Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

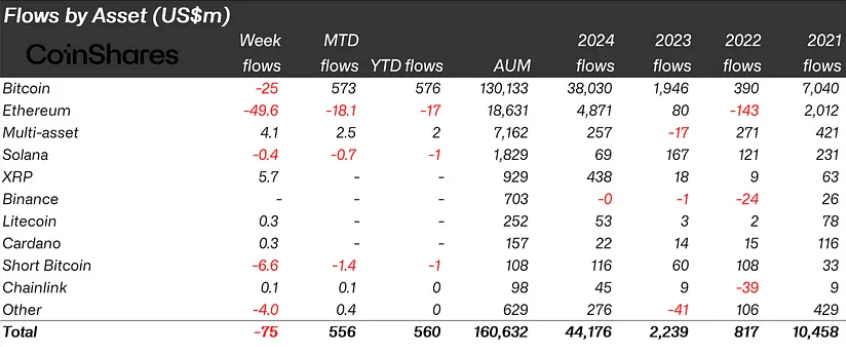

The cryptocurrency market is experiencing unprecedented growth in investment flows, with digital asset investment products attracting massive capital in early 2025. The first week of January has already seen $585 million in crypto inflows, building on 2024’s record-breaking performance of $44.2 billion in total inflows.

Recent Crypto Inflows Break Records

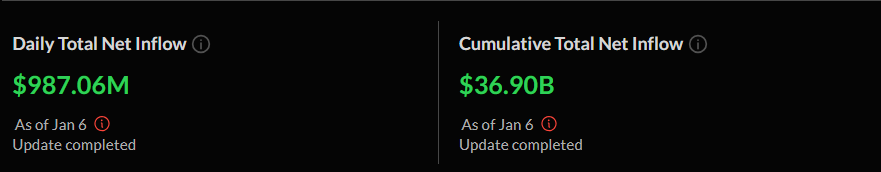

U.S. spot Bitcoin and Ethereum ETFs pulled in a combined $1.1 billion on Monday alone, highlighting strong institutional interest. Fidelity’s FBTC fund led the charge with $370.2 million in inflows, while BlackRock’s IBIT and Ark Invest’s ARKB followed with $209.1 million and $152.9 million, respectively.

This surge helped push Bitcoin’s price above $100,000, reaching a peak of $102,767 before dropping to around $98,000 on Tuesday.

The impressive performance marks a significant turnaround from late December’s outflows, proving the resilience of crypto investment products. Bitcoin ETFs have maintained strong momentum, recording over $900 million in net inflows for two consecutive trading days. This comes after facing nearly $2 billion in outflows during the previous two weeks.

ETF Performance and Market Impact

Looking at the broader picture, Bitcoin dominated the 2024 inflows with $38 billion, representing 29% of total assets under management (AuM). Ethereum has also shown remarkable growth, with its ETFs collecting $2.8 billion since their July launch. The latest data shows Ethereum ETFs brought in $128.7 million on Monday, primarily driven by BlackRock’s ETHA fund.

Alternative cryptocurrencies (excluding Ethereum) attracted $813 million throughout 2024, though this represents just 18% of their total AuM. The distribution of flows across various funds suggests a maturing market with diverse investment options.

The geographic breakdown of flows reveals interesting patterns, with U.S.-based products capturing the majority of investments. While Switzerland saw inflows of $630 million, some markets experienced significant outflows, with Canada and Sweden recording $707 million and $682 million, respectively, as investors shifted their focus to U.S.-based products.

These record-breaking inflows signal growing confidence in cryptocurrency as an asset class, particularly among institutional investors. The successful launch and performance of spot ETFs have created new pathways for traditional investors to gain exposure to digital assets, potentially setting the stage for continued growth throughout 2025.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.