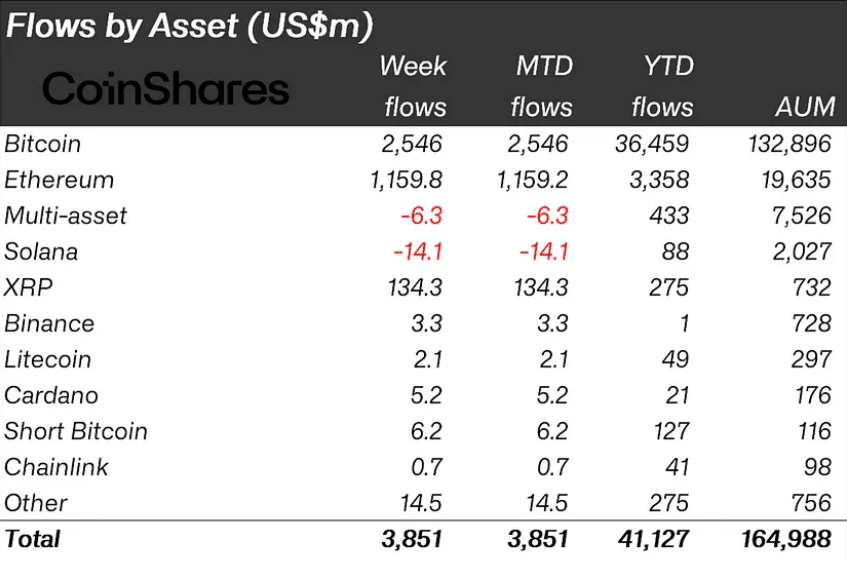

The cryptocurrency market experienced its largest-ever weekly crypto inflows, reaching $3.85 billion, while simultaneously witnessing massive liquidations as Bitcoin briefly dipped below $95,000.

This unprecedented surge in investment activity marks a significant milestone for the crypto industry, dramatically surpassing previous records.

Understanding Recent Crypto Inflows

Ethereum emerged as a major beneficiary of this investment wave, securing $1.2 billion in inflows—its highest weekly figure ever recorded. This exceptional performance outpaced even the substantial inflows seen during the ETF launches in July.

Meanwhile, blockchain equities attracted $124 million, marking their strongest showing since January 2024.

The geographic distribution of investments revealed a concentrated focus in specific markets. The United States led with $3.6 billion in inflows, followed by Switzerland ($160 million), Germany ($116 million), Canada ($14 million), and Australia ($10 million).

This broad international participation suggests growing institutional confidence in digital assets.

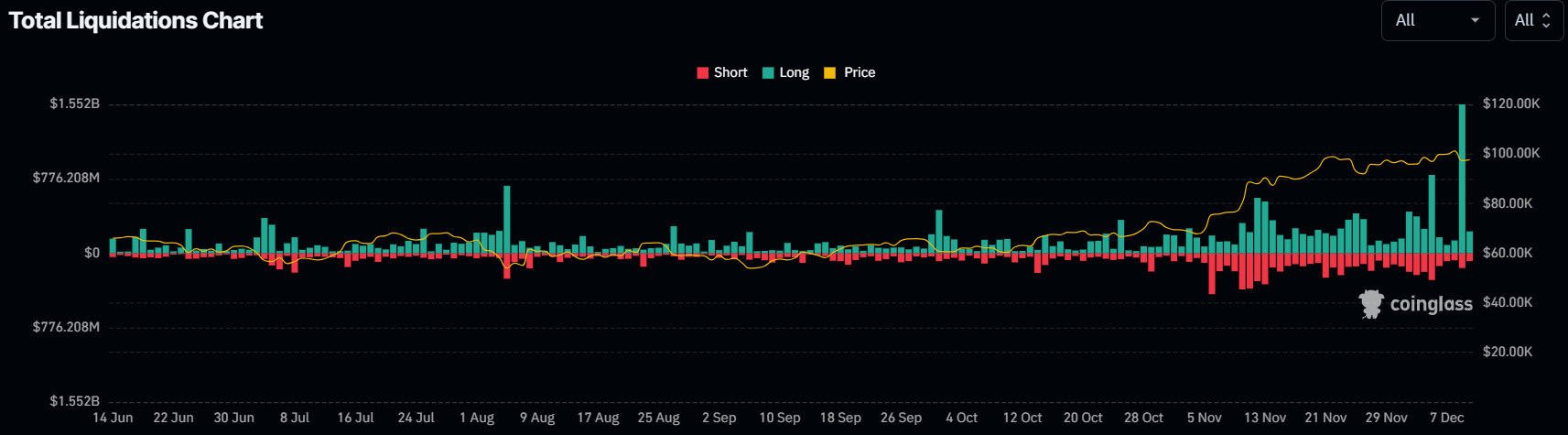

Market Volatility and Liquidation Events

Despite the record inflows, the market experienced significant turbulence. Over 514,400 traders faced liquidations totaling $1.70 billion on December 9, with long positions accounting for $1.55 billion of the total.

Bitcoin temporarily dropped to $94,200 before recovering to the upper-$97,000 range, triggering substantial market movements.

The liquidation event follows a previous $1.1 billion wipeout on December 5, which ranked as the largest since December 2021. Bitcoin’s recent achievement of breaking the $100,000 barrier for the first time, reaching an all-time high of $103,653, adds context to these market dynamics.

The current market conditions reflect a complex interplay between strong institutional investment and leveraged trading risks. Total assets under management in the crypto sector have now reached $165 billion, significantly exceeding the previous cycle’s peak of $83 billion in 2021. This growth suggests increasing mainstream acceptance of digital assets, despite the inherent market volatility.

These developments occur against a backdrop of changing market structure, with traditional finance increasingly embracing digital assets. The contrast between record inflows and major liquidations highlights the market’s current state of rapid evolution and the ongoing maturation of the cryptocurrency ecosystem.

This period of intense market activity underscores both the growing institutional appetite for digital assets and the persistent risks associated with leveraged trading in volatile markets. As the crypto sector continues to expand, these dynamics will likely play an increasingly important role in shaping market behavior and investment strategies.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.