Digital asset investment products are experiencing unprecedented crypto inflows, reaching a new record of $37.3 billion in 2023, according to CoinShares’ latest weekly report.

This surge comes alongside MicroStrategy’s aggressive Bitcoin acquisition strategy, with the company adding 15,400 BTC to its holdings.

Weekly Crypto Inflows Analysis

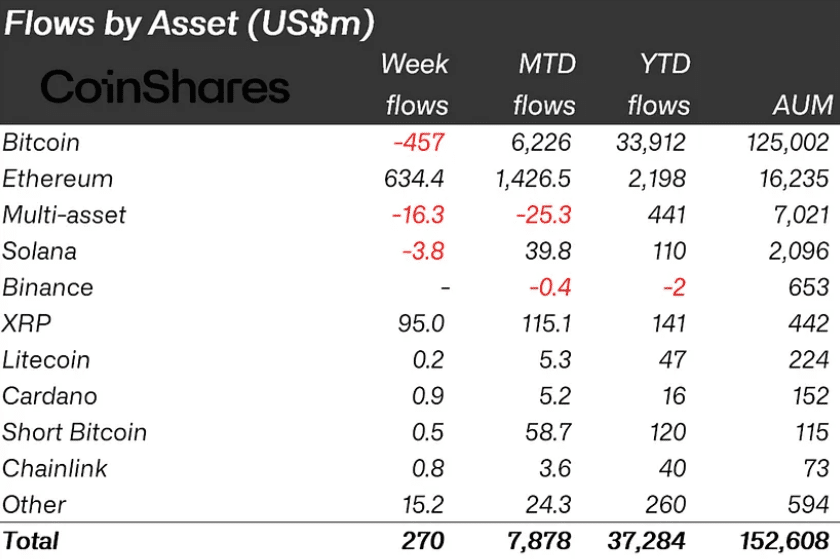

The past week saw total inflows of $270 million into digital asset investment products, though with notable contrasts between different cryptocurrencies. Bitcoin experienced its first major outflow since early September, with investors pulling out $457 million as the cryptocurrency tested the $100,000 price level. Market analysts attribute this movement to profit-taking behavior.

Meanwhile, Ethereum emerged as the week’s standout performer, attracting $634 million in new investments. This boost pushed Ethereum’s year-to-date inflows to $2.2 billion, surpassing its previous record from 2021. The surge reflects growing investor confidence in Ethereum’s long-term potential.

Regional investment patterns show strong activity in the United States, which recorded $266 million in inflows. Hong Kong and Germany also showed significant interest, contributing $39 million and $12.3 million, respectively. Notably, XRP saw record inflows of $95 million, driven by speculation surrounding a potential U.S. ETF approval.

MicroStrategy’s Bitcoin Accumulation Strategy

In a parallel development, MicroStrategy has further strengthened its position as a major corporate Bitcoin holder. The company purchased 15,400 BTC between November 25 and December 1, investing approximately $1.5 billion at an average price of $95,976 per bitcoin. This acquisition brings MicroStrategy’s total holdings to 402,100 BTC, valued at over $38 billion.

MicroStrategy has acquired 15,400 BTC for ~$1.5 billion at ~$95,976 per #bitcoin and has achieved BTC Yield of 38.7% QTD and 63.3% YTD. As of 12/2/2024, we hodl 402,100 $BTC acquired for ~$23.4 billion at ~$58,263 per bitcoin. $MSTR https://t.co/K3TK4msGp0

— Michael Saylor⚡️ (@saylor) December 2, 2024

The purchase follows MicroStrategy’s strategic share offering, which raised equivalent funds through the sale of 3,728,507 company shares. Looking ahead, the company has outlined ambitious plans for further Bitcoin acquisitions, with approximately $11.3 billion in shares still available for sale as part of its larger $42 billion capital raise target over the next three years.

The combination of institutional investment flows and corporate Bitcoin acquisitions suggests growing mainstream acceptance of digital assets, despite short-term price volatility. These developments indicate a maturing market where both traditional investment vehicles and corporate treasury strategies are increasingly incorporating digital assets.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.