The cryptocurrency market is seeing a massive wave of new money, with crypto inflows reaching $2.2 billion in recent weeks. This surge marks the biggest weekly increase since July 2024, driven largely by growing confidence in the U.S. market and rising interest in Bitcoin ETFs.

Understanding Recent Crypto Inflows

The U.S. market leads this financial push, bringing in $2.3 billion in new investments. This stands in sharp contrast to other regions, where minor outflows suggest investors are taking profits. The American investment surge likely stems from two key factors: growing optimism about upcoming U.S. elections and the strong performance of Bitcoin spot ETFs.

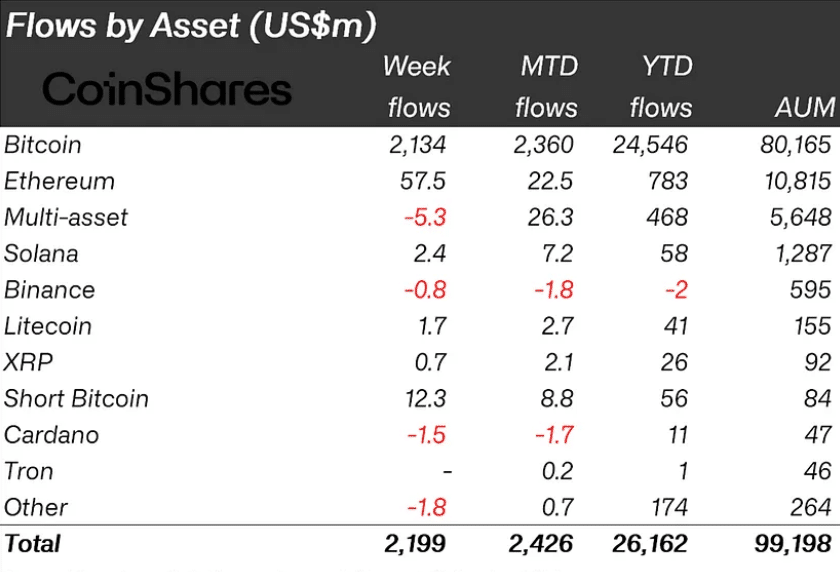

Bitcoin remains the top choice for investors, pulling in $2.13 billion of the total inflows. Other cryptocurrencies saw smaller but notable gains, with Ethereum attracting $58 million in new investments. Smaller cryptocurrencies like Solana and Litecoin also saw positive movement, though at much lower levels.

Breaking Down ETF Investment Patterns

A closer look at ETF investments shows an important shift in how big investors are using these products. While earlier in the year many investors used ETFs mainly for complex trading strategies, recent data shows more are simply betting on Bitcoin’s price going up. About 60% of recent ETF investments—roughly $1.4 billion—represent straightforward bets on Bitcoin’s growth.

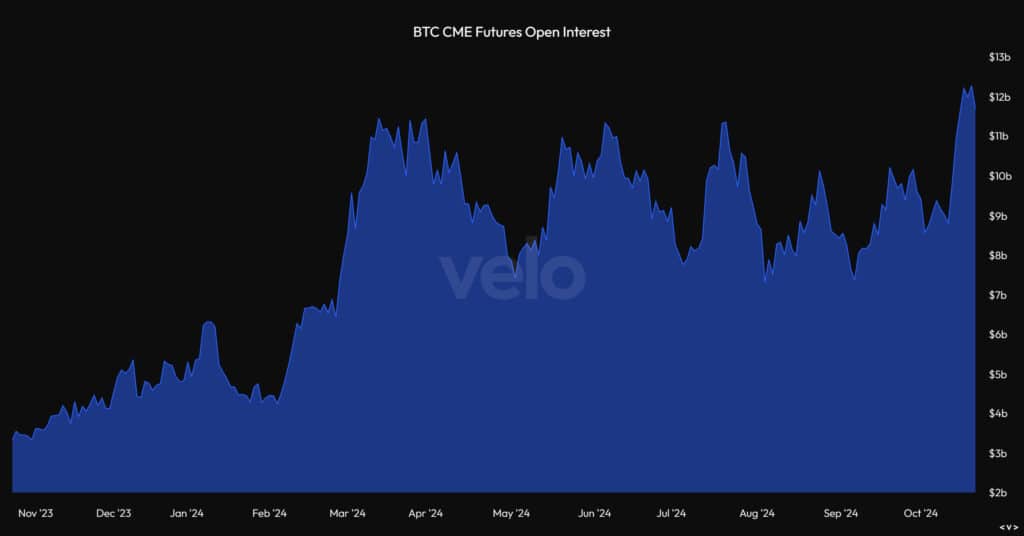

This change in investment behavior has pushed Bitcoin futures prices higher than spot prices by almost 14% on an annual basis—the biggest gap since May. This price difference typically means investors are very bullish on Bitcoin’s future.

The total value of Bitcoin futures contracts on the Chicago Mercantile Exchange has hit new records above $12 billion.

This growth, combined with strong ETF inflows, suggests both small and large investors are increasingly confident in cryptocurrency markets.

Looking ahead, these inflows might signal a broader acceptance of cryptocurrencies by traditional investors. With total assets under management approaching $100 billion and trading volumes up by 30%, the market shows signs of growing maturity and stability.

However, some caution remains as different regions show varying levels of enthusiasm. While U.S. investors pour money in, other countries like Canada, Sweden, and Switzerland have seen small outflows, highlighting the market’s complex global dynamics.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.