The cryptocurrency market is experiencing a significant uptick in investment, with recent data showing a substantial increase in crypto inflows. This trend signals growing confidence among investors and could potentially lead to further price appreciation in the digital asset space.

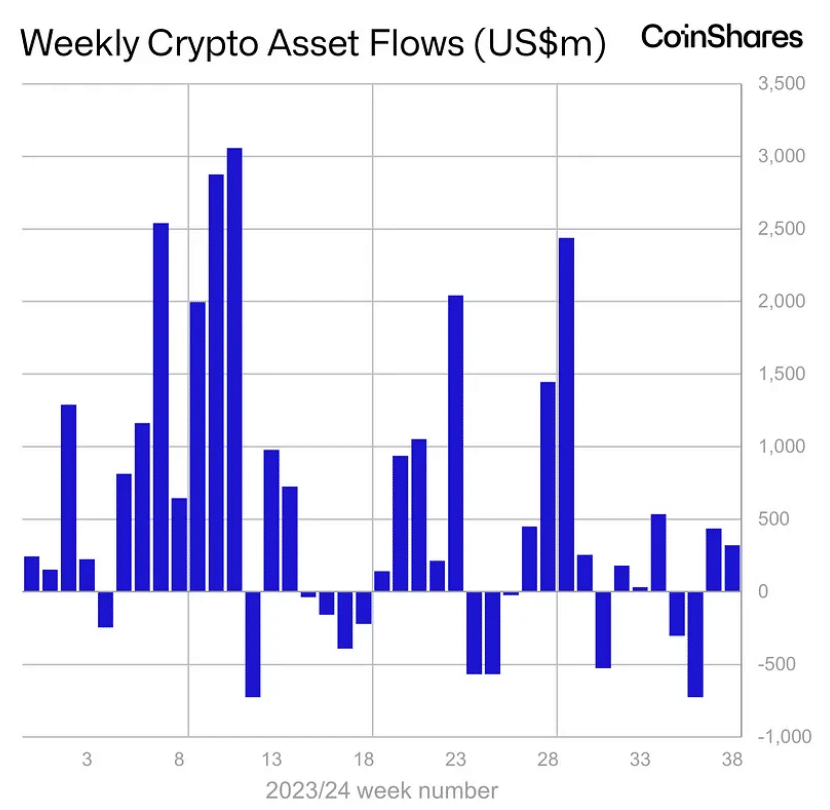

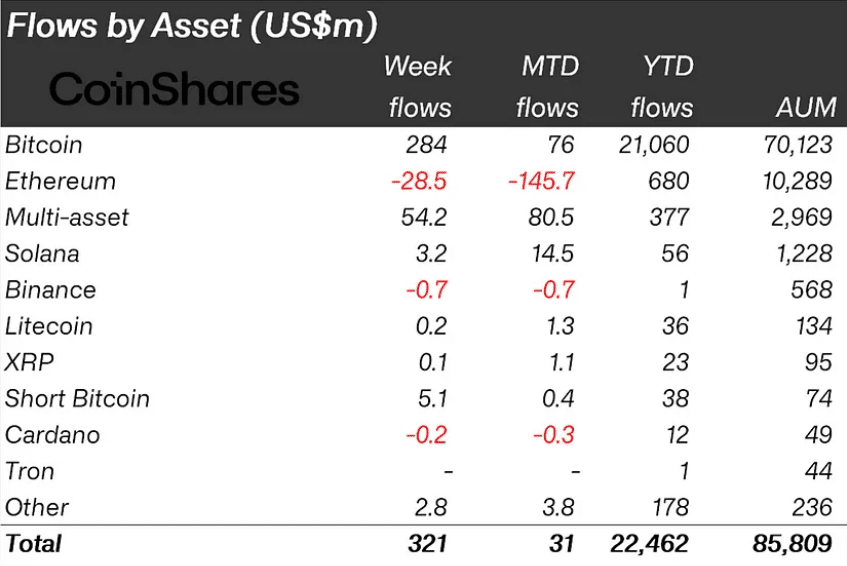

According to the latest reports from CoinShares, digital asset investment products saw inflows totaling $321 million in the past week. This marks the second consecutive week of positive fund flows, indicating a shift in investor sentiment.

Recent Crypto Inflows Prompted By US Fed Decision

The surge in investments comes on the heels of the Federal Reserve’s decision to cut interest rates by 50 basis points, which has created a more favorable environment for risk assets like cryptocurrencies.

Bitcoin, the largest cryptocurrency by market capitalization, was the primary beneficiary of this influx of capital. The flagship digital asset attracted $284 million in inflows, demonstrating its continued dominance in the crypto investment landscape.

Interestingly, short-bitcoin investment products also saw modest inflows of $5.1 million, suggesting that some investors are hedging their bets or capitalizing on short-term price volatility.

While Bitcoin led the charge, other cryptocurrencies showed mixed results.

Notably, Ethereum experienced outflows for the fifth consecutive week, totaling $29 million. This ongoing trend of Ethereum outflows is primarily attributed to persistent withdrawals from the Grayscale Ethereum Trust and limited inflows into newly launched Ethereum ETFs.

In contrast, Solana investment products continued to attract small but consistent weekly inflows, with the latest figures showing $3.2 million in new investments.

The recent surge in crypto inflows has had a significant impact on the overall market. Total assets under management (AuM) in digital asset investment products grew by 9%, reflecting the increased capital flowing into the sector. Additionally, trading volumes in these investment products rose to $9.5 billion, marking a 9% increase from the previous week.

What’s Coming?

Looking ahead, analysts are optimistic about the crypto market’s prospects for the fourth quarter of 2024. Factors contributing to this positive outlook include ongoing institutional adoption, potential regulatory developments following the U.S. presidential election, and technological advancements in areas such as Layer 2 scaling solutions and tokenization of real-world assets.

As the crypto market continues to evolve, investors should remain vigilant and consider the broader economic context when making investment decisions. While the recent inflows are encouraging, the cryptocurrency market remains volatile and subject to rapid changes in sentiment and regulatory landscapes.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.