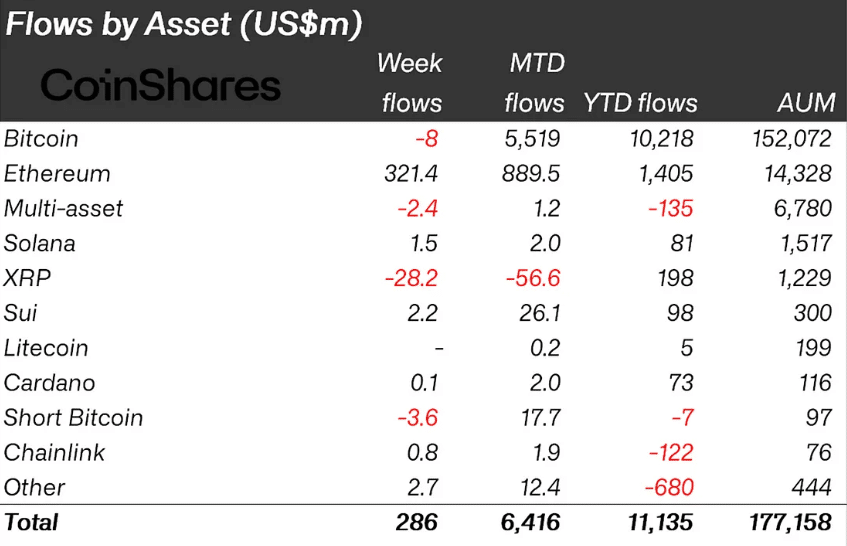

Digital asset investment products experienced significant crypto inflows of $286 million last week, extending a remarkable seven-week streak that has brought total inflows to $10.9 billion.

This sustained momentum demonstrates renewed investor confidence despite recent market volatility triggered by uncertainty surrounding US trade policies.

According to the latest CoinShares report, Ethereum emerged as the clear winner, attracting $321 million in inflows during the week. This marks the cryptocurrency’s strongest six-week performance since December 2024, with consecutive weekly inflows totaling $1.19 billion.

The surge indicates a decisive shift in market sentiment toward Ethereum-based investment products.

Meanwhile, Bitcoin experienced a more turbulent week. Strong initial inflows reversed mid-week following a New York Court decision declaring certain US tariffs illegal, ultimately resulting in minor outflows of $8 million. This ended Bitcoin’s impressive six-week run of inflows that had accumulated $9.6 billion.

Regional Crypto Inflows Pattern Shows Geographic Diversification

The report showed that investment activity spread beyond traditional US dominance, though America still led with $199 million in inflows.

Germany and Australia recorded substantial gains of $42.9 million and $21.5 million, respectively. Hong Kong achieved its strongest weekly performance since launching exchange-traded products over a year ago, securing $54.8 million in inflows.

Switzerland bucked the trend with $32.8 million in outflows, maintaining its position as one of the few countries showing net negative flows year-to-date.

Venture Capital Activity Faces Headwinds Despite Strong M&A Performance

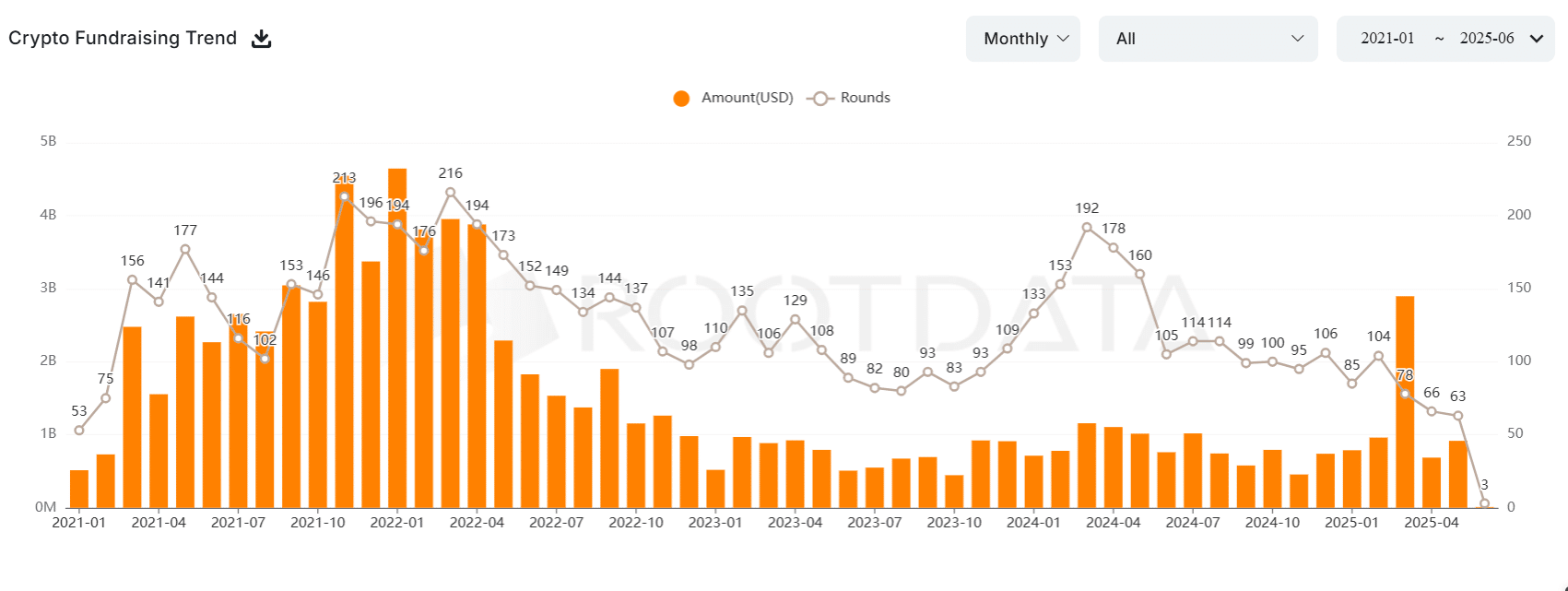

In related news, cryptocurrency venture capital deals dropped to 2025 lows, with only 63 funding rounds completed in May. This represents the weakest monthly performance since January 2021, despite these rounds raising over $909 million in total capital.

Market analysts attribute this decline to multiple factors. Higher interest rates, volatile bond markets, and ongoing tariff concerns have created challenging conditions for risk assets.

Most transactions now focus on consolidation plays rather than growth investments, reflecting typical patterns during market cooling periods.

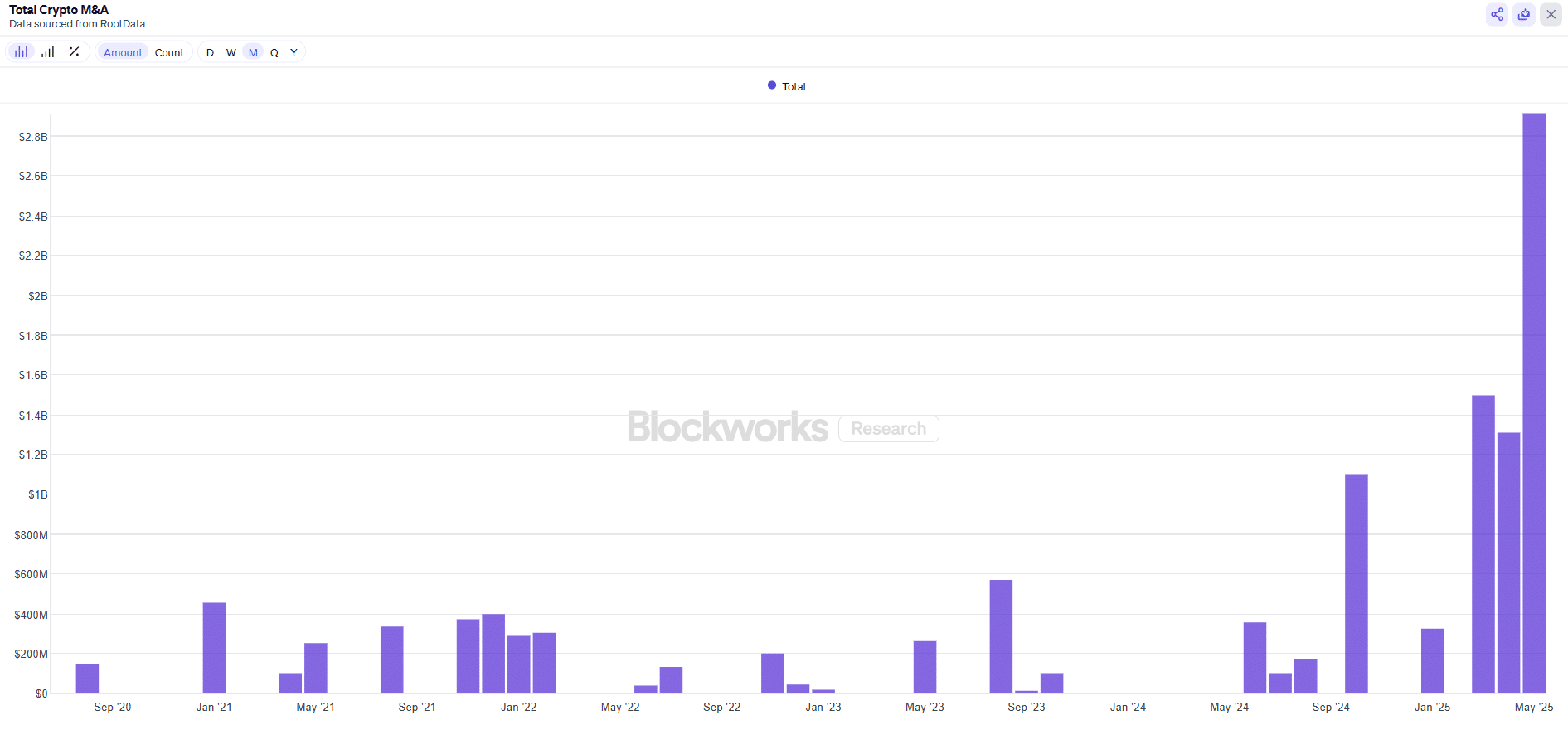

However, merger and acquisition activity remained robust. Coinbase Global’s $2.9 billion acquisition of Deribit set a new record for crypto M&A transactions, demonstrating that established players continue pursuing strategic expansions.

Industry experts expect seasonal patterns to influence activity through the summer months, with traditional pickup anticipated in early Q4 when institutional investors typically return from reduced summer operations.

The combination of regulatory clarity improvements and direct deals between major companies may further strengthen market fundamentals moving forward.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.