Digital asset investment products experienced massive crypto inflows of $3.75 billion last week, marking the fourth-largest weekly surge on record.

This influx pushed total assets under management to an unprecedented $244 billion, demonstrating growing institutional confidence in cryptocurrency markets.

The United States dominated these flows, accounting for 99% of total inflows at $3.73 billion. Smaller contributions came from Canada ($33.7 million), Hong Kong ($20.9 million), and Australia ($12.1 million).

However, Brazil and Sweden reported modest outflows of $10.6 million and $49.9 million, respectively.

Ethereum’s Remarkable Market Performance

Ethereum emerged as the clear winner, capturing $2.87 billion in inflows—representing 77% of total weekly investment.

This performance brought Ethereum’s year-to-date inflows to a record $11 billion, significantly outpacing Bitcoin on a proportional basis. The inflows represent 29% of Ethereum’s assets under management, compared to Bitcoin’s 11.6%.

This surge coincides with U.S. spot Ethereum exchange-traded funds now holding over 5% of the total ETH supply.

According to on-chain data, these funds control approximately 6.3 million ETH worth $26.7 billion, representing 5.08% of the current supply. Digital asset treasuries control an additional 2% of the total ETH supply.

Meanwhile, $ETH‘s recent rally remained a key market focus after surpassing its highest levels against USD since 2021.

Much of this activity was driven by digital asset treasuries (DATs), who now control over 2% of the total ETH supply. pic.twitter.com/qhrD0BF1a3

— Coinbase Institutional 🛡️ (@CoinbaseInsto) August 15, 2025

Crypto Inflows by Asset

Bitcoin saw more modest gains with $552 million in weekly inflows, while alternative cryptocurrencies also attracted attention. Solana recorded substantial inflows of $176.5 million, and XRP drew $125.9 million.

In contrast, Litecoin and Ton experienced minor outflows of $0.4 million and $1 million, respectively.

Market Dynamics and Provider Concentration

An unusual aspect of this week’s flows was their concentration within a single provider—iShares—and one specific investment product. This concentration suggests targeted institutional strategies rather than broad market enthusiasm.

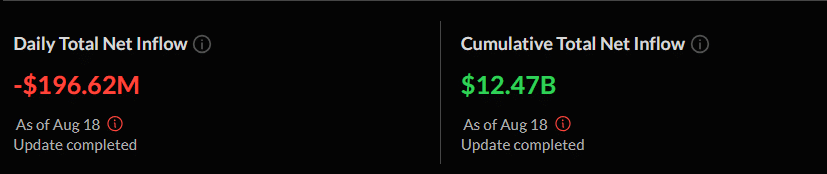

However, Monday’s session showed signs of profit-taking, with Ethereum ETFs reporting $196.6 million in net outflows—the second-largest single-day exodus since their launch.

Bitcoin ETFs also experienced outflows of $121.8 million on the same day.

Despite these short-term fluctuations, the overall trend indicates robust institutional adoption of cryptocurrency investment vehicles, with Ethereum leading the charge in capturing investor interest and capital allocation.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.