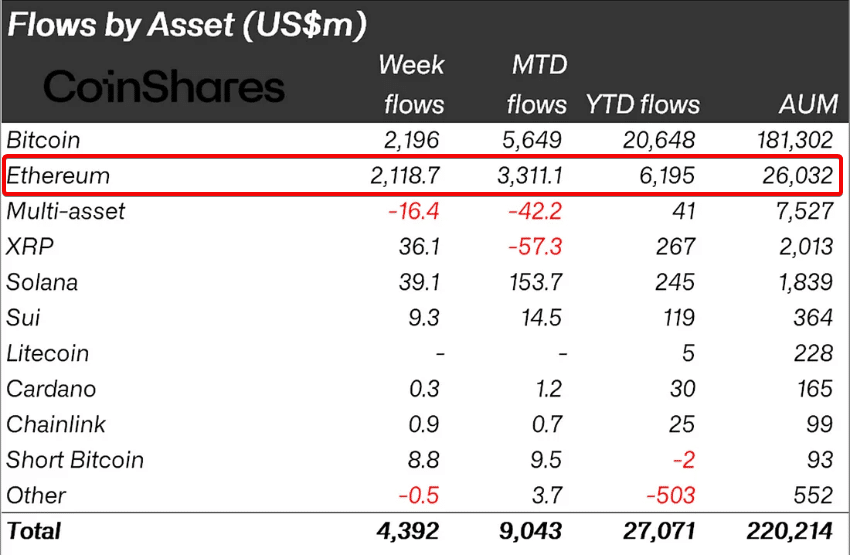

Digital asset investment products achieved their highest weekly crypto inflows on record, reaching $4.39 billion and pushing total assets under management to an unprecedented $220 billion.

This massive capital injection represents the 14th consecutive week of positive flows, bringing year-to-date inflows to $27 billion, according to the latest CoinShares report.

The United States dominated these flows, accounting for $4.36 billion of the total weekly inflows. Switzerland, Hong Kong, and Australia also posted positive numbers with $47.3 million, $14.1 million, and $17.3 million, respectively.

Meanwhile, Brazil and Germany experienced modest outflows of $28.1 million and $15.5 million.

Ethereum Drives Unprecedented Crypto Inflows

Ethereum emerged as the standout performer, attracting a record-breaking $2.12 billion in weekly inflows—nearly double its previous weekly record of $1.2 billion.

This surge pushed Ethereum’s 2025 inflows to $6.2 billion, already surpassing the entire 2024 total. The past 13 weeks of continuous inflows now represent 23% of Ethereum’s total assets under management.

Large transaction volume data reveals institutional players are rotating capital from Bitcoin into Ethereum. On-chain transfers exceeding $100,000 totaled more than $100 billion last week—the highest weekly volume since 2021.

Big-money ETH is back: last week, on-chain transfers over $100K totaled more than $100B, the highest weekly volume since 2021. pic.twitter.com/XWSzdnzNB0

— Sentora (previously IntoTheBlock) (@SentoraHQ) July 22, 2025

This institutional rotation suggests the beginning of what analysts call “Ethereum season,” where ETH outperforms Bitcoin and triggers broader altcoin market expansion.

Bitcoin Maintains Strong Performance Despite Rotation

Bitcoin recorded $2.2 billion in weekly crypto inflows, slightly down from the previous week’s $2.7 billion.

Exchange-traded product trading volumes represented 55% of total Bitcoin exchange volume, highlighting continued institutional interest despite the capital rotation toward Ethereum.

Alternative cryptocurrencies also captured significant attention. Solana attracted $39 million in inflows, while XRP and Sui recorded $36 million and $9.3 million, respectively.

Global ETP trading turnover reached a record $39.2 billion, driven by elevated volumes across Bitcoin and Ethereum products.

These record-breaking inflows indicate institutional confidence in digital assets remains robust, with Ethereum’s technical improvements and regulatory clarity driving unprecedented capital allocation toward the ecosystem’s second-largest cryptocurrency.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.