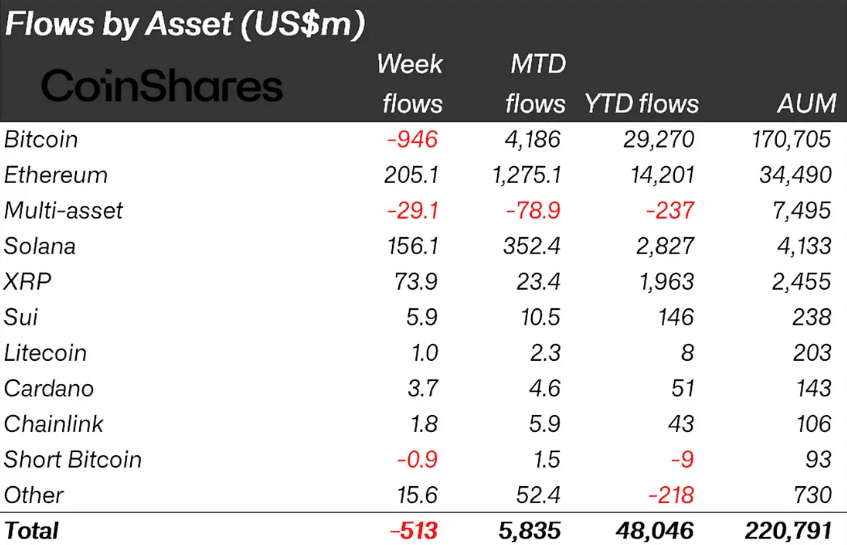

Digital asset investment products experienced significant crypto outflows totaling $513 million last week, according to the latest data from CoinShares.

The selling pressure came after market volatility on October 10th, though exchange-traded product (ETP) investors showed less concern than expected about the recent market turbulence.

The outflows were heavily concentrated in the United States, which saw $621 million exit crypto investment products. Meanwhile, investors in Germany, Switzerland, and Canada took advantage of lower prices, adding $54.2 million, $48 million, and $42.4 million, respectively, to their positions.

Bitcoin ETFs Lead the Crypto Outflows Trend

Bitcoin bore the brunt of the selling, with $946 million leaving Bitcoin-focused products last week. This marks a notable shift in sentiment, as year-to-date inflows for Bitcoin products now stand at $29.3 billion, falling short of 2024’s record $41.7 billion.

U.S. spot Bitcoin ETFs extended their negative streak to four consecutive days, with Monday alone seeing $40.5 million in outflows.

BlackRock’s IBIT fund was the primary source of redemptions, losing $100.7 million, though some of this was offset by modest inflows into funds managed by Fidelity, Grayscale, and others.

The sustained outflows occurred even as Bitcoin briefly recovered above $111,000 on Monday before falling back to around $109,900. Market analysts suggest the disconnect between ETF flows and spot prices reflects complex market dynamics, including hedging activity and differences between institutional and retail investor behavior.

Ethereum Sees Opportunity Buying Despite Broader Weakness

While Bitcoin faced heavy selling, Ethereum products attracted $205 million in new investments.

Investors appeared to view the price weakness as a buying opportunity, with the largest inflows going into a 2x leveraged Ethereum ETP that pulled in $457 million. This suggests strong conviction among certain investor segments.

Other alternative cryptocurrencies also benefited from the rotation out of Bitcoin. Solana products attracted $156 million, while XRP saw $73.9 million in inflows, driven by excitement around potential new ETP launches for these assets.

Trading volumes remained elevated at $51 billion for the week, nearly double the 2025 weekly average, indicating continued high interest and activity in crypto markets despite the outflow trends.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.